MIT Study of Relationship Between Oil and Gas Prices

One of the remarkable aspects of the oil and gas markets over the last few years has been the rapid decline of natural gas prices despite the continuing high price of crude oil. Historically, analysists have assumed that there is a relationship between the price of the two commodities. After all, both are basically sources of stored energy, which can be measured in British Thermal Units, or Btus. One barrel of crude oil has about the same energy as six million Btu of natural gas, so it has been assumed that one barrel of crude should have about the same value as six MMBtu of gas. When companies report their reserves, they often use the term BOE, or “barrels of oil equivalent,” meaning that they convert their gas reserves to oil barrels using this 6-to-1 ratio. But at today’s prices, the ratio on a Btu basis is closer to 12-to-1; it has been as low as 2.5-to-1 and as high as 19-to-1. So why is there now such a de-coupling of oil and gas prices?

I recently ran across a paper published by two MIT professors titled “The Weak Tie Between Natural Gas and Oil Prices,” by David J. Ramberg and John E. Parsons. You can find it here. The authors ask the question: Is there a relationship between the price of oil and the price of natural gas? If there was formerly such a relationship, has it been broken? They use historical data and analysis to answer these questions. Their conclusion:

despite large temporary deviations, natural gas prices continue to exhibit evidence of a cointegrating relationship with crude oil prices, and gas prices consistently return to a long-run relationship. However, this relationship has apparently shifted at least once over a 12-year period to a new equilibrium. There is no statistical evidence to support the claim that a relationship between the two price series has been completely severed.

Groundwater Districts’ Regulation of Water Supply Wells – What Landowners Should Know

A lot has been written lately about the amount of groundwater being used for hydraulic fracturing in shale plays – particularly in the Eagle Ford Shale, and more recently in the Permian Basin. This raises the question whether — and to what extent — exploration companies’ water wells used in fracing are subject to regulation by groundwater districts in Texas. It turns out that this is not an easy question to answer.

I am indebted to Mary K. Sahs (Carls, McDonald & Dalrymple, LLP), an Austin attorney who specializes in water law and who has written an excellent paper, Frac Water – Regulation of Quantity and Quality, and Reporting by Texas Groundater Conservation Districts, for the State Bar conference “The Changing Face of Water Rights” held on February 23 of this year in San Antonio, for a thorough explanation of this subject. I have borrowed liberally from her work.

Groundwater conservation districts are governed by the Texas Water Code, Chapter 36, and by any special provision in the law that authorized creation of each district. Section 36.117 (b) (2) of the Water Code provides that the following are exempt from regulation: “drilling a water well used solely to supply water for a rig that is actively engaged in drilling or exploration operations for an oil or gas well … located on the same lease or field associated with the drilling rig.” This has been referred to as the exemption for “rig supply wells.” Rig supply wells are still subject to any water well spacing rules imposed by the water district, and the district may require the well to be registered and may require it to be properly equipped and completed.

EPA Region 6 Administrator Al Armendariz Resigned

Controversial EPA Administrator Al Armendariz has resigned his post as Administrator of Region 6, which includes Texas, after Senator James Inhofe (R-Okla.) called for an investigation of the EPA’s actions related to oil and gas exploration. Armendariz was previously a professor at Southern Methodist University in Dallas. Prior to his appointment by the Obama administration he published a highly criticized study of air quality in the DFW area that found that oil and gas exploration in the Barnett Shale is a significant contributor to air pollution in that region. Since his appointment Armendariz has been a lightening rod for the exploration industry’s criticism of the EPA.

In his remarks on the Senate floor, Senator Inhofe highlighted a talk given by Armendariz that was captured on video and recently posted to YouTube, in which he says that, because of the limited number of staff in his office, his approach is to act like the Romans: “They’d go into a little Turkish town somewhere, they’d find the first five guys they saw and they would crucify them. And then you know that town was really easy to manage for the next few years.”. Inhofe also wrote a letter (Inhofe letter 04-26-12.pdf) to EPA Administrator Lisa Jackson, highly critical of Armendariz’s actions.

Armendariz was also responsible for the “emergency order” issued by his office against Range Resources for allegedly contaminating groundwater in Parker County — an allegation since disproven. Recently, EPA voluntarily dismissed its suit seeking to enforce the emergency order, after the Texas Railroad Commission found that Range was not responsible for the methane in the contaminated water well.

Exxon, XTO and Shale Plays

Fortune Magazine’s April issue has three good articles on the resurgence of oil and gas exploration and production activity US onshore. The lead article, “Exxon’s Big Bet on Shale Gas,” provides a good summary of the growth and success of unconventional shale plays in the US in the last 8-10 years. A second article chronicles the revival of the North American oil and gas industry and its effects on the US economy. The third article is an interview with Daniel Yergin, author of The Prize: the Epic Quest for Oil, and most recently The Quest: Energy, Security, and the Remaking of the Mordern World.

In 2010 Exxon purchased XTO Energy for $35 billion in stock, Exxon’s largest acquisition since its merger with Mobil in 1999. Exxon’s acquisition was an effort to get in on the shale gas revolution by buying XTO, one of the biggest holders of shale gas reserves. Exxon has (wisely in my view) kept XTO as a separate entity, in what Rex Tillerson, Exxon’s CEO, calls “reverse integration.” Since Exxon acquired XTO, XTO’s gas reserves have increased 81% to 82 Tcf. Fifty percent of Exxon’s total reserves are now in natural gas. XTO is Exxon’s big bet on the long-term success of domestic natural gas as the preferred energy source for the US.

US natural gas production has increased 28% since 2005, and about one-third of that production is from shale gas. By 2035 it is estimated that shale gas will make up about 60% of US production. Rex Tillerson believes that natural gas will be the fuel of choice for electricity generation. Exxon estimates that world demand for electricity will grow 80% by 2040 and that natural gas will pass coal as the world’s second-largest fuel source (behind crude oil) by 2025. Daniel Yergin: “I believe natural gas in the years ahead is going to be the default fuel for new electrical generation. Power demand is going to go up 15% to 20% in the US over this decade because of the increasing electrification of our society — everything from iPads to electric Nissan Leafs. Utilities will need a predicable source of fuel in volume to meet that demand, and natural gas best fits that description.”

Report Card on HB 2259 – Inactive Wells

In its 2009 Legislative Session, the Texas Legislature passed House Bill 2259, whose stated purpose is to ensure that inactive oil and gas wells get plugged and that surface equipment associated with those wells gets removed. I provided a summary of the bill’s terms in a post on this site. A summary of the bill’s requirements from the Texas Railroad Commission may be found here. The Texas Land and Mineral Owners Association, which lobbied for the bill, has now issued its report card: the Railroad Commission is not doing its job.

HB 2259 does not actually require that inactive wells be plugged. It imposes requirements on operators of inactive wells, depending on how long the wells have been inactive, to: disconnect the wells from electricity; post additional bonds to assure that the wells will eventually be plugged; and remove surface equipment from the wells. These provisions are phased in over a 10-year period. HB 2259 provides that an operator who does not comply with the new requirements will lose its operating permit (known as a P-5) — meaning that it will not have the right to continue to operate any wells in the State.

Recently, TLMA asked the RRC how many P-5 permits have been denied because of failure to comply with HB 2259. The answer: none. Even though, according to TLMA, almost 1,500 operators failed to comply with the statute.

News from the Oil Patch

EPA Dismisses Suit Against Range

The Environmental Protection Agency has thrown in the towel. It dismissed its suit against Range Resources that sought to enforce its emergency order claiming that Range was responsible for contamination of water wells in Parker County. See Bloomberg’s article here.

I have previously written about this controversy. See my previous posts here and here and here and here and here. The EPA alleged that the water well belonging to the Lipskys had been contaminated with methane by Range’s fracing of wells in the area. Range called a hearing at the Railroad Commission and invited the EPA and the Lipskys to attend, but they declined. The RRC found that Range’s well was not the cause of the water well contamination; it concluded that the methane was naturally occurring and was caused when the water well was drilled too deep, into a shallow gas formation. Range fought the EPA’s allegations vigorously. So far, the EPA has been unable to link any groundwater contamination to hydraulic fracturing.

EIA Creates New Toy for Energy Geeks

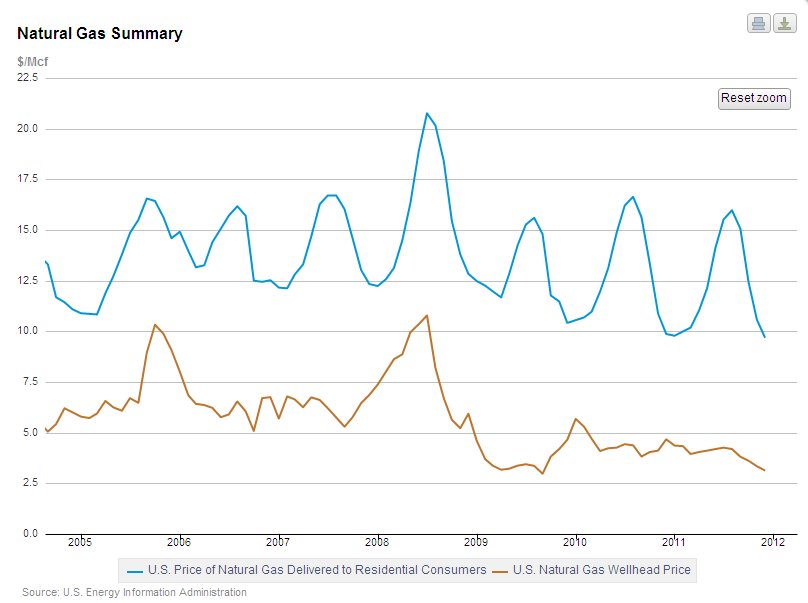

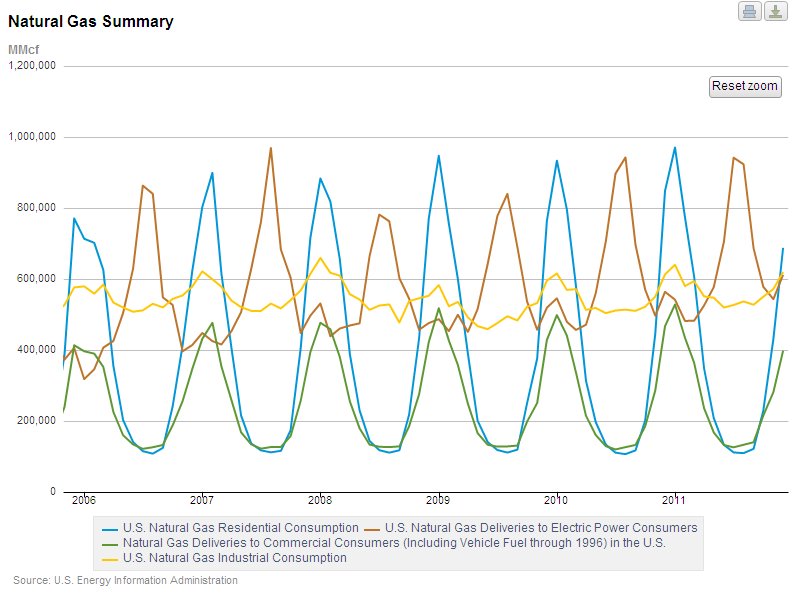

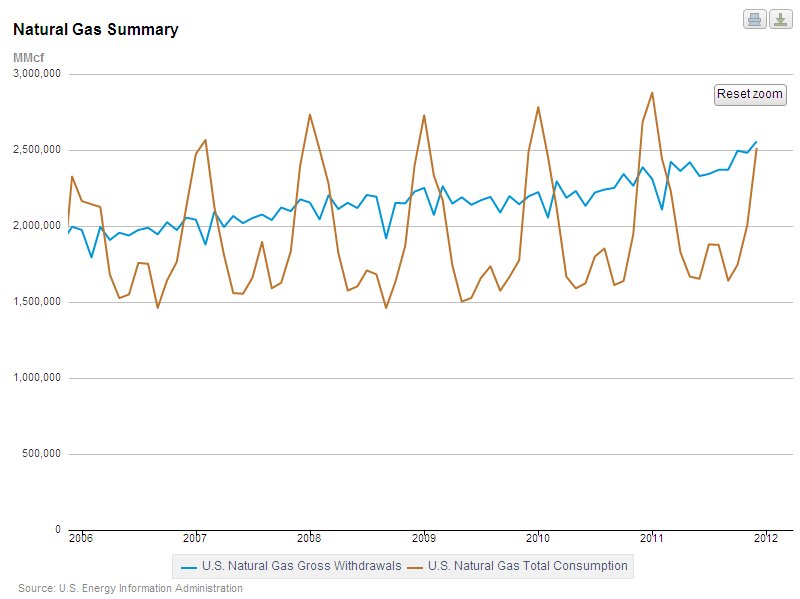

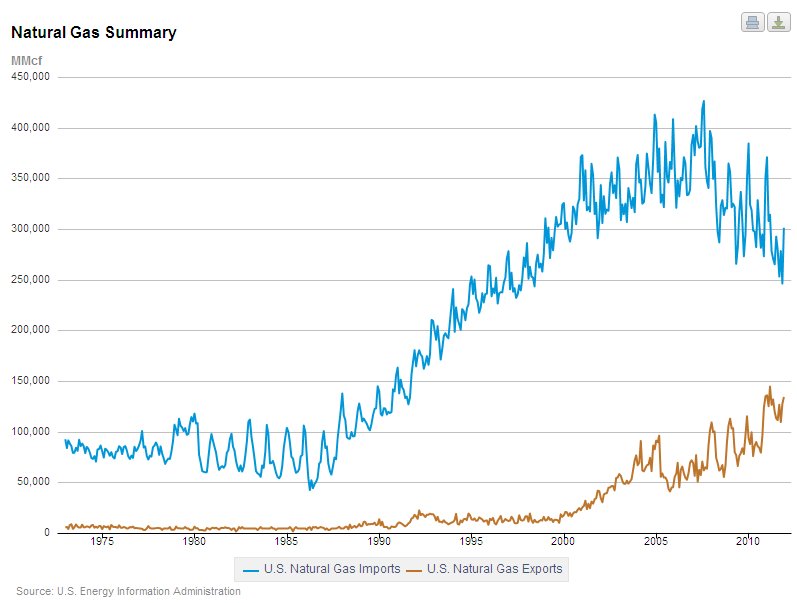

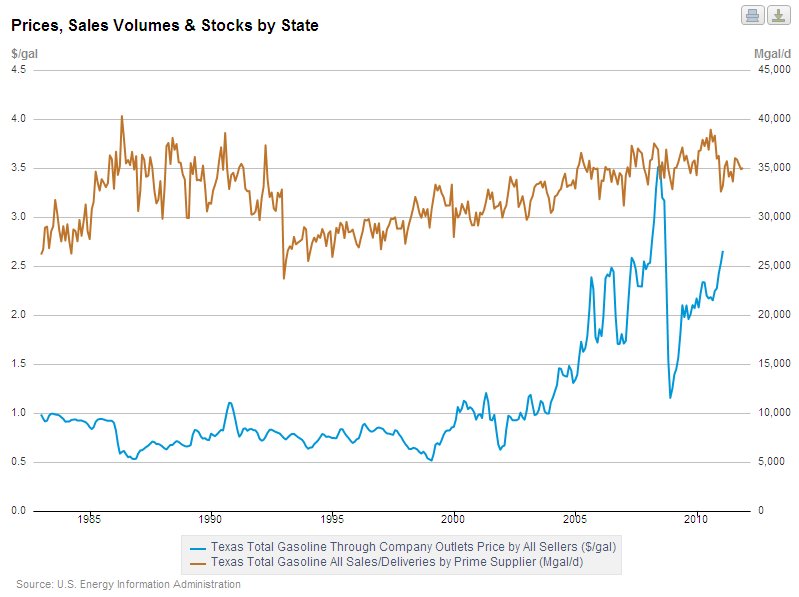

I love graphs. The Energy Information Administration, the guys that crunch numbers on all things energy-related, have come up with a new way to let us graph-lovers play with their data. The new interface is in its beta testing version, and you can play with it here. The site allows you to create your own graphs by selecting the data you want to depict. This allows you to compare two or more sets of data in graphic form. Here are some examples:

Try it for yourself. It’s fun, and you may learn something in the process.

Rolling Stone Picks Fight with Aubrey McClendon

Rolling Stone magazine’s Jeff Goodell has weighed in on the debate over natural gas reserves, the safety of hydraulic fracturing, global warming, methane groundwater contamination, and Chesapeake Energy’s controversial finances, in an article titled “The Big Fracking Bubble: The Scam Behind the Gas Boom.” Goodell pulled no punches. He calls Aubrey McClendon, Chesapeake’s CEO, “an influential right-wing power broker.” He says that “Fracking, it turns out, is about producing cheap energy the same way the mortgage crisis was about helping realize the dreams of middle-class homeowners.” He claims that “for Chesapeake, the primary profit in fracking comes not from selling the gas itself, but from buying and flipping the land that contains the gas,” and that Chesapeake “has more in common with Enron than ExxonMobil.”

Goodell’s article covers ground that is not new in the debate over the safety, ecology and economics of hydraulic fracturing. He touches on the study by Anthony Engraffea at Cornell University on whether natural gas has less global-warming effect than coal. He discusses the Duke University study of methane in water wells in Pennsylvania. He quotes Arthur Berman (Berman says miss-quoted), a long-time critic of the industry’s estimates of shale gas reserves.

McClendon says he agreed to talk to Goodell after he was told that the magazine would publish an article on Chesapeake whether it cooperated or not. Chesapeake has issued a rebuttal to the article (“Although our expectations for honesty and fairness were quite low, the writer failed to reach even that low bar.”), and Goodell has responded to Chesapeake’s rebuttal (“The company entirely dodges the article’s central point: that Chesapeake is a highly-leveraged firm operated by a corporate gambler who engaged in complex scheme to profit off the illusion that America has a virtually unlimited supply of cheap natural gas.”). (Isn’t the internet amazing?)

Texas Supreme Court Affirms its Decision in Denbury Pipeline Case

This week, the Texas Supreme Court denied Denbury Green Pipeline’s motion for rehearing in Texas Rice Land Partners v. Denbury, leaving essentially untouched its conclusion that pipelines must prove that they serve the public in order to exercise eminent domain power.

I wrote about this case a couple of weeks ago. See my prior discussion here. Pipeline companies had deluged the Court with briefs after its initial opinion, claiming that the Court’s decision will halt pipeline construction across the state.

While denying Denbury’s motion for rehearing, the Court did issue a revised opinion that made some changes to its language. The Court’s opinion adds language responding to some of the arguments of the friend-of-the-court briefs filed by other pipeline companies; and the revised opinion changes the holding as follows: