Articles Posted in Unconventional Resources

The Law of Hydraulic Fracturing

Paul Yale and Brooke Sizer, lawyers at Gray Reed & McGraw in Houston, published an article in the most recent Section Report of the Oil, Gas & Energy Resources Law Section of the State Bar, “ A Brief Look at the Law of Hydraulic Fracturing in Texas and Beyond.” It will be published in a future issue of The South Texas Law Review. It is an excellent overview of the development of horizontal drilling and hydraulic fracturing and the law and controversies surrounding their use. The article is balanced and fully supported by citations to resources and authorities.

The authors cover the benefits and risks of hydraulic fracturing, including reduction of foreign imports, jobs, reduced prices for consumers, water quality and usage, air quality, earthquakes, and social impacts. It gives a balanced view of the ongoing debate over whether increased use of natural gas for generation of electricity reduces greenhouse gas emissions, whether there is a connection between hydraulic fracturing and earthquakes, and adverse impacts on roads and other infrastructure.

The article also contains information on the process of hydraulic fracturing itself:

Two Good Websites for Shale Plays from Norton Rose Fulbright

Here are two good websites providing information about shale plays all across the world, from the worldwide law firm Norton Rose Fulbright:

Its Hydraulic Fracking Blog gives commentary on legislation across the country affecting drilling and operations in shale plays.

Its Shale Gas Handbook explains how the technology works, and prospects for shale oil and gas development in countries from Europe to China.

The Passing of Aubrey McClendon

Aubrey McClendon, the founder of Chesapeake Energy, died in a car crash last Wednesday, a day after he was indicted on federal charges of conspiring to rig the price of oil and gas leases. Numerous articles have reviewed his life and legacy. Russell Gold, senior energy writer for the Wall Street Journal and an energy journalism fellow at UT Austin, wrote in the Wall Street Journal that “Aubrey McClendon will be remembered … for helping to usher in an era of abundant natural gas, a weakened OPEC and a grievously wounded American coal industry. We are all living in the energy world that he envisioned a decade ago. ” McClendon was 56 years old.

In some respects, McClendon follows the tradition of wildcatters like Roy Cullen, H.L. Hunt, and Clint Murchison – taking big risks, re-inventing the industry. In other respects, he was the 21st century energy entrepreneur. He was single-handedly responsible for reviving the natural gas industry in the U.S. and, as reported by Gold, “grievously wounding” the U.S. coal industry. He did not invent hydraulic fracturing, but he used it to reinvigorate the oil and gas industry in the U.S.

McClendon was forced out of Chesapeake in 2012, after growing the company into the second largest natural gas producer in the U.S. He started his new company, American Energy Partners, and was recently working on a deal to exploit a shale play in Argentina.

Classification of Wells Becomes a Political Issue

An article by Jim Malewitz in The Texas Tribune, “As Oil Prices Plunge, Questions about Big Tax Credit,” sheds light on an arcane and technical issue not well understood even by most oil and gas lawyers – classification of wells as “oil wells” or “gas wells” by the Texas Railroad Commission. While most wells produce both oil and gas, under RRC rules a well must be either one or the other. Different rules apply depending on well classification. Why does it matter?

For one thing, oil and gas leases traditionally have allowed larger pooled units for gas wells than oil wells – allowing operators to hold more acreage with a single well. This distinction is based on the theory that gas wells drain a larger area than oil wells – probably true in most conventional reservoirs, where oil and gas migrate through the formation as wells withdraw production. Not so true for new unconventional shale formations, which have very low permeability and porosity, and where oil and gas don’t “flow” through the formation but are produced through artificially induced fractures.

But operators recently are rushing to “reclassify” wells as gas wells that were originally classified as oil wells. According to Malewitz, the RRC granted operator applications to reclassify 844 wells from oil to gas this year – nearly six times the number reclassified in 2013. And Devon Energy has asked the RRC to reclassify more than 200 of its wells from oil to gas. The reason? Tax credits. Continue reading →

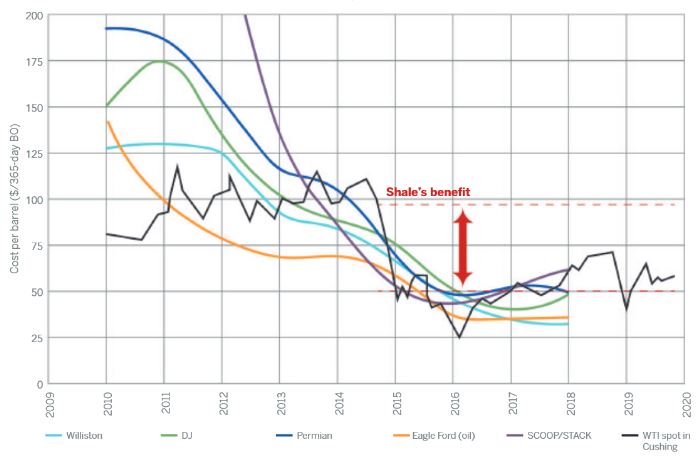

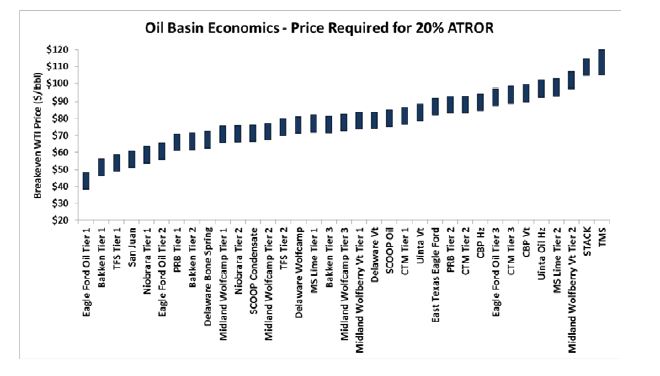

Break-Even Prices in Shale Plays

Here is a chart I came across estimating what oil price is necessary to achieve a 20% after-tax rate of return on wells in various shale plays. Not pretty in light of current oil prices.

Texas Tribune Unique Look at Texas Oil Boom

The Texas Tribune has created an unusual interactive website with stories about life in the oil patch and the effect of the boom on the lives of those who live and work in the areas affected. Take some time and explore it. http://apps.texastribune.org/shale-life/eagle-ford-air/

An Alternative View of the Shale Boom

There are always nay-sayers who predict that the current boom, whatever it may be, will soon be a bust. Recently, however, some pretty prominent voices have cautioned that all of the rosy predictions about the future of the shale boom, US energy independence, and the continued growth of US oil and gas production are false – a bubble soon to burst.

One of those is J. David Hughes, a geoscientist with the Post-Carbon Institute. He spent 32 years with the Geological Survey of Canada, and coordinated an assessment of Canada’s unconventional natural gas potential. He has authored “Drill, Baby, Drill,” published last year by the Post Carbon Institute and the Energy Policy Forum. It is a pretty comprehensive review of the long-term viability of the shale plays. Some excerpts:

- “World energy consumption has more than doubled since the energy crises of the 1970s, and more than 80 percent of this is provided by fossil fuels. In the next 24 years world consumption is forecast to grow by a further 44 percent–and U.S. consumption a further seven percent–with fossil fuels continuing to provide around 80 percent of total demand.”

New Newspaper for the Oil Patch

I ran across an article in the New York Times about a new publication, “The Boom,” becoming popular with oil field workers in the Eagle Ford. It’s a good read. And it’s free online. Check out the article in the August publication, “Eagle Ford Shale Takeaways.” It’s a reprint of an article from Drillinginfo, based on Drillinginfo’s analysis of several thousand wells in the Eagle Ford play. One conclusion from that article:

The very best Eagle Ford Shale operators produce 30% to 40% better than the median FOR THE SAME QUALITY OF ROCK, and they produce three times as much as operators at the low end. … The implications for mineral owners in this scenario are obvious. Massive gaps in production naturally lead to large gaps in royalty payments. A 25% royalty lease with an average operator is equivalent to an 18% royalty lease with the best operators. That same lease with the worst operators is the same as an 8% lease with the best.

Also check out Texas Eagle Ford Shale Magazine, another digital publication catering to the Eagle Ford play.

Two New Technologies Could Change How We Use Energy

Here are two emerging technologies that could change how we might use natural gas to fuel our cars and electrify our homes and offices.

A company called Redox Power Systems is building a plant in Florida to produce The Cube, a dishwasher-sized system that generates electricity from natural gas using electro-chemical fuel cell technology.

With almost no moving parts, The Cube can provide enough electricity to power a gas station or a small grocery store. It also generates heat that can be used to heat a home or business. It’s technology was developed at the University of Maryland. The system also emits carbon dioxide, but according to a review by MIT, its emissions should be lower than those associated with power from the grid. Redox plans to complete a 25-kilowatt prototype and start selling complete systems by the end of this year.

Oil and Gas Lawyer Blog

Oil and Gas Lawyer Blog