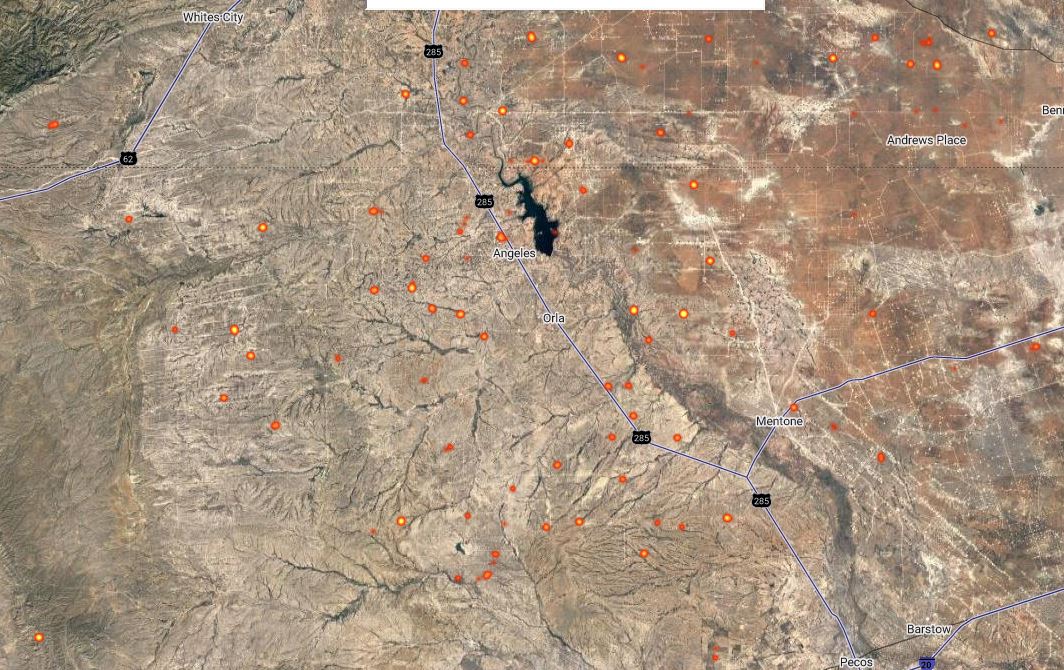

Last March the San Antonio Court of Appeals handed down its decision in Bell v. Chesapeake Energy, No. 04-18-00129-CV. Chesapeake has asked the Texas Supreme Court to review the case. The facts bear a resemblance to Murphy v. Adams, decided by the Supreme Court last year. Both involve construction of an express offset clause in an oil and gas lease.

A typical express offset clause provides that, if a well is drilled within a certain distance from the lease boundary, the lessee must either drill an offset well or pay compensatory royalty based on the production from the adjacent well. The lessor is not required to show that the adjacent well is actually draining the leased premises. In Murphy v. Adams, the issue was what constitutes an “offset well.” The Supreme Court held (in a 5 to 4 decision) that, in the context of horizontal drilling in the Eagle Ford formation, any well drilled on the leased premises, regardless of its location, may satisfy the lessee’s obligation to drill an offset well.

In Bell v. Chesapeake, the issue is what amount of compensatory royalty Chesapeake must pay. The wells drilled on tracts adjacent to Chesapeake’s leases were not drilled parallel to the lease line, but a portion of the adjacent wells’ horizontal wellbore was within the minimum distance from the lease line to trigger the offset-well obligation. The lessors contend that Chesapeake must pay compensatory royalty based on 100% of the production from the adjacent well. Chesapeake argues that it should have to pay compensatory royalty only on the portion of the adjacent well’s production coming from perforations or “take points” that are within the minimum distance from the lease line specified in the lease.