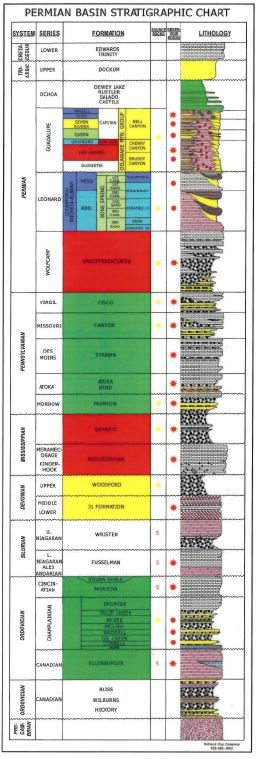

This article appeared yesterday in the New York Times: Land Rush in Permian Basin, Where Oil Is Stacked Like a Layer Cake. Exxon announced a $6.6 billion deal to buy the Bass family’s position in the Permian. Noble Energy agreed to buy Clayton Williams Energy for $2.7 billion, acquiring Williams’ 120,000 acres in the Permian. Anadarko announced it is selling its Eagle Ford shale leases to Sanchez Energy and Blackstone Group for $2.3 billion so it can concentrate on developing its leases in the Permian. SM Energy and EOG Resources are also selling assets in other fields to acquire larger interests in the Permian. According to the Times, there have been more than $25 billion of mergers and acquisitions in the Permian since June last year. The frenzy to acquire assets has become known as “Permania.” Companies claim they can make money at as little as $40/bbl. The reason: multiple “stacked” zones in the Permian, principally the Spraberry and Wolfcamp formations, allow multiple wells at different depths on each property.

Published on:

Oil and Gas Lawyer Blog

Oil and Gas Lawyer Blog