From Visual Capitalist (click on image to enlarge):

Colors of Hydrogen

Maybe you’ve heard of “green hydrogen.” There’s been a lot of press lately about projects to produce hydrogen to use as an alternative fuel, and the Inflation Adjustment Act provides tax credits for production of “green hydrogen.” But did you know that there are other hydrogen “colors”? An excellent article from MartenLaw.com provides a summary of the methods and tax credits and regulations being developed for green hydrogen programs. Here is its description of colors of hydrogen:

Types of Hydrogen

Hydrogen can be created through a variety of techniques. To distinguish between the different processes, the industry has developed an informal color-based categorization system:

Carbon Capture and Underground Storage

Since passage by Congress of the Inflation Reduction Act (IRA) in 2022, significant activities and developments have taken place in Texas regarding carbon capture and underground storage (CCUS) projects. The IRA provides tax credits for injection and underground storage of carbon dioxide. As a result, major companies have begun developing CCUS projects in Texas and other states. Landowners are signing agreements with these developers allowing use of their land for injection and storage.

Tax Credits for CCUS Projects

The economic benefits to developers of CCUS projects derive solely from the federal income tax credits granted for underground storage of CO2. The credits are granted based on tons of CO2 injected. The amount of the credit varies depending on the type of project.

A New Ad Valorem Tax Exemption for Minerals Owned by Charities

Governor Abbot has signed House Bill 456, passed by the Legislature, granting certain charities an exemption from ad valorem taxes on their oil and gas royalties, effective January 1, 2024. The bill amends Tax Code Section 11.18(a), which provides ad valorem tax exemptions for charitable organizations, including churches and educational institutions. The bill amends the statute to provide an ad valorem tax exemption for mineral and royalty interests, but only for some charitable organizations.

The exemption applies to the following types of charitable organizations who provide services without regard to ability to pay, but only if the mineral or royalty interest (i) is not severed from the surface estate (i.e., is under land owned by the charity), or (ii) was donated to the charity:

- a charity providing medical care;

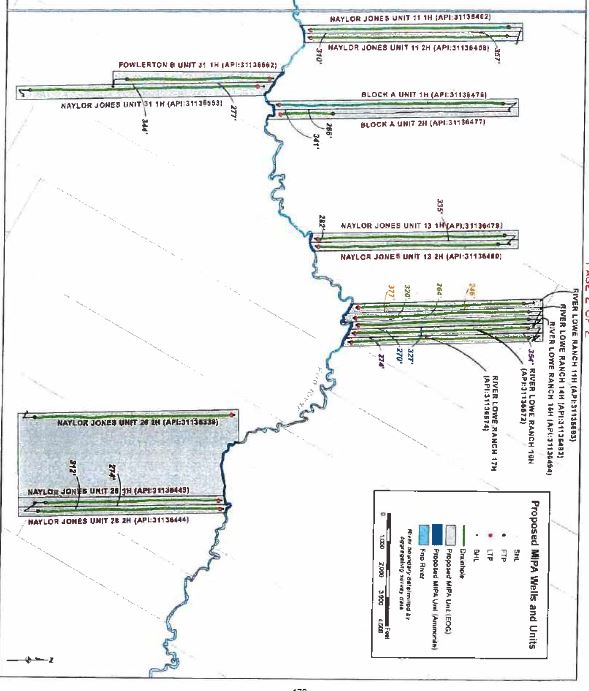

Texas Supreme Court Agrees to Hear Appeal of MIPA Case

Today the Texas Supreme Court agreed to hear Ammonite Oil & Gas Corp. v. Railroad Commission of Texas and EOG Resources, an appeal from the Commission’s denial of sixteen applications by Ammonite under the Mineral Interest Pooling Act.

I wrote about this case when it was decided against Ammonite by the Austin Court of Appeals. Ammonite has oil and gas leases from the State on the bed of the Frio River. Operators, including EOG, have drilled horizontal wells whose last take points extend to 100 feet from the edge of the river. Ammonite applied to the Commission to include portions of the riverbed in the units for the EOG wells. The Commission denied the applications.

Ammonite holds more than 50 state riverbed leases and has filed MIPA cases against EOG, Apache, Chesapeake and ConocoPhillips, all of which have resisted Ammonite’s efforts to include riverbed acreage in their units, leaving the minerals under the riverbed stranded. Royalties from riverbed leases are paid into the Texas Permanent School Fund for the benefit of Texas schools, managed by the Texas General Land Office.

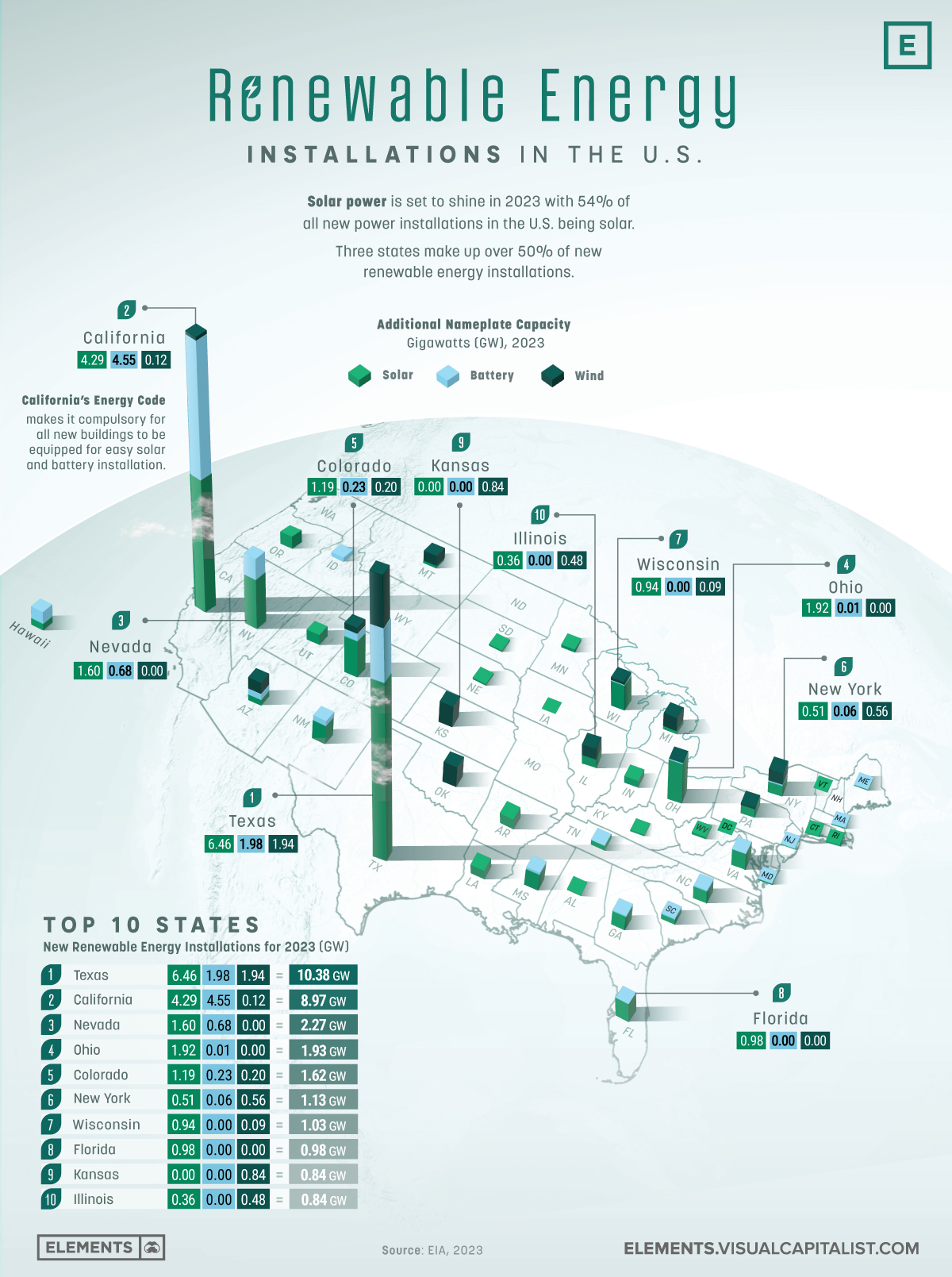

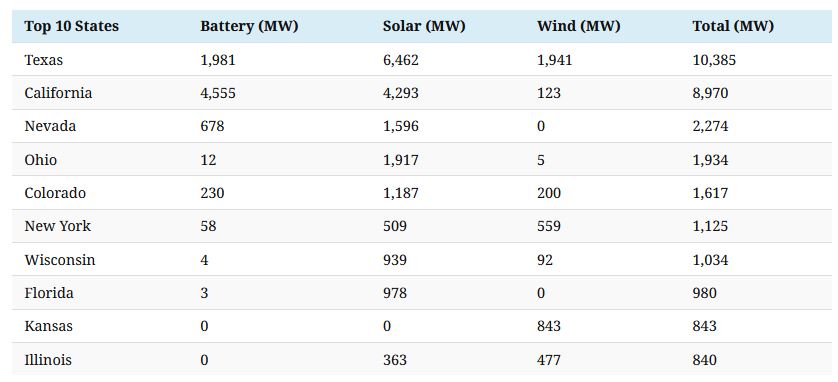

Texas Leads in Solar and Wind Energy Projects in 2023

“No form of energy is renewable.”

Excerpts from Dr. Scott Tinker’s AEIN – Alfred J. Boulos lecture:

“Energy security underpins economic security, which in turns lets you invest in the environment and obtain climate security. If you start by focusing on low emissions, you will not get energy that is affordable or reliable. You need to focus on the ‘radical middle’ of this particular triangle.

“Before the Paris accords, the middle ground was leaning towards the economy. The Paris Agreement made the focus a lot firmer on climate. Then the pandemic hit, and we went straight back to the economy. After COP26, the focus shifted again to climate, but the war in Ukraine put it squarely on security. There is always a factor to make the focus on one rather than all three.

Dr. Scott Tinker on the Future of Energy

Below is an article from Dr. Tinker, written in advance of his upcoming lecture at the International Energy Summit on June 1, used with permission.

When it comes to managing Energy, optionality is vital

Dr. Scott Tinker, Director, Bureau of Economic Geology, The University of Texas at Austin, talks about the challenges we face in addressing the multiple and varied needs of energy markets throughout the world and how we need to better understand all the vectors involved if we are going to succeed. He will be delivering the “Boulos Lecture Series” at the forthcoming International Energy Summit (IES) hosted by the AIEN in Miami from May 30 to June 1.

A Great Resource for New Mexico Oil and Gas Law

Thomas C. Turner, Jr. has written a great brief summary of oil and gas law in New Mexico. A great resource for anyone who owns minerals in New Mexico. You can buy it on Amazon.

EP Energy v. Storey Minerals – a $41 million most-favored-nations clause

EP Energy E&P Co., L.P. v. Storey Minerals, Ltd., 2022 SL 223253 (Tex.App.-San Antonio 2022, pet. denied)

The Texas Supreme Court recently refused to review the opinion of the San Antonio Court of Appeals in this case, involving construction of a favored nations clause in an oil and gas lease. The court of appeals held that, under the favored nations clause, EP Energy owed the lessor an additional $41 million bonus. One judge dissented.

The case also recounts the “colorful history” of the Altito Ranch, covering about 23,000 acres in La Salle County. EP Energy’s brief describes that history: