StateImpact Texas has published a series of good articles about the growing evidence that the huge quantities of wastewater being injected in the Barnett Shale field are causing earthquakes — some of sufficient intensity to cause significant damages. Lawsuits have been filed in Johnson County to recover for the damage. StateImpact’s most recent article can be found here. Links to all of StateImpact’s articles on earthquakes caused by oil and gas activity are here.

FPL Farming Case – Can Salt Water Injection Wells Cause Subsurface Trespass?

Suppose that the fluids injected into a disposal well migrate beyond the boundary of the tract where the well is located; does that incursion of the injected fluids into and under the neighbor’s property constitute a trespass? Until recently, this question had never been addressed by a Texas appellate court, and the assumption in the disposal industry was that such incursion was not actionable. The Beaumont Court of Appeals, in FPL Farming Ltd. (“FPL”) v. Environmental Processing Systems, L.C. (“EPS”), concluded that the neighbor does have a trespass claim.

The Beaumont Court of Appeals has issued two opinions in the case; the first was appealed to the Supreme Court which reversed and remanded to the Court of Appeals, and the second has also been appealed to the Supreme Court, where it is now pending. FPL Farming Ltd. v. Environmental Processing Systems, L.C., 305 S.W.3d 739 (Tex.App.-Beaumont), reversed and remanded 351 S.W.3d 306 (Tex. 2011), on remand 383 S.W.3d 274 (Tex.App.-Beaumont May 24, 2012, pet. filed 1/18/13).

The facts in FPL are these: EPS operates an injection well for non-hazardous waste on land adjacent to the land owned by FPL. FPL previously objected to an amendment of EPS’s permit that increased the rate and volumes allowed to be injected. The Austin Court of Appeals affirmed the permit amendment over FPL’s objections, ruling that “the amended permits do not impair FPL’s existing or intended use of the deep subsurface.” FPL Farming Ltd. v. Tex. Natural Res. Conservation Comm’n, 2003 WL 247183 (Austin 2003, pet. denied).

Chesapeake and Post-Production Costs

Lawsuits against Chesapeake Exploration for wrongfully deducting post-production costs from its gas royalty payments are hitting a boiling-point. Suits are being pursued against the company in every jurisdiction where it operates, including Texas, Arkansas, Lousiana, Kansas, Ohio, West Virginia, Oklahoma and Pennsylvania. Chesapeake has recently been much more aggressive in deducting post-production costs. In the Barnett Shale in North Texas, its post-production cost deductions have been as much as $.70 to $1.00 per mcf, and with such low gas prices, some royalty owners’ payments have been halved by such deductions. Chesapeake’s royalty payments in North Texas have reportedly been on a net price of as little as eleven cents per mcf, and as little as 11% of the price other producers have based their royalty payments on. A recent Bloomberg article summarizes Chesapeake’s royalty payment practices.

Chesapeake has settled some claims, including large royalty owner claims in Pennsylvania. Chesapeake’s marketing practices in Pennsylvania mirror those it uses in the Barnett Shale. Last year, Chesapeake settled a claim brought by the Dallas-Fort Worth Airport for underpayment of royalties for $5 million. The Bass family in Fort Worth recently sued the company for wrongfully deducting post-production costs.

Chesapeake’s tactics for how it calculates its royalties cannot be understood without knowing something about how Texas courts have addressed deductibility of post-production costs. I have previously written three posts on this topic that can be seen here, here and here.

Twenty Biggest Oil Companies

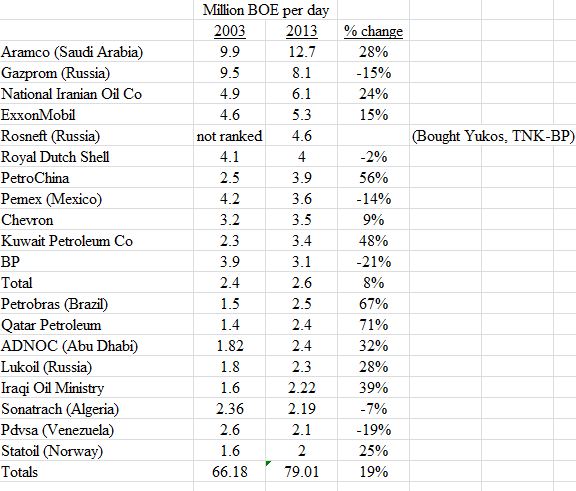

WoodMackenzie has recently come out with its 2013 ranking of the world’s twenty largest oil companies, and their change in production over the last ten years:

(BOE is barrels of oil equivalent.) As you can see, most are state-owned companies. Russia re-acquired its privately-owned companies. Saudi Arabia has increased its production 28% in the last 10 years. Iran, despite the embargo, has increased its production by 24%, in part because of increased export of natural gas. Venezuela’s production has suffered from politicization of its national oil company. Shell’s efforts to increase production by acquiring a position in U.S. shale plays has not been successful. BP has sold off a substantial part of its production. China has invested big-time to fuel its economy. And the world economy has managed to survive $100 oil. For comparison, the total world production in 2010 was about 137 BOE/day. These top twenty companies together produced about 60% of that total.

For a good article on these numbers, see Forbes’ article, The World’s Biggest Oil Companies – 2013, here.

Environmental Report Card on Fracing

A group of environmentally conscious social and investor organizations has produced a report, Disclosing the Facts: Transparency and Risk in Hydrualic Fracturing Operations. The report grades companies on how well they report risks attendant to operations in the major US shale plays.

The report is a collaboration of four organizations: As You Sow, Boston Common Asset Management, Green Century Capital Management, Inc., and The Investor Environmental Health Network. It was made possible by grants from several foundations, listed in the report.

The report assesses the public disclosures of 24 oil and gas companies on their quantitative reporting in five areas of environmental, social and governance metrics: toxic chemicals, water and waste management, air emissions, community impacts, and management accountability. Each company is graded on these metrics based on how well they measure and disclose, quantitatively, their performance in these areas. The grades are based solely on publicly available information provided by the companies. Example criteria:

End of the Shale Boom?

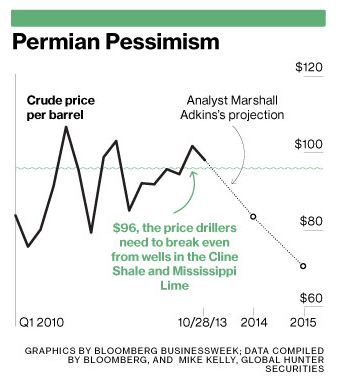

I have recently seen articles predicting the end of the shale boom, coming not only from those who have consistently predicted that shale production would never amount to anything, but also from respected sources whose predictions have previously proven accurate. A recent Houston Chronicle article quotes from a paper written by Amy Myers Jaffe, executive director for energy and sustainability at the University of California, Davis, and Mahmoud El-Gamal of Rice University, saying that “The most likely scenario – absent war – is for oil prices to decline significantly.” A significant decline in oil prices would make many if not most wells shale wells now being drilled in the Eagle Ford and Permian areas of Texas uneconomical. Jaffe expects oil prices to decline in the next three to five years. “To hold up prices it would have to be a regime change in several countries that results in lasting civil wars with lots of infrastructure being blown up,” she said.

An article in Business Week says that the break-even price for profitability in the Cline Shale play of the Permian Basin is $96 per barrell; in the Eagle Ford, it’s $78/barrel, and in the Bakken, $84. Here is one analyst’s prediction of future oil prices:

Falling fuel demand is a big part of the prediction. Jaffe believes demand will fall even with continued growth in China and other emerging nations. The average fuel economy for new vehicles in the US is up 4.7 mpg since October 2007. And Americans are driving less. Lower-priced natural gas will replace some of the oil demand. From the Energy Information Administration:

Klotzman Allocation Well Proceeding

For those following the Klotzman allocation well dispute, here are links to the replies of EOG and intervenors to the Klotzmans’ motion for rehearing at the Railroad Commission:

The Limits of Rational Decisionmaking

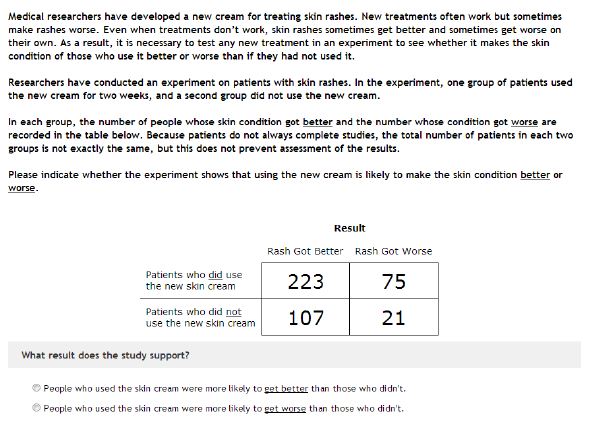

I recently came across a study just published by a group of sociology professors testing our ability to make decisions based on facts. It takes a little explanation, but it is worth looking at. The question they asked: Why does public conflict over societal risks persist in the face of compellng and widely accessible scientific evidence? To find out, the professors asked 1,111 participants a series of questions designed to gauge their political views, and then they were asked to solve a word math problem. Half of the participants were given the following problem:

The correct answer? Patients who used the skin cream were more likely to get worse than those who didn’t. Roughly 1 in 3 patients who used the skin cream got worse, but roughly 1 in 5 of those who didn’t use the skin cream got worse. Solving the problem requires skill in “numeracy”, basically the ability to solve math problems. (For the study, the data were reversed for half of the participants and presented so that they suggested that the skin cream did work.) 59% of those in the study got the answer wrong. The more “numerate” the study participants were, the more likely they were to get the problem right. That was true whether the participants were liberal Democrats or conservative Republicans.

The other half of the participants were given a different problem: they were asked to determine the effectivenes of laws “banning private citizens from carrying concealed handguns in public.” Participants were given data about cities that had or had not passed concealed carry bans, and where crime in these cities had or had not decreased. The numbers used in this problem were exactly the same as those in the skin-rash problem. The results are shown below:

Motion for Rehearing filed in Klotzman v. EOG Allocation Well Permit Dispute

For those of you following the Klotzman proceeding at the Texas Railroad Commission, you can read the Klotzman Motion for rehearing here. #02-0278952 Klotzman Motion for Rehearing.PDF

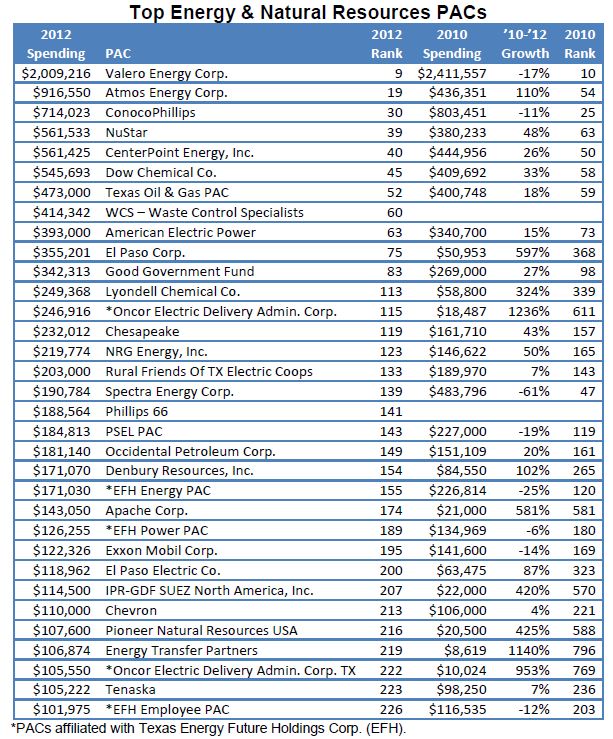

Texas PACs Giving in Energy Sector

Texans for Public Justice, www.tpj.org, issued its report on 2012 Election Cycle Spending by Texas political action committees. You can see it here. Some highlights:

Of the $70 million spent by Texas business PACs in 2011-12, $11.9 million, or 9%, was spent by PACs devoted to energy and natural resources issues/candidates. Here are the top spenders:

The above figures represent spending by these PACs both in-state and out-of-state.