A recent report from Deloitte provides a good perspective on the prospects for wind and solar electricity.

Some takeaways:

Costs of wind and solar are now competitive with coal and gas. “Power purchase agreement (PPA) prices for wind and solar power are also competitive with other resources. The weighted average US price for the first half of 2021 from auction and PPAs for solar PV is US$31/MWh, while for onshore wind it is US$37/MWh. This compares to a weighted average wholesale electricity price of about US$34/MWh across US markets during the same period.” It now costs less to build new solar and wind plants than to continue operating existing coal-fired plants. Wind and solar costs are projected to fall by half by 2030.

“Power systems in some countries and states are already operating with more than 50% penetration of wind and solar generation annually without impacting reliability. There is an expanding set of operational and technical solutions to help integrate these resources and building new conventional power plants to back them up has not been necessary.” Twelve states generated more than a fourth of their electricity from variable renewable energy (VRE) sources in 2020. Texas is projected to get 55% of its electricity from VRE by 2035.

Challenges:

About 85% of solar panels sold in the US come from China and Southeast Asia.

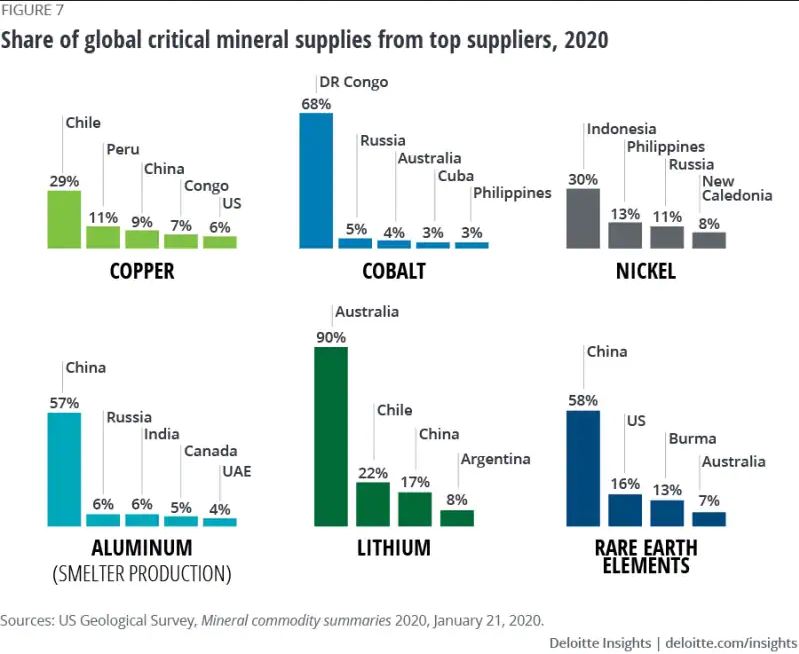

Battery storage is a critical part of using VRE. 42% to 65% of key battery components come from China. The US imports nearly 3/4ths of wind power generating equipment from Spain, 64% of wind towers from Asia, and 22% of blades and hubs from China.

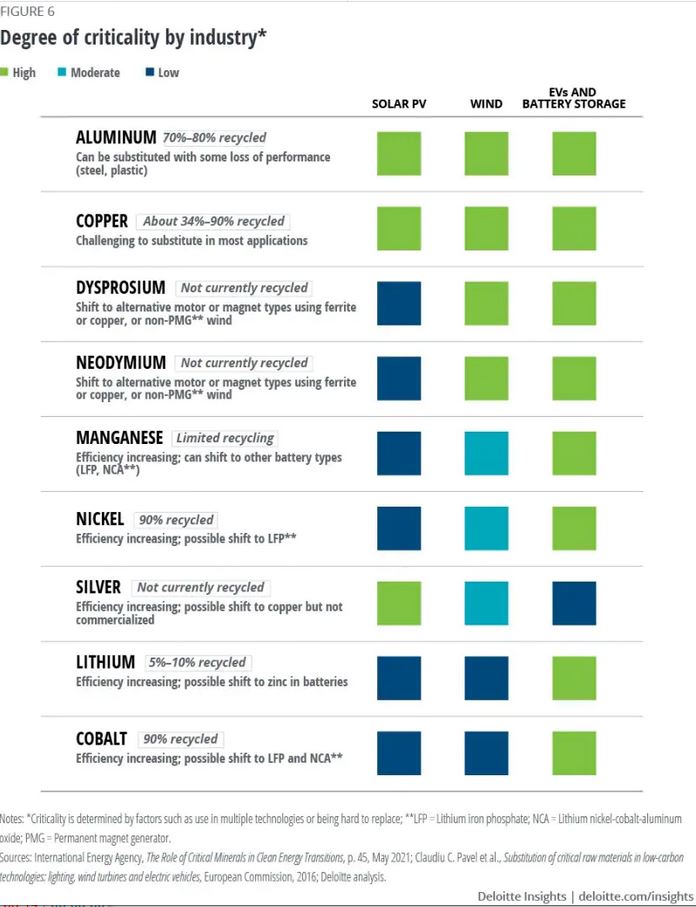

The need for critical minerals could be a significant constraint (click on image to enlarge):

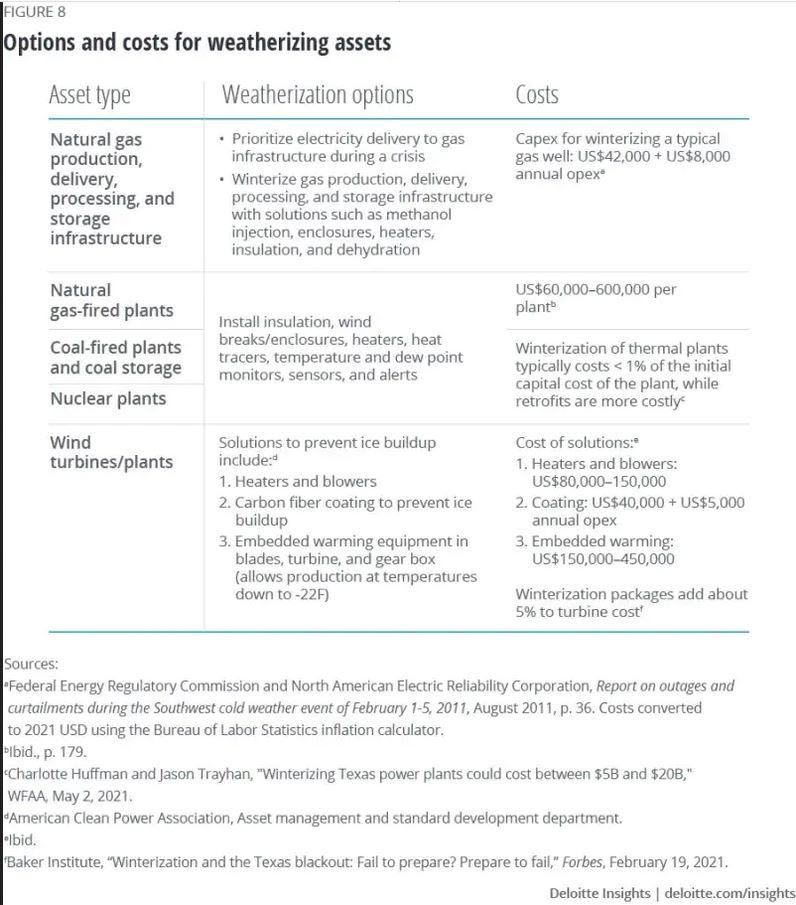

The report also addresses the electric generating system’s vulnerability to weather, fire and other disasters. It gives the following costs for winterizing energy infrastructure:

Note that the first asset type is natural gas production, delivery, processing and storage. Estimated cost for winterizing a typical gas well is $42,000, plus $8,000/year operating costs.

The report concludes on an optimistic note. None of the challenges to meeting net-zero emissions and emission-free electricity by 2035 are insurmountable.

Oil and Gas Lawyer Blog

Oil and Gas Lawyer Blog