The Texas Supreme Court has denied motion for rehearing of its opinion in Burlington Resources Oil & Gas Company v. Texas Crude Energy, No. 17-0266. The case addresses deductibility of post-production costs in the context of an overriding royalty. The case may, however, have implications for post-production-cost deductions in oil and gas royalty clauses.

Texas Crude acquired oil and gas leases in Live Oak, Karnes and Bee Counties, and entered into an agreement with Burlington to develop those leases. The parties agreed that any oil and gas lease acquired by either party within the designated area would be part of the development agreement, and that Texas Crude would receive an overriding royalty interest in all leases within the development area. Texas Crude subsequently sued Burlington over various alleged breaches of the development agreement, including the deduction of post-production costs from Texas Crude’s overriding royalties. The parties filed summary judgment motions asking the trial court to construe the language in the assignments of overriding royalty, and the trial court ruled that post-production costs were not deductible. The parties agreed to seek an interlocutory appeal of this issue, which the court granted. The Corpus Christi Court of Appeals agreed to hear the case, and it affirmed the judgment of the trial court. 516 S.W.3d 638. Burlington then appealed to the Texas Supreme Court, which reversed and remanded, holding that the language of the overriding royalty assignments permits deduction of (some?) post-production costs.

The pertinent language of all of the overriding royalty assignments is identical:

The overriding royalty interest share of production shall be delivered to ASSIGNEE or to its credit into the pipeline, tank or other receptacle to which any well or wells on such lands may be connected, free and clear of all royalties and other burdens and all costs and expenses except the taxes thereon or attributable thereto, or ASSIGNOR, at ASSIGNEE’S election, shall pay to ASSIGNEE, for ASSIGNEE’S overriding royalty oil, gas or other minerals, the applicable percentage of the value of the oil, gas or other minerals, as applicable, produced and saved under the leases. “Value”, as used in this Assignment, shall refer to (i) in the event of an arm’s length sale on the leases, the amount realized from such sale of such production and any products thereof, (ii) in the event of an arm’s length sale off of the leases, the amount realized for the sale of such production and any products thereof, and (iii) in all other cases, the market value at the wells.

The unanimous decision, opinion by Justice Blacklock, held that the controlling language of the assignments is “delivered to ASSIGNEE or to its credit into the pipeline, tank or other receptacle to which any well or wells on such lands may be connected …” Texas Crude argued that the controlling language was in the definition of “Value”: “the amount realized from such sale of such production and any products thereof.” Texas Crude contended that under the court’s prior opinion in Chesapeake v. Hyder, 483 S.W.3d 870 (2016), a royalty based on the “amount realized,” without more, is free of post-production costs, and that the “into-the-pipeline” language would not be relevant unless Texas Crude elected to take its royalty share of production in kind. Continue reading →

Granger read aloud General Order No. 3:

Granger read aloud General Order No. 3:

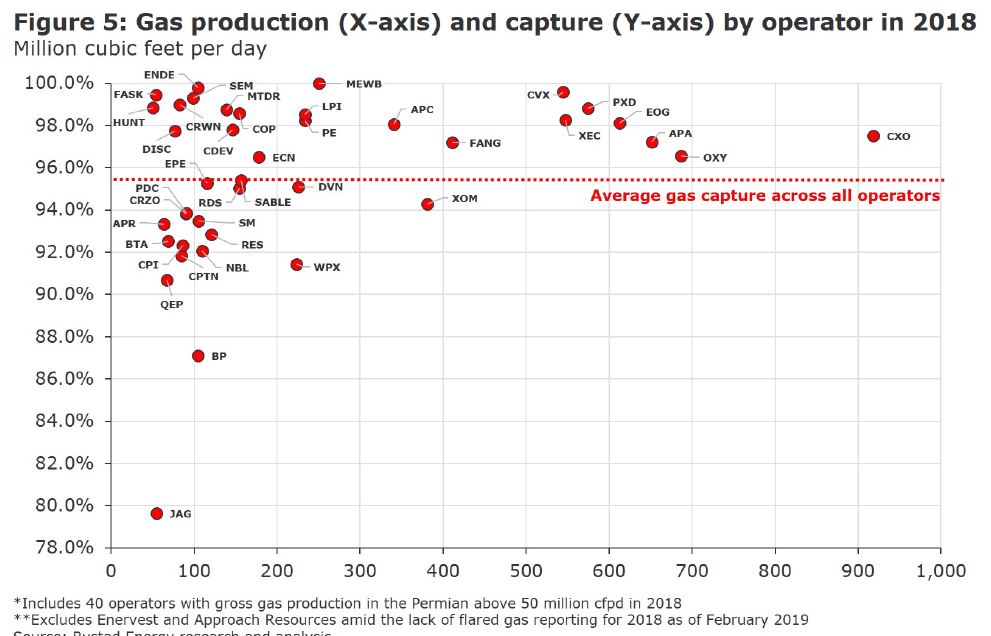

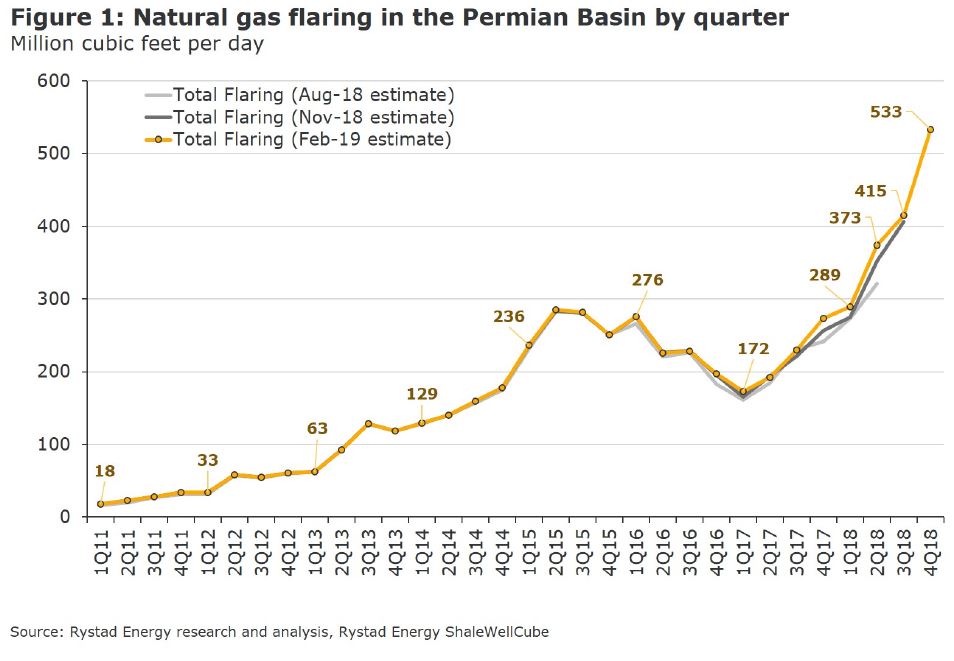

The flared volumes represented an average of less than 5% of all gas produced. But results varied greatly by operator. (click to enlarge)

The flared volumes represented an average of less than 5% of all gas produced. But results varied greatly by operator. (click to enlarge)