We’ve seen much posturing and finger-pointing from politicians on who is to blame for power failures during Winter Storm Uri last February. UT’s Austin Energy Institute has issued a report: The timeline and Events of the February 2021 Texas Electric Grid Blackouts, laying out the facts on what happened. The POWER Committee of the Austin Energy Institute, chaired by Dr. Carey King, issued this report. Dr. King does research related to how energy systems interact within the economy and environment, and how policy and social systems can made decisions and trade-offs among competing factors. The report clarifies how much the reduction in natural gas supply contributed to the disaster.

Summary from the report:

Factors contributing to the electricity blackouts of February 15-18, 2021, include the following:

- All types of generation technologies failed. All types of power plants were impacted by the winter storm. Certain power plants within each category of technologies (natural gas-fired power plants, coal power plants, nuclear reactors, wind generation, and solar generation facilities) failed to operate at their expected electricity generation output levels.

- Demand forecasts for severe winter storms were too low. ERCOT’s most extreme winter scenario underestimated demand relative to what actually happened by about 9,600 MW, about 14%.

- Weather forecasts failed to appreciate the severity of the storm. Weather models were unable to accurately forecast the timing (within one to two days) and severity of extreme cold weather, including that from a polar vortex.

- Planned generator outages were high, but not much higher than assumed in planning scenarios. Total planned outage capacity was about 4,930 MW, or about 900 MW higher than in ERCOT’s “Forecasted Season Peak Load” scenario.

- Grid conditions deteriorated rapidly early in February 15 leading to blackouts. So much power plant capacity was lost relative to the record electricity demand that ERCOT was forced to shed load to avoid a catastrophic failure. From noon on February 14 to noon on February 15, the amount of offline wind capacity increased from 14,600 MW to 18,300 MW (+3,700 MW). Offline natural gas capacity increased from 12,000 MW to 25,000 MW (+13,000 MW). Offline coal capacity increased from 1,500 MW to 4,500 MW (+3,000 MW). Offline nuclear capacity increased from 0 MW to 1,300 MW, and offline solar capacity increased from 500 MW to 1100 MW (+600 MW), for a total loss of 24,600 MW in a single 24-hour period.

- For wind and solar electricity generation, nameplate capacity is not a meaningful measure of the amount of power generation expected when the unit is not experiencing an outage, though nameplate capacity provides a meaningful metric for the thermal fleet of power plants (e.g., coal, nuclear, and natural gas-fired generating units). Using backcasted values of the available wind and solar radiation, available wind capacity outages actually decreased from 9,070 MW to 5,020 MW (-4,050) over the same time period and solar outages increased less, from 108 MW to 545 MW (+437 MW).

- Power plants listed a wide variety of reasons for going offline throughout the event. Reasons for power plant failures include “weather-related” issues (30,000 MW, ~167 units), “equipment issues” (5,600 MW, 146 units), “fuel limitations” (6,700 MW, 131 units), “transmission and substation outages” (1,900 MW, 18 units), and “frequency issues” (1,800 MW, 8 units).

- Some power generators were inadequately weatherized; they reported a level of winter preparedness that turned out to be inadequate to the actual conditions experienced. The outage, or derating, of several power plants occurred at temperatures above their stated minimum temperature ratings.

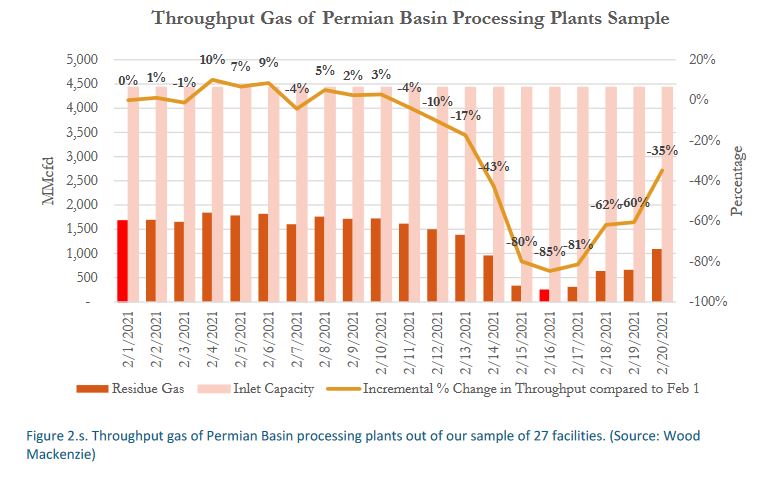

- Failures within the natural gas system exacerbated electricity problems. Natural gas production, storage, and distribution facilities failed to provide the full amount of fuel demanded by natural gas power plants. Failures included direct freezing of natural gas equipment and failing to inform their electric utilities of critical electrically driven components. Dry gas production dropped 85% from early February to February 16, with up to 2/3 of processing plants in the Permian Basin experiencing an outage.

- Failures within the natural gas system began prior to electrical outages. Days before ERCOT called for blackouts, natural gas was already being curtailed to some natural gas consumers, including power plants.

- Some critical natural gas infrastructure was enrolled in ERCOT’s emergency response program. Data from market participants indicates that 67 locations (meters) were in both the generator fuel supply chain and enrolled in ERCOT’s voluntary Emergency Response Service program (ERS), which would have cut power to them when those programs were called upon on February 15. At least five locations that later identified themselves to the electric utility as critical natural gas infrastructure were enrolled in the ERS program.

- Natural gas in storage was limited. Underground natural gas storage facilities were operating at maximum withdrawal rates and reached unprecedently-low levels of working gas, indicating that the storage system. was pushed to its maximum capability.

The ERCOT system operator managed to avoid a catastrophic failure of the electric grid despite the loss of almost half of its generation capacity, including some black start units that would have been needed to jump-start the grid had it gone into a complete collapse. Some power plants experienced multiple outages and may be included in more than one category.

Had one or more of the problems listed above not occurred, outages might still have occurred, but their duration and severity would likely have been lower. The magnitude of the failures caused unprecedented impacts:

- Rolling blackouts turned into persistent days-long electrical outages affecting millions of Texans connected to the ERCOT grid and leading to loss of life.

- The financial impacts were tremendous. According to PUCT data, natural gas prices, normally much less than $10/MMBTU, spiked to over $400/MMBTU at Texas trading hubs. Natural gas providers that were able to produce and transport gas reported windfall profits. Many financial sector firms that operate in the ERCOT energy market also reported large profits.

- The price of electricity spiked to $9,000 per MWh and stayed there by orders of the PUCT, which suspended some market price setting rules during the electricity blackouts. The PUCT stated that high prices were intended to ensure that generating units would participate in the market and that price-sensitive energy consumers would minimize their demand for electricity from the market. The PUCT also stated that the suspension of the rules was due to two reasons. First, to account for load that had been removed due to forced outages from the calculation of prices. Second, to avoid potentially even higher electricity prices that would result from the high price of natural gas.

- The financial losers included power generators whose equipment failed, generators dependent upon natural gas that were unable to obtain the fuel or were unhedged to high natural gas prices, and load serving-entities (retail electric providers, municipal utility systems, and rural electric cooperatives) who were inadequately hedged.

- Many market participants defaulted on their payment obligations to ERCOT, which serves as a central counter-party in the markets for electrical energy and ancillary services that it administers. These defaults may translate into increased costs for electricity consumers in Texas for many years to come.

Oil and Gas Lawyer Blog

Oil and Gas Lawyer Blog