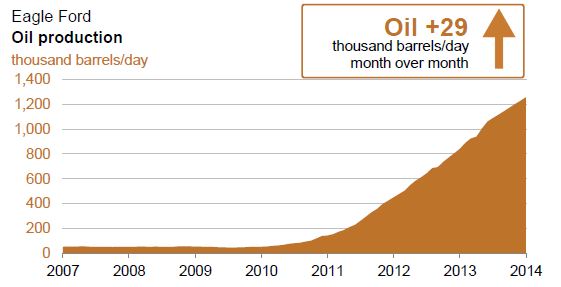

I ran across an article in the New York Times about a new publication, “The Boom,” becoming popular with oil field workers in the Eagle Ford. It’s a good read. And it’s free online. Check out the article in the August publication, “Eagle Ford Shale Takeaways.” It’s a reprint of an article from Drillinginfo, based on Drillinginfo’s analysis of several thousand wells in the Eagle Ford play. One conclusion from that article:

The very best Eagle Ford Shale operators produce 30% to 40% better than the median FOR THE SAME QUALITY OF ROCK, and they produce three times as much as operators at the low end. … The implications for mineral owners in this scenario are obvious. Massive gaps in production naturally lead to large gaps in royalty payments. A 25% royalty lease with an average operator is equivalent to an 18% royalty lease with the best operators. That same lease with the worst operators is the same as an 8% lease with the best.

Also check out Texas Eagle Ford Shale Magazine, another digital publication catering to the Eagle Ford play.

Oil and Gas Lawyer Blog

Oil and Gas Lawyer Blog