The Gardiners claimed that a compressor station across the road from their property created a nuisance that damaged the value of their property. A trial resulted in a $2 million judgment for the Gardiners. After an eight-year battle, the Texas Supreme Court decided the Gardiners would have to try their case again. The case is another in a recent spate of cases alleging nuisance damages for operations in the oil field. Continue reading →

Two Good Websites for Shale Plays from Norton Rose Fulbright

Here are two good websites providing information about shale plays all across the world, from the worldwide law firm Norton Rose Fulbright:

Its Hydraulic Fracking Blog gives commentary on legislation across the country affecting drilling and operations in shale plays.

Its Shale Gas Handbook explains how the technology works, and prospects for shale oil and gas development in countries from Europe to China.

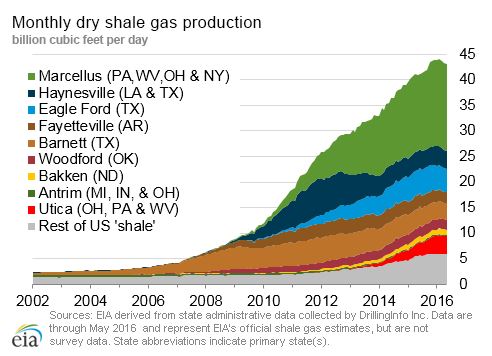

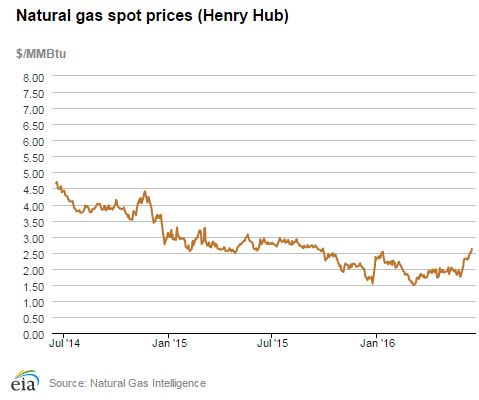

Great graphic from the Energy Information Administration

Great graphic from the Energy Information Administration:

It’s amazing how production has held up and even increased despite low gas prices. Production declines have shown up only at the beginning of this year, even though prices have been below $3.00 since January 2015.

Energynet – a Dotcom Success in the Oil and Gas Sector

One of the speakers at our firm’s recent oil and gas seminar for land and mineral owners was Chris Atherton, President of EnergyNet, Inc. EnergyNet is an online auction site for oil and gas assets- mineral and leasehold interests. It now controls 75% of the online auction business for oil and gas assets in the U.S.; so far in 2016, it has sold 354 asset packages for $155 million. It makes its money by taking a commission on each sale. Properties are sold both in online auctions and in sealed-bid sales.

Recently, the Texas General Land Office began using EnergyNet for its auctions of oil and gas leases on state lands. It also auctions leases for Colorado, North Dakota, Utah and Wyoming, and it has recently signed up the Bureau of Land Management to conduct lease sales. An example of an EnergyNet offer for lease of a state tract in Loving County, Texas can be viewed here.

One of EnergyNet’s first big deals was sale of a package of 220,000 net mineral acres owned by Chevron in 2003, in dozens of counties in multiple estates. Chevron wanted at least $80 million. By breaking the assets down into smaller parcels, EnergyNet sold them for $120 million.

Adams v. Murphy Exploration – When is an offset well not an offset well?

The Fourth Court of Appeals in San Antonio handed down an opinion this week in Adams v. Murphy Exploration & Production Co.-USA, deciding the meaning of “offset well” as used in an oil and gas lease.

The plaintiffs in the case signed an oil and gas lease to Murphy containing the following provision:

It is hereby specifically agreed and stipulated that in the event a well is completed as a producer of oil and/or gas on land adjacent and contiguous to the leased premises, and within 467 feet of the premises covered by this lease, that Lessee herein is hereby obligated to, within 120 days after the completion date of the well or wells on the adjacent acreage, as follows:

(1) to commence drilling operations on the leased acreage and thereafter continue the drilling of such offf-set well or wells with due diligence3 to a depth adequate to test the same formation from which the well or wells are producing from on the adjacent acreage; or

(2) pay the Lessor royalties as provided for in this lease as if an equivalent amount of production of oil and/or gas were being obtained from the off-set location on these leased premises as that which is being produced from the adjacent well or wells; or

(3) release an amount of acreage sufficient to constitute a spacing unit equivalent in size to the spacing unit that would be allocated under the lease to such well or wells on the adjacent lands, as to the zones or strata producing in such adjacent well.

Texas Supreme Court refuses to review Forest Oil v. McAllen

The Supreme Court last week denied the petition for review of the Corpus Christi Court of Appeals’ decision in Forest Oil v. El Rucio Land and Cattle Company. Forest was acquired by Sabine Oil & Gas during the course of the case, which started in 2004. Jimmy McAllen and his company obtained a $20 million arbitration award against Forest, and the Corpus Christi Court affirmed the award. The Texas Supreme Court has now declined to hear the case. I have written about this interesting case here and here.

Railroad Commissioner Ryan Sitton, the first engineer on the Commission in 50 years, talks about earthquakes, climate change, and the recommendations of the Sunset Commission

Ryan Sitton is interviewed by Evan Smith of The Texas Tribune. And endorses Donald Trump. And questions the human causes of climate change. Watch the interview here.

Coyote Lake Ranch v. City of Lubbock: Accommodation Doctrine Applies to Groundwater

The Texas Supreme Court last week handed down its opinion in Coyote Lake Ranch v. City of Lubbock, holding, in a case of first impression, that the accommodation doctrine applies to govern the City’s right to use the surface of the Ranch to develop its groundwater.

Coyote Lake Ranch covers 40 square miles in Bailey County, on the Texas-New Mexico border northwest of Lubbock. In 1953, the then owners of the Ranch sold the groundwater under the Ranch to the City of Lubbock. The Ranch reserved the right to use groundwater for domestic use, ranching operations, oil and gas production, and agricultural irrigation, but the conveyance limits the Ranch to one or two wells in each of 16 specified locations. The Deed contains lengthy, detailed provisions on the City’s right to use the land. It grants to the City the right “at any time and location [to] drill water wells and test wells” on the Ranch, and to build roads, power lines and other improvements and otherwise make use of the Ranch lands “necessary and incidental” to the production of groundwater.

The groundwater underlying the Ranch is the Ogallala Aquifer, a huge aquifer that underlies much of north Texas as well as parts Oklahoma, New Mexico, Kansas, Colorado, and Nebraska. Water from the aquifer has made the arid high plains one of the most prolific agricultural regions of the United States. It is also a depleting resource and has been depleted in substantial areas of the Texas Panhandle. Continue reading →

RRC Sunset Review Part III – Bond Requirements for Well Plugging

The draft Sunset Commission report on the Texas Railroad Commission makes recommendations for legislative changes to the bonding requirements for oil and gas wells. Landowners should be familiar with how the RRC’s bonding system works, and how it could affect operations on their property.

Operators of oil and gas wells in Texas must have a permit to operate. In order to obtain that permit, the operator must provide financial security in the form of cash, a bond, or a letter of credit to provide financial assurance that it will plug any wells it operates. The amount of financial security required is set by statute and was last revised in 1991. Most operators comply with the bonding requirement by furnishing “blanket” bonds. The amount of the bond depends on the number of wells operated by the operator:

- Operators with 1-10 wells must have a $25,000 blanket bond.

- Operators with 11-99 wells must have a $50,000 blanket bond.

- Operators with 100 or more wells must have a $250,000 blanket bond.

The theory is that, if an operator becomes insolvent and is unable to plug its wells, the RRC can call on the bonding company to provide the money to plug the wells. But in reality, bonds provide only about 16% of the cost of plugging abandoned wells. In FY 2015, the RRC collected $4.288 million on bonds from 94 operators who abandoned 1,584 wells – an average of only $2,707 per well. In the same year, the RRC spent $11.722 million plugging 692 wells – an average of $17,012 per well. Continue reading →

RRC Sunset Review Part II: Monitoring and Enforcement

The third issue identified by the Sunset Commission in its draft report on review of Texas Railroad Commission operations was the RRC’s monitoring and enforcement of its regulations. As in previous Sunset reports on the RRC, the Sunset Commission criticized the Commission’s enforcement practices and policies.

RRC field inspections and enforcement are the areas where landowners most often come into contact with RRC operations. The RRC is responsible for enforcing rules related to oil and gas spills and contamination, including contamination of groundwater.

Facts:

The RRC employs 151 oil and gas field inspectors. In FY 2015, the RRC reported that those inspectors conducted 134,484 inspections and cited 61,189 violations. When it finds a rule violation, the RRC can fine the operator, and it can issue a “severance order,” requiring suspension of oil and gas production until the violation is remedied. In FY 2015, the RRC assessed 1,878 administrative penalties and issued 7,936 severance orders.