The news is filled with stories predicting the effect of falling oil prices on US production. Good news for the economy, bad news for the Texas oil and gas industry. Will the rig count fall? Will companies go into bankruptcy? Only time will tell.

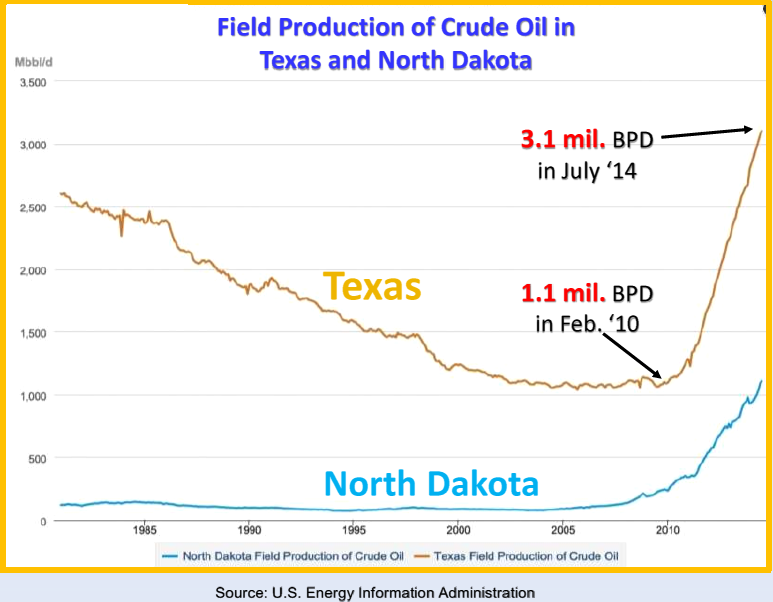

The answer may depend on OPEC. OPEC countries produce about one-third of the world’s total oil each month. OPEC countries have about 80 percent of the world’s oil reserves. Predictions of OPEC’s demise are greatly exaggerated. But US production has increased to almost 9 million barrels a day, close to Saudi Arabia’s production. Texas is responsible for a big part of that increase:

Clearly the increased US production, combined with the predictable decline in demand and the slowdown of China’s and Europe’s economies, is affecting the world oil price. OPEC convenes on November 27, and pundits are guessing what it will do. On October 29, OPEC’s Secretary-General Abdalla El-Badri, cautioned calm, after a conference in London: “We don’t see really fundamental changes in the supply side or the demand side. Unfortunately everyone is panicking. The press is panicking, consumers are panicking. We really should think and see how this will develop.”

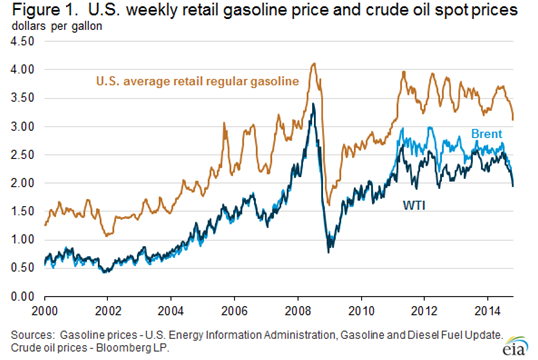

El-Badri has a point. Looked at over the long term, as shown below, this may be but another adjustment in world prices.

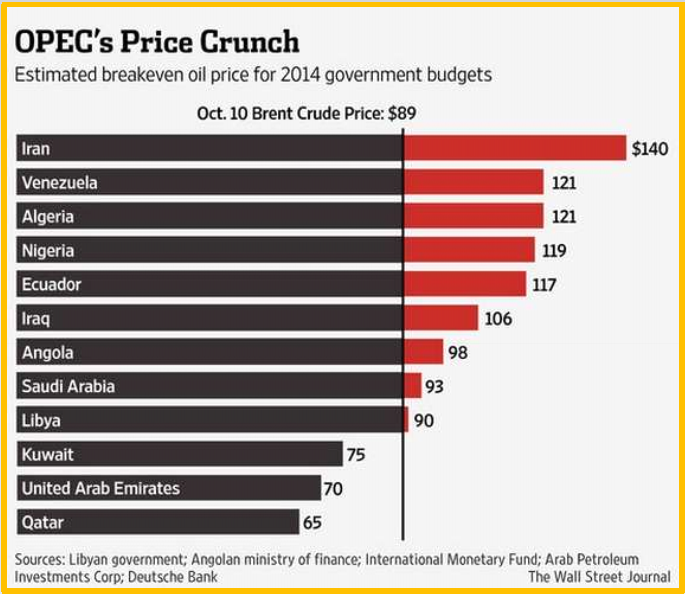

Not all OPEC countries are the same. Some countries will be squeezed by oil prices below $80:

So far, the falling oil price appears to have had little effect on drilling activities in Texas. The Texas Petro Index published by the Texas Alliance of Energy Producers reached 312.3 in September, up 6% over last September. The Baker Hughes rig count in Texas was 902 in September, up from 837 rigs in September 2013. But the US rig count dropped by 4 rigs to 1,925 for the week ended November 7, although horizontal rigs gained 9 to 1,362.

One analyst, Gavekal Dragonomics, says that, if oil prices continue to fall, “drilling activity is likely to decline.” But the negative effects on the energy sector will be outweighed by the positive effect on US consumers. Lower prices will lift net exports. And each one-cent drop in gasoline prices puts $1 billion in the pockets of consumers over a one-year period.

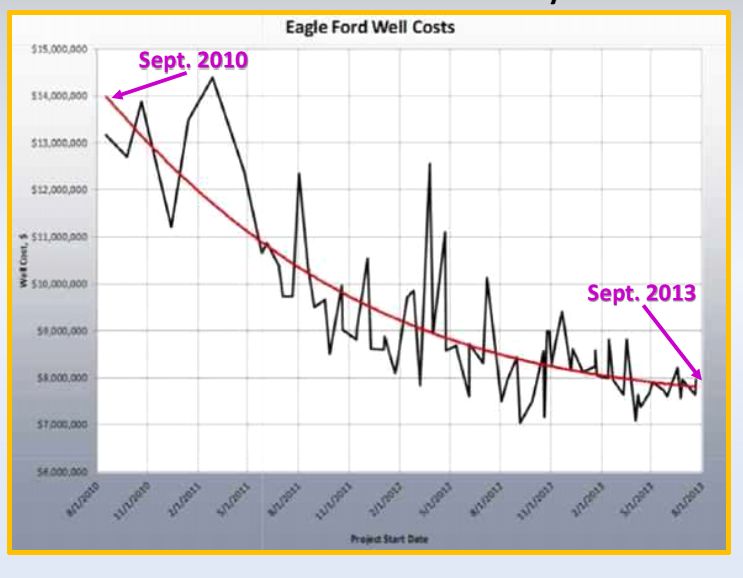

Dr. Harold Hunt, professor at the Texas A&M Real Estate Center, recently presented an analysis of how falling oil prices affect the Houston economy. Here is a link to the Powerpoint of his presentation: Hunt_S_TX_College_Oct__2014___.pdf Dr. Hunt notes the declining cost of drilling in the Eagle Ford, lowering the break-even price of oil:

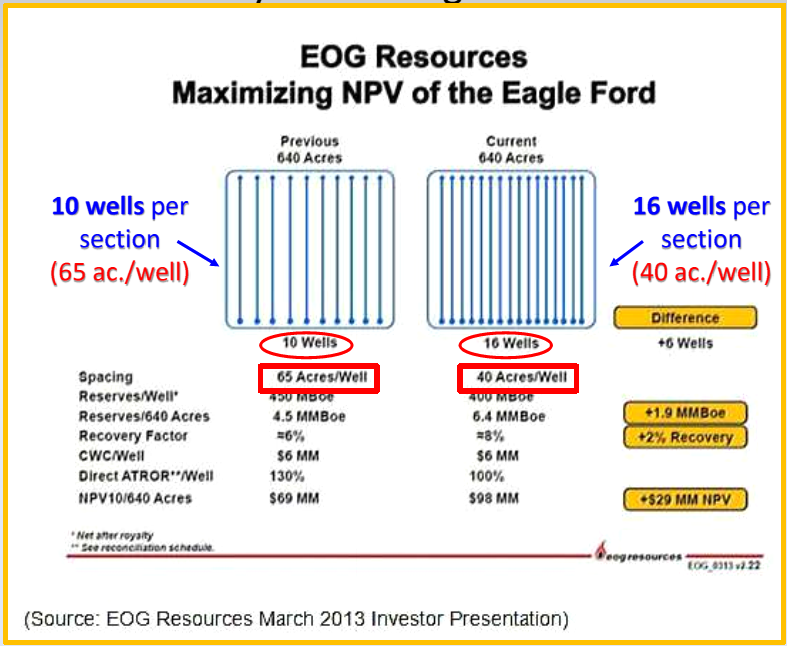

Down-sizing of well spacing has also maximized the value of Eagle Ford acreage:

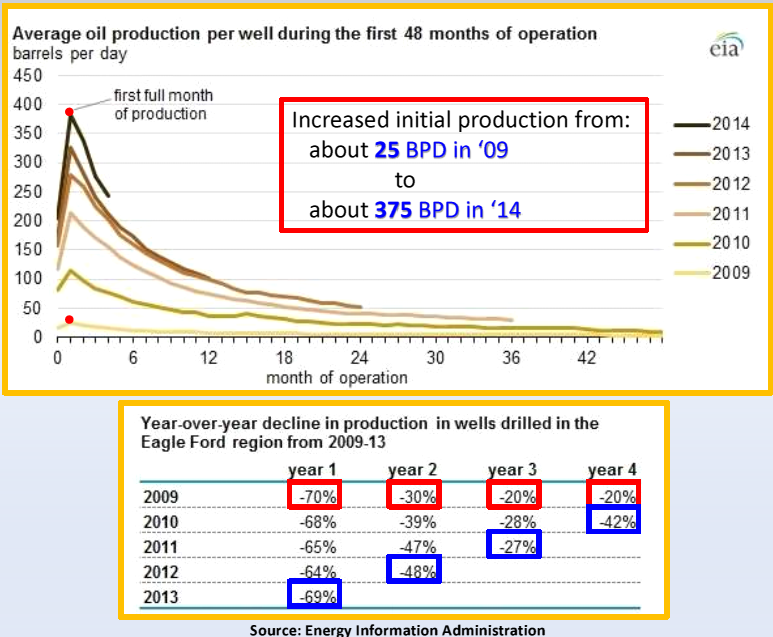

Dr. Hunt also notes the increased rates of initial production in the Eagle Ford, but also the increase in decline rates of those later wells:

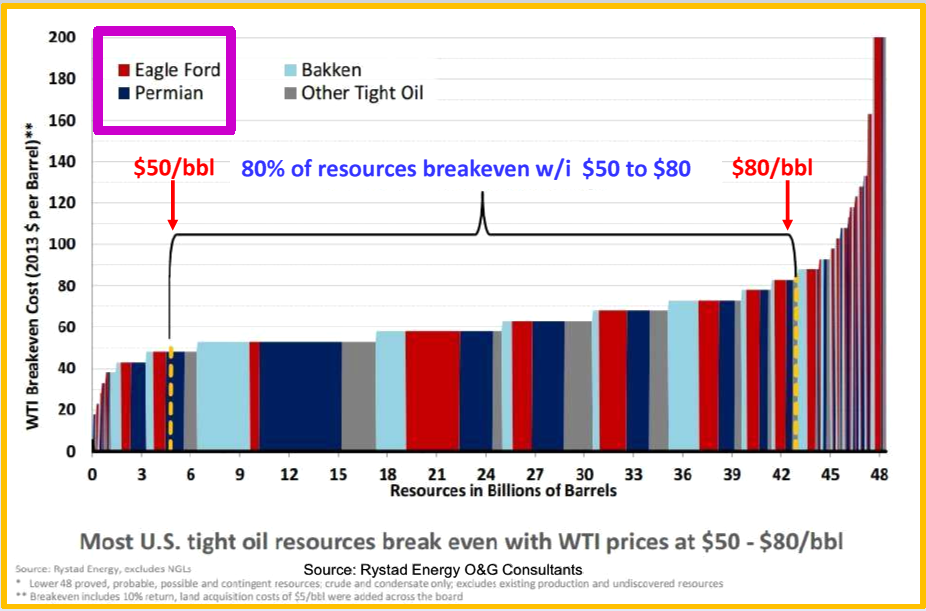

His conclusion: 80% of shale oil resources in the US can make money with oil at $50 to $80 per barrel:

Much depends on where the acreage is in the play. There are good sections and bad sections in the Eagle Ford, as in all fields. Those producers on the margins will suffer at $80 prices. And investors may be more wary of putting their money in areas with higher risk.

Oil and Gas Lawyer Blog

Oil and Gas Lawyer Blog