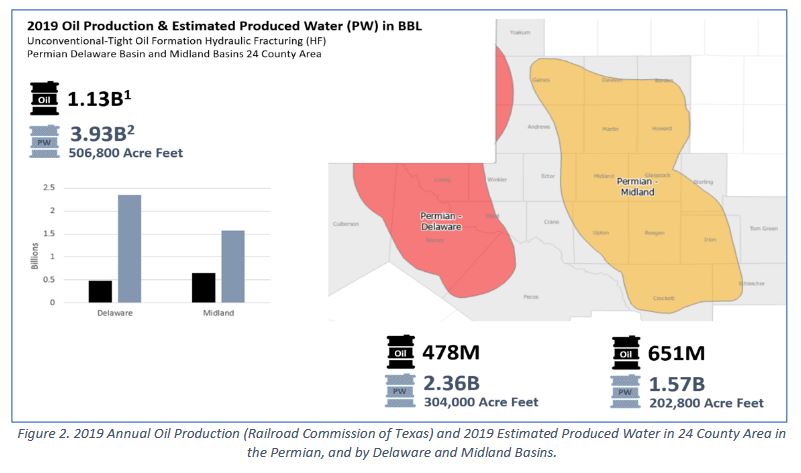

In 2021 the Texas Legislature created the Texas Produced Water Consortium to study possible beneficial uses of fluid oil and gas wastes. The Consortium produced its report to the Legislature in 2022. I recently ran across a remarkable conclusion in that report: it estimates that in 2019 unconventional tight-oil formation wells in the Texas portion of the Permian Basin produced almost 4 billion barrels, or 506,800 acre-feet, of wastewater. (click on image to enlarge)

506,800 acre-feet is a column of water covering an acre of land and 96 miles high. Or 11.6 square miles covered one foot deep in water. Lake Buchanan, the largest Texas lake, has a capacity of 992,000 acre-feet. New York City consumes 1,236,000 acre-feet of water per year.

506,800 acre-feet is a column of water covering an acre of land and 96 miles high. Or 11.6 square miles covered one foot deep in water. Lake Buchanan, the largest Texas lake, has a capacity of 992,000 acre-feet. New York City consumes 1,236,000 acre-feet of water per year.

It is no wonder that the underground injection of such a huge volume of water is causing problems. Much of that water is being injected into shallow oil-producing formations, in particular the depths of the Delaware Mountain Group, damaging producing wells and causing waste. The increased pressures in injection zones have caused abandoned wells to erupt in gushers of injected water. And water injection is inducing seismic events, otherwise known as earthquakes. The Railroad Commission has even ordered some injection wells to be shut down in response to those quakes.