Click here to see the agenda and speakers and to register.

Royalty on Federal Lands

The US Department of Interior finalized a rule on Friday increasing royalty rates on oil and gas leases of federal land from 1/8th to 1/6th, and increasing minimum bonus rates from $2/acre to $10/acre. The regulations also increase bonding requirements to secure operators’ obligation to plug their wells.

I’ve always been puzzled why federal leases are not granted the same way the Texas General Land Office does, with competitive bidding. Almost all leases of lands owned by the State of Texas or University Lands reserve one-fourth royalty.

A lot of federal oil and gas leases cover offshore tracts, and thousands of wells have been drilled in federal offshore waters in the Gulf of Mexico. I recently heard a CLE presentation about companies’ plugging obligations in the Gulf. Unlike Texas, federal law provides that all operators in the chain of title to a federal well are jointly and severally liable for the plugging costs and for properly disposing of the platform once the wells are plugged. Many plugging obligations end up in bankruptcy courts, and prior operators are now receiving notices from the BLM notifying them of their plugging obligations. Louisiana also holds prior operators liable for plugging obligations. If prior operators in Texas retained liability for well plugging, the list of Texas “orphan wells” would shrink substantially.

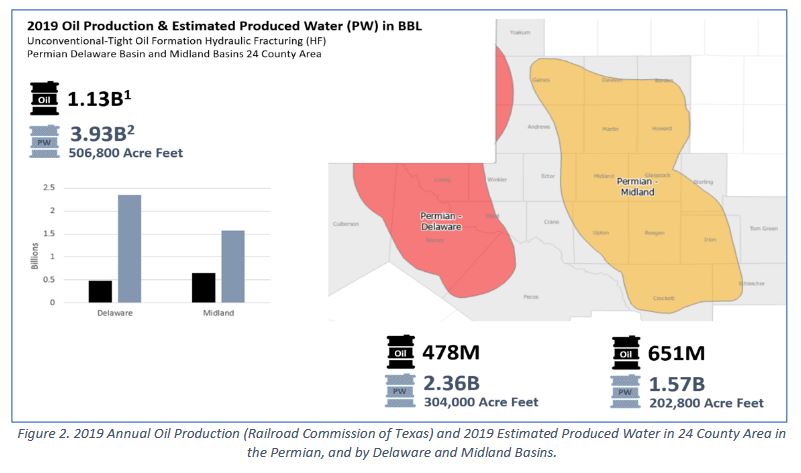

Disposal of Produced Water in the Permian Basin

In 2021 the Texas Legislature created the Texas Produced Water Consortium to study possible beneficial uses of fluid oil and gas wastes. The Consortium produced its report to the Legislature in 2022. I recently ran across a remarkable conclusion in that report: it estimates that in 2019 unconventional tight-oil formation wells in the Texas portion of the Permian Basin produced almost 4 billion barrels, or 506,800 acre-feet, of wastewater. (click on image to enlarge)

506,800 acre-feet is a column of water covering an acre of land and 96 miles high. Or 11.6 square miles covered one foot deep in water. Lake Buchanan, the largest Texas lake, has a capacity of 992,000 acre-feet. New York City consumes 1,236,000 acre-feet of water per year.

506,800 acre-feet is a column of water covering an acre of land and 96 miles high. Or 11.6 square miles covered one foot deep in water. Lake Buchanan, the largest Texas lake, has a capacity of 992,000 acre-feet. New York City consumes 1,236,000 acre-feet of water per year.

It is no wonder that the underground injection of such a huge volume of water is causing problems. Much of that water is being injected into shallow oil-producing formations, in particular the depths of the Delaware Mountain Group, damaging producing wells and causing waste. The increased pressures in injection zones have caused abandoned wells to erupt in gushers of injected water. And water injection is inducing seismic events, otherwise known as earthquakes. The Railroad Commission has even ordered some injection wells to be shut down in response to those quakes.

White v. Hilcorp – Heritage v. Nationsbank Again Rears its Ugly Head

In January the US 5th Circuit Court of Appeals submitted a “certified question” to the Texas Supreme Court. Federal courts have jurisdiction over cases involving only state-law issues if the parties are from different states – diversity jurisdiction. This is one such case. Carl v. Hilcorp Energy Company, No. 24-0036.

The trustees of the Carl/White Trust sued Hilcorp Energy on behalf of royalty owners with language in their leases providing that the lessee must pay royalties on gas “sold or used off the premises.” The suit seeks class-action status on behalf of these royalty owners. The Trust’s lease also provides that royalty on gas should be paid on the “market value at the well.” Hilcorp moved to dismiss the claim, arguing that under a “market-value-at-the-well” lease, Hilcorp was allowed to deduct all post-production costs and therefore had no obligation to pay for gas used in processing. The trial court agreed with Hilcorp and dismissed the case; the Trust appealed to the 5th Circuit.

When a case in federal court is governed by state law, a federal appeals court may ask the state’s top court to opine on a question of law critical to its case – to submit the question as a “certified question” to the state court. The 5th Circuit did so here, asking the Texas Supreme Court: “can a market-value-at-the-well lease containing an off-lease-use-of-gas clause and a free-on-lease-use clause be interpreted to allow for the deduction of gas used off lease in the post-production process?” The Texas Supreme Court agreed to consider the question, and the parties have submitted briefs. Two amicus briefs, one from Texas Oil & Gas Association supporting Hilcorp’s arguments, and one by Texas Land & Mineral Association and National Association of Royalty Owners-Texas, Inc., supporting the Trusts’ arguments.

GDHM Land & Mineral Owner Seminar

Two Cases on Royalty Fractions

This year the Texas Supreme Court decided Van Dyke v. The Navigator Group, trying to give some structure to cases construing conveyances and reservations of royalty interests-whether fixed or floating. I wrote about the case last February. Since then two court of appeals cases have grappled with the issue: Royalty Asset Holdings II, LP v. Bayswater Fund III-A LLC, in the El Paso Court of Appeals, No. 08-22-00108-CV; and Thomson v. Hoffman, in the San Antonio Court of Appeals, No. 04-19-00771-CV.

In Royalty Asset, the court construed the following royalty reservation:

EXCEPT that Grantors, for themselves and their heirs and assigns, retain, reserve and except from this conveyance and [sic] undivided 1/4th of the land owner’s usual 1/8th royalty interest (being a full 1/32nd royalty interest) payable or accruing under the terms of any existing or future oil, gas or mineral lease pertaining to or covering the oil, gas and other minerals on, in or under the above described [sic] land. It is distinctly understood and agreed that the interest in royalties hereby retained and reserved by Grantors does not participate in any bonus or delay rentals payable for or accruing under the terms of any such oil, gas and mineral lease or leases, and it shall not be necessary for Grantors to join in, execute or ratify any oil, gas and mineral lease covering said above described tract, the right and privilege to execute any oil, gas and mineral lease or leases covering the full mineral interest in the above described tract being hereby granted and conveyed to Grantees herein, their heirs and assigns.

Gill v. Hill – Another Case on Due Process Requirements in a Tax Foreclosure

Last year the Texas Supreme Court decided Mitchell v. MAP Resources, holding that a mineral owner whose interest was sold at a tax foreclosure could collaterally attack the judgment and introduce extrinsic evidence that he had not been properly served with notice of the suit and therefore was deprived of due process under the 14th Amendment of the US Constitution. Gill v. Hill is another such case. The El Paso Court of Appeals ruled against the plaintiff, with one judge dissenting. The Texas Supreme Court agreed to hear the case, where it is now pending.

The tax foreclosure in Gill v. Hill took place in 1999. Suit seeking to set aside the foreclosure was filed in 2019. The El Paso Court of Appeals distinguished the case from Mitchell v. MAP Resources. In both cases the taxpayer was served by posting on the courthouse door. In Mitchell, both sides moved for summary judgment, and the party seeking to set aside the foreclosure introduced extrinsic evidence that she could easily have been personally served because her name and address were in courthouse deed records and appraisal district records. In Gill v. Hill, the defendant moved for summary judgment on the ground that the suit was barred by limitations. The plaintiff alleged that he could have been personally served but did not move for summary judgment or introduce any extrinsic evidence.

The Court of Appeals held it was plaintiff’s burden to raise a fact issue on whether adequate notice of suit was given by introducing extrinsic evidence. The dissent would hold that the defendant had the burden on summary judgment to show that proper notice of the suit was given.

Point Energy Partners Permian v. MRC Permian Company – did a force majeure event save the lease?

In this case, decided last April, the Texas Supreme Court held that the force majeure clause in an oil and gas lease could not be relied on to extend the date by which a well had to be commenced to keep the lease in force.

The facts are these:

MRC owned a lease covering 4,000 acres in Loving County. The lease provided that, at the end of the primary term, the lease would terminate except as to designated production units around existing wells unless MRC engaged in “continuous drilling”—spudding a well within 180 days after the spud date of the previous well. Prior to the end of the primary term MRC had drilled five wells on the lease. Under continuous drilling clause, MRC had to spud a well by May 21, 2016 to avoid partial termination of the lease.

Crane County salt water spill from overpressured zone used for water disposal

This link shows a report from CBS Odessa affiliate about a huge leak of injected water. These events are occurring all over West Texas because the Railroad Commission grants permits to dispose of produced water into shallow formations. Thousands of old wellbores exist in West Texas, some never plugged, some plugged before regulation of wells, some plugged in violation of regulations. The over-pressurized formation breaks into the wellbore, or finds its way to the surface. Until the Commission addresses the problem by properly regulating produced water injection, these problems will only grow. (Click on image to enlarge)