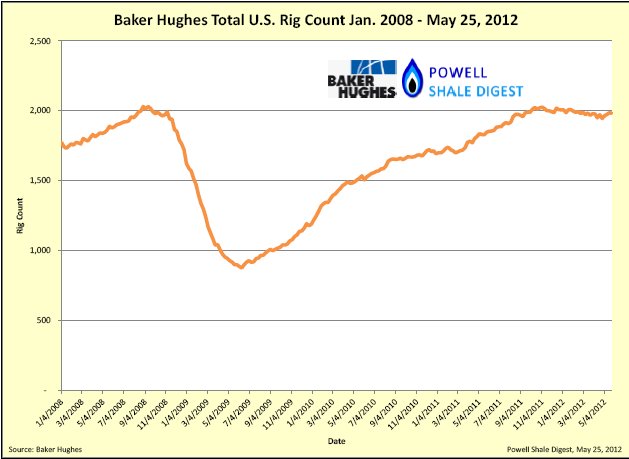

Rig count remains steady:

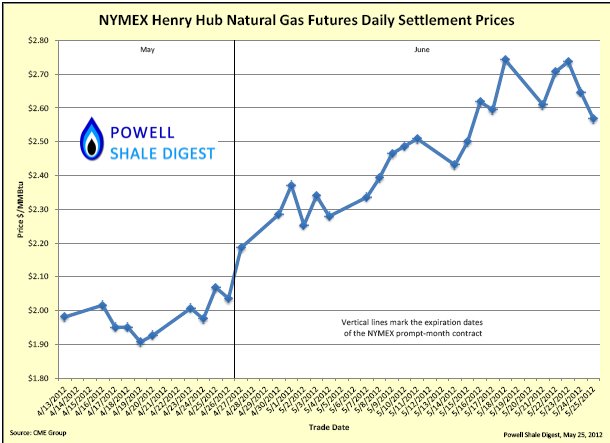

Gas prices rise:

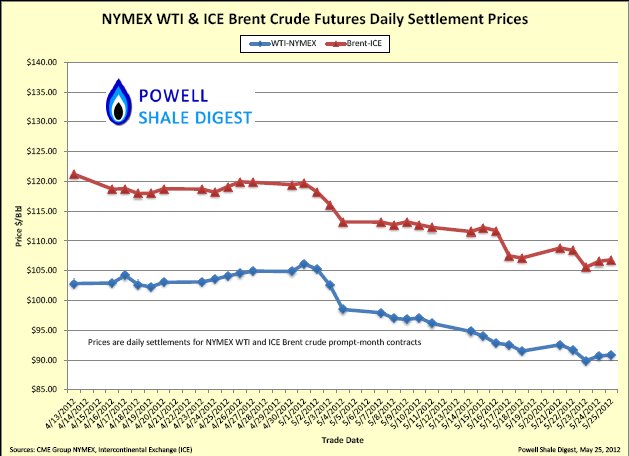

Oil prices decline:

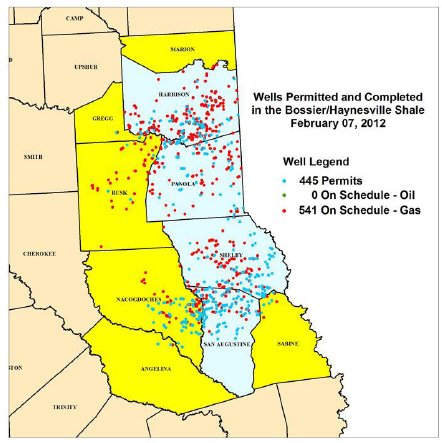

The Haynesville Shale is now one of the largest gas fields in the nation. The Texas part of the field alone has produced almost 800 Tcf of gas since inception from some 800 wells. The biggest producers are Anadarko, Chesapeake, Devon, EOG and Exco. Anadarko recently said that it has opened a liquids-rich play in the Carthage area with an estimated 300 million Boe, and more than 350 drill sites in the Haynesville and 100 in the Cotton Valley.

News reports recently announced that North Dakota has now surpassed Alaska as the second-biggest oil-producing state in the US, behind Texas. Five years ago, when the Bakken play in North Dakota was just beginning, North Dakota’s average daily production was 118,000 bbl/day. Today it is 575,500 bbl/day. Texas produces about 1,287,000 bbl/day. North Dakota’s top oil and gas regulator said that the state’s production could double to more than one million bbl/day by 2015. There are now 214 rigs drilling in North Dakota, a record. Experts at a recenty symposium on the Eagle Ford Shale said it could reach on million bbls/day by 2016.

An independent review of the US EPA’s draft report on water pollution near Pavillion, Wyoming has concluded that there is no scientific basis to conclude that hydraulic fracturing caused underground water contamination. The report, by SS Papadopulos & Associates, concluded that the EPA used improper analytical methods and field procedures and misinterpreted the data. http://www.ogj.com/articles/2012/05/ipaa-independent-review-finds-epa-pavillion-report-lacks-data.html

Meanwhile, EPA is requesting more money to finish its Congressionally mandated study on hydraulic fracturing. http://www.upi.com/Business_News/Energy-Resources/2012/05/17/EPA-wants-more-money-to-probe-fracking/UPI-24671337255312/

The Texas Tribune reported recently that Texas oil producers are increasingly flaring gas because of lack of pipeline infrastructure in areas such as the Eagle Ford Shale and Permian Basin. Flaring permits have risen from 107 in 2008 to 651 in 2011. The RRC has called for increased regulation of flaring. http://myhighplains.com/fulltext?nxd_id=269702

Increased drilling activity has also caused a headache for road maintenance across the country. States and counties are trying to figure out how to get the industry to help maintain and repair roads damaged by increased oil field traffic. http://www.businessweek.com/news/2012-05-15/taxpayers-pay-as-fracking-trucks-overwhelm-rural-cow-paths

The Texas Railroad Commission has limited public access to the portion of its website that allows for searches of well information between 8 am and 11 am. The RRC says that use of its site has grown beyond its capacity and is limiting its staff’s ability to process permits and completion reports. It says it is working on the problem and hopes to have a solution in about 12 weeks. It is estimated that the RRC is about 12,000 behind in its processing of well completions.

Kinder Morgan has completed its $21 billion acquisition of El Paso Corp., making it the largest natural gas pipeline operator in the US.

The International Energy Agency has issued a report concluding that the shale gas boom in the US, and the substitution of gas for coal, have reduced CO2 emissions by almost 5 million tons in five years. During that time, coal use declined 19% and gas use jumped 38%. http://www.bizjournals.com/houston/morning_call/2012/05/shale-boom-has-led-to-lower-us.html

David Blackmon, director of govenmental affairs for El Paso Corp., recently told an energy conference audience what I have been saying all along — that water pollution for oil and gas operations typically stems from wastewater and other spills on the surface rather than from hydraulic fracturing. http://www.ogj.com/articles/2012/05/el-paso-spokesman-calls-fracturing-controversy-misdirected.html

New developments in Range’s battle with the Lispkys over alleged contamination of their water well have taken an interesting turn. District Judge Trey Loftin required Sharon Wilson, the Lispkys’ consultant, to turn over emails she exchanged with the EPA and Lispky, and refused to dismiss Range’s $3 million counterclaim. The Lispkys and Wilson alleged that the counterclaim violated Texas’ SLAPP Act, the law prohibiting lawsuits intended to limit public participation in legitimate issues of public concern. The Lipskys have appealed that ruling. Judge Loftin has been criticized recently because he referred to the Range case in campaign materials that criticized the EPA’s involvement in the Lispky matter. Critics contend that the campaign materials violate the state’s code of judicial ethics. http://fuelfix.com/blog/2012/05/18/range-resources-sues-homeowner-over-youtube-of-flaming-well/

Meanwhile, three families in Washington County, Pennsylvania sued Range alleging that leaking impoundments caused contaminated water to get onto their properties and make them sick. http://www.post-gazette.com/stories/local/marcellusshale/shale-drilling-contaminated-water-families-say-in-lawsuit-637571/?p=0 And the Pennsylvania DEP is investigating complaints of methane contamination in three private water wells and two streams in Bradford County, near a Chesapeake well site. http://www.post-gazette.com/stories/local/breaking/methane-gas-found-in-three-wells-two-streams-637440/

The Alamo Area Council of Governments reported to the Texas Raiload Commission’s Eagle Ford Shale Task Force that oil and gas activity around San Antonio could push that city ogver the federal government’s limits for ozone. San Antonio is currently the nation’s largest city in compliance with the EPA’s ozone standards.

One of the newest shale plays is the Utica Shale in Ohio. State legislatures, concerned about use of fresh water for fracing, are considering legislaton to limit water withdrawals and sources. One producer plans to try out GasFrac Energy’s process for using liquefied petroleum gas in place of water for fracing. Little is known about the success of the GasFrac technology. Last year Chevron tried it on several wells in the Pisceance Basin and said that the technology “significantly increases production while minimizing water usage.” BlackBrush recently said it signed a two-year contract with GasFrac to use its technology in the Eagle Ford. http://www.midwestenergynews.com/2012/05/15/waterless-fracking-technique-makes-its-debut-in-ohio/

Oil and Gas Lawyer Blog

Oil and Gas Lawyer Blog