An article in the Harvard Business Review, Oil’s Boom-and-Bust Cycle May Be Over. Here’s Why, provides an excellent overview of how the global oil market has been changed fundamentally by development of shale oil resources. Excerpts:

- U.S. shale producers “now represent half of U.S. oil production, up from a mere 10% just seven years ago in 2011. In fact, 2018 may mark the first year shale producers will be able to fund future expansions of drilling programs through their own cash flow.”

- ” Oil companies will need to develop both new conventional and unconventional crude oil resources to keep up with current demand for roughly one million more barrels of oil every year in addition to replacing the approximately four million barrels lost annually as reservoirs are naturally depleted. In total, we estimate that the oil and gas industry will have to replace about 40% of today’s oil production over the next seven to nine years.”

- “Transportation accounts for the majority of the world’s oil demand, and as long as oil prices stay way below their 2008 peak crude oil price of $145 per barrel, there’s less economic urgency to switch to electric vehicles and hybrids, even in China and Europe where there has been governmental support to move away from internal combustion cars. Electric vehicles will only account for 7% of the cars on the road over the next 12 years, Morgan Stanley estimated when oil prices were relatively low in May in a report titled ‘One Billion BEVS by 2050.'”

The authors posit that price swings will be shorter and less predictable – what the article calls “low-grade volatility” – because of shale producers’ ability to quickly ramp up production when prices rise, and that rapidly developing technology and improved drilling and completion techniques have reduced the cost of producing a barrel of crude below $40. The rapid decline curves of shale wells mean that wells must be drilled constantly to replace dwindling reserves. According to the article, the world’s growing appetite for oil means that shale oil reserves in the US will likely provide only 10 years’ supply of oil rather than 50, as commonly predicted. Although shale oil reserves exist all over the globe, investments in the infrastructure necessary to develop those reserves will take time.

So our addiction to hydrocarbons will probably continue for some time, with the attendant effect on climate.

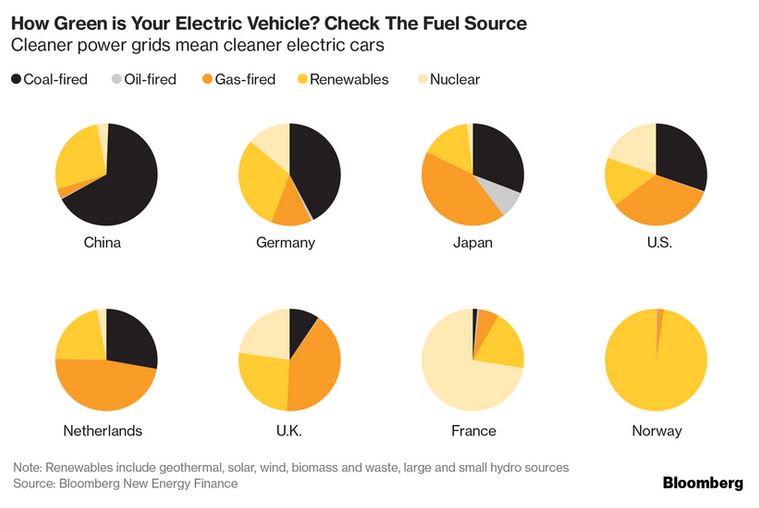

Speaking of climate, I ran across another article in Bloomberg asking “How Green is Your Electric Car?” The electricity used in EVs has to be generated, and much of that electricity is generated by hydrocarbon fuels. So it depends on where you live:

In the US, a gasoline-powered vehicle emits an average of 248.5 grams of CO2 per mile and the average EV emits 147.5 grams per mile, taking into account emissions from the plants that generate its electricity supply. But in France, which gets its a large portion of its electricity from nuclear power plants, EVs account for only 2.7 grams of CO2 per mile. So if your goal is to limit CO2 emissions, go nuclear.

In the US, a gasoline-powered vehicle emits an average of 248.5 grams of CO2 per mile and the average EV emits 147.5 grams per mile, taking into account emissions from the plants that generate its electricity supply. But in France, which gets its a large portion of its electricity from nuclear power plants, EVs account for only 2.7 grams of CO2 per mile. So if your goal is to limit CO2 emissions, go nuclear.

Oil and Gas Lawyer Blog

Oil and Gas Lawyer Blog