EP Energy E&P Co., L.P. v. Storey Minerals, Ltd., 2022 SL 223253 (Tex.App.-San Antonio 2022, pet. denied)

The Texas Supreme Court recently refused to review the opinion of the San Antonio Court of Appeals in this case, involving construction of a favored nations clause in an oil and gas lease. The court of appeals held that, under the favored nations clause, EP Energy owed the lessor an additional $41 million bonus. One judge dissented.

The case also recounts the “colorful history” of the Altito Ranch, covering about 23,000 acres in La Salle County. EP Energy’s brief describes that history:

In 1908, Harry Landa, who was then the owner of the Altito Ranch, subdivided it into thousands of ten-acre “farms” for sale to third parties in a development project marketed to potential buyers as “Get a Home in Cotulla.” The town of Cotulla, located a few miles to the west of the Altito Ranch, had recently become the seat of La Salle County.

Landa’s agent developed a plan “to subdivide 400 acres [on the eastern portion of the Altito Ranch] into 2,005 town lots, with streets, alleys, and public grounds for schools, churches, and cotton gin, and to subdivide 22,600 acres [on the western portion of the Altito Ranch] into 2,005 farms, of which 1,920 were to be of 10 acres each, 50 of 20 acres each, 20 of 40 acres each, 10 of 80 acres each, and 5 of 160 acres each.” Generally, each “farm” buyer would receive “ten acres of land in the western portion of [the] ranch . . . together with one town lot . . . in the townsite of Altito” on the eastern portion of the ranch, and “sales would be vigorously pushed by traveling and resident salesmen.” The Altito Ranch was subdivided according to the plan, and many tracts were sold to third-party buyers near and far. But the development project failed to launch, and the subdivided Altito Ranch sat almost entirely undeveloped.

In the 1920s, the Storey family (predecessor to Petitioner Storey Minerals, Ltd., or “Storey”) fenced in the Altito Ranch and began work to establish record title to each of the thousands of subdivided tracts, tract by tract. Through marriage, inheritance, and other conveyances, Storey’s ownership—and the title acquisition project—came to be shared with Petitioners Maltsberger/Storey Ranch, LLC (“Maltsberger”), and Rene R. Barrientos, Ltd. (“Barrientos”). Today, Petitioners have established record title to most of the tracts comprising the Altito Ranch. Petitioners claim the remaining tracts and their associated mineral interests by adverse possession. But Petitioners have not reduced that blanket adverse possession claim to a final judgment of record. Therefore, Petitioners cannot show complete record title ownership of the mineral interest in the Altito Ranch; record title to the mineral interests associated with some of the subdivided tracts remains in third parties.

(Harry Landa was a prominent Texas businessman in New Braunfels and San Antonio. He was a member of the original board of directors of the San Antonio Southern Railway charted in 1920. His palatial home in San Antonio was converted into the Landa Library; Landa Park on the Comal River in New Braunfels is named after him.)

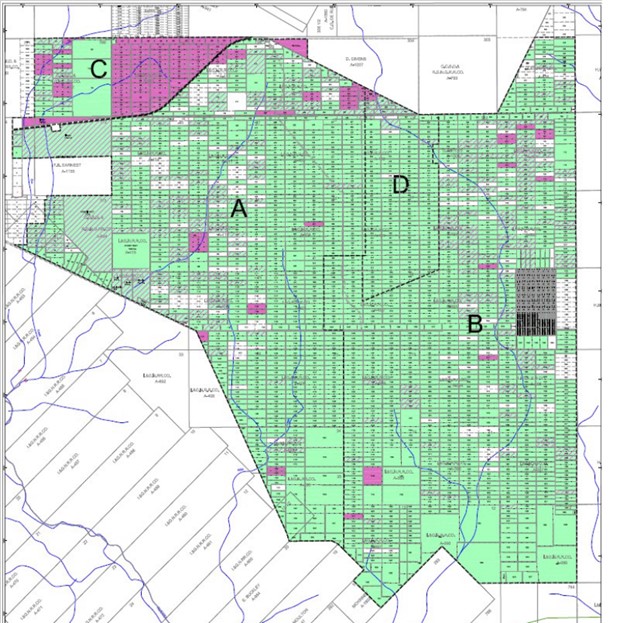

A map of the Ranch (click to enlarge):

Storey, Maltsberger and Barrientos each own undivided interests in the Ranch. In 2009, early in the scramble for leases covering the Eagle Ford play, they concluded leases of the Ranch to EP Energy. The Ranch was divided into four areas, and each owner executed a lease on each of the three areas. The dispute is over the three leases covering Area A, about 8,700 acres.

All of the leases are on the same form and all contain the following “favored nations” clause:

If at any time during the existence of this lease, the lessee or any subsidiary or affiliate of lessee directly or indirectly (including, but not limited to an assignment), acquires an Oil and Gas Lease on a portion of the leased premises with any other individual or entity that owns a mineral interest in the leased premises on such terms that the royalty, bonus, and rentals or any of them are greater than those provided to be paid to lessor hereunder, lessee expressly stipulates, warrants, and agrees that it will execute an amendment to this lease, effective as of the date of the third party lease on the leased premises, to provide that the lessor hereunder shall receive thereafter the same percentage (per net mineral acre) royalty, bonus, and/or rentals as any subsequent lessor of the leased premises to the extent that such royalty, bonus and/or rentals are greater than those provided to be paid herein. To the extent that the royalty, bonus and/or rentals in any subsequent lease are less than provided herein, lessor hereunder shall continue to receive the royalty, bonus, and/or rentals as provided in this lease. Lessee expressly stipulates warrants and agrees that it shall provide lessor hereunder with a copy of any leases that it, or any subsidiary or affiliate of lessee directly or indirectly acquires on the leased premises, immediately upon their execution. This Paragraph XXVI shall not apply to any lease or contract with a mineral owner that covers less than twenty (20) net mineral acres.

EP Energy agreed to pay a bonus for execution of the leases of $500/acre. But because the lessors’ title to some of the acreage was not yet established, the parties entered into a lease addendum providing that bonuses would be paid on acreage if and as title to the tracts was cleared. This apparently took some time as to some of the tracts.

In 2018, EP Energy acquired oil and gas leases from Carrizo Oil & Gas, including three leases that covered lands in Area A of the Altito Ranch. Carrizo had paid a bonus of $5,200 per acre for one of those leases, the “Donaldson Brown Lease,” dated September 25, 2013. When Storey, Maltsberger and Barrientos discovered EP’s acquisition it demanded payment of an additional bonus of $4,700 per acre ($5,200 less $500) on the 8,700 acres of Area A – an additional $41 million.

The trial court held that EP owed the additional $41 million, and the court of appeals agreed, with one judge dissenting. The Supreme Court has refused to hear the case.

EP’s argument: the MFN clause required it to pay the additional $4,700/acre bonus only on acreage within Area A on which it paid bonus under the MSR leases – pursuant to the deferred bonus addendum — after the date of the Donaldson Brown Lease – 9/25/13. That amounts to only some $1.7 million. A creative argument, based on a creative reading of the MFN clause. It argued that, if EP acquires a lease that “triggers” the MFN clause, it must pay the additional bonus only on bonuses due “thereafter” under the Area A leases. The dissenting justice agreed with this construction.

The case provides a lesson in how a lease clause, seeming perfectly clear when drafted, can later be ingeniously re-construed when $41 million is at stake.

Oil and Gas Lawyer Blog

Oil and Gas Lawyer Blog