In Hamilton v. ConocoPhillips, the Corpus Christi Court of Appeals construed a Production Sharing Agreement – to my knowledge the first appellate court to do so.

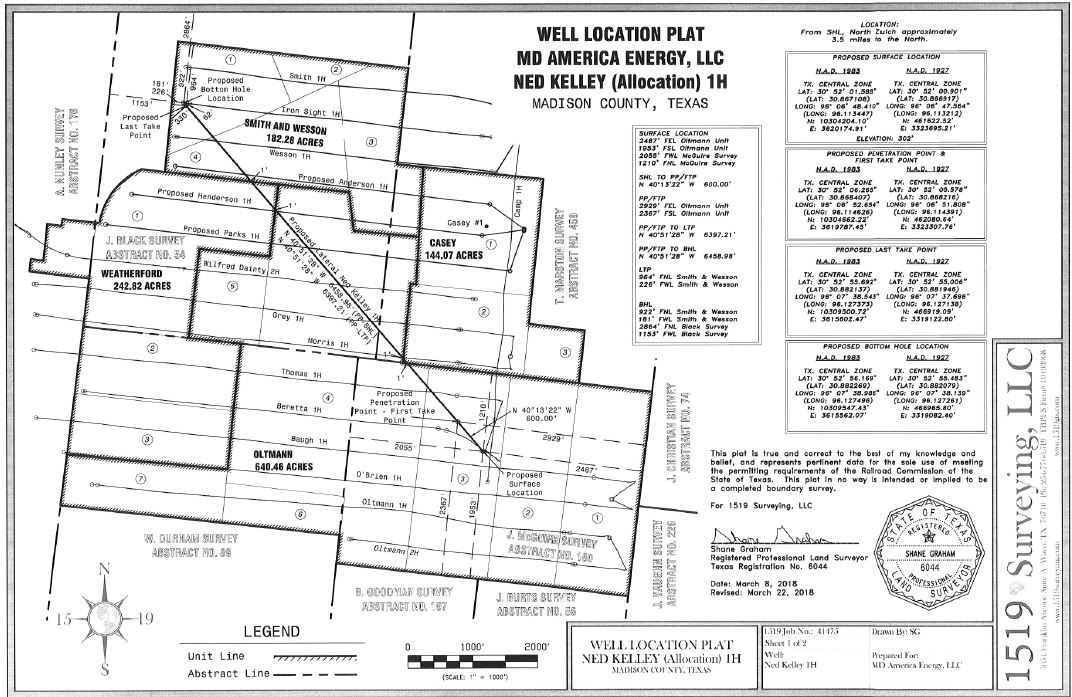

A Production Sharing Agreement is an agreement between mineral owners and an operator to allow the operator to drill a horizontal well whose lateral will be located partly on the leased premises and partly on other lands. Generally, such agreements provide that the allocation will be based on the number of productive lateral feet of the well on each tract crossed by the well. If a well crosses Tract A and Tract B, and 60% of the productive lateral is on Tract A, then the parties agree that the royalty owners in Tract A will be paid royalty on 60% of the production from the well. Such an agreement is a form of combining multiple tracts to produce from a single well–essentially a form of pooling with a different method of allocation.

In Hamilton, Lloyd Hamilton owned a mineral interest in the original Hamilton Ranch in DeWitt County, covering some 5,000 acres, which the Hamilton family leased to Burlington Resources Oil & Gas (now a subsidiary of ConocoPhillips). After the lease was signed the family partitioned the land and Lloyd received a separate surface tract, subject to the lease. The family then signed a Production Sharing Agreement allowing Burlington to drill wells located partly on the Ranch.

Oil and Gas Lawyer Blog

Oil and Gas Lawyer Blog