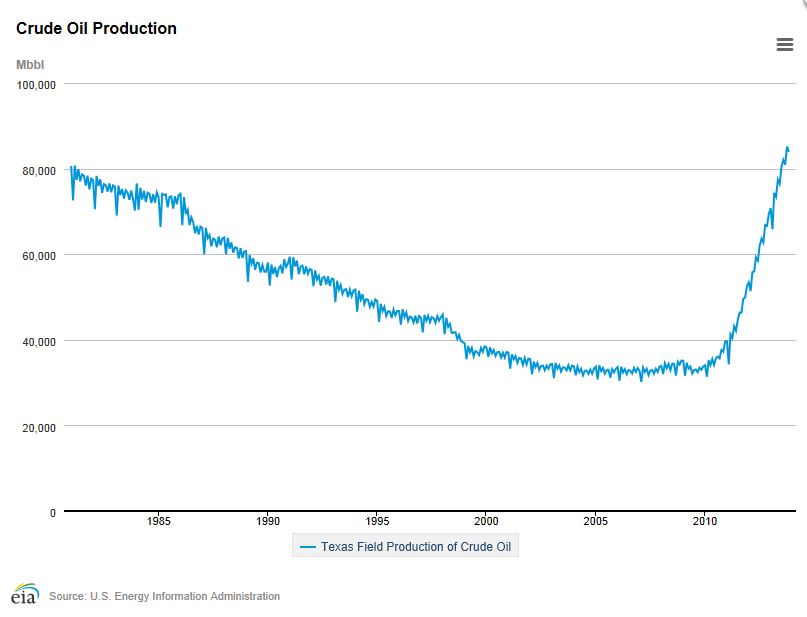

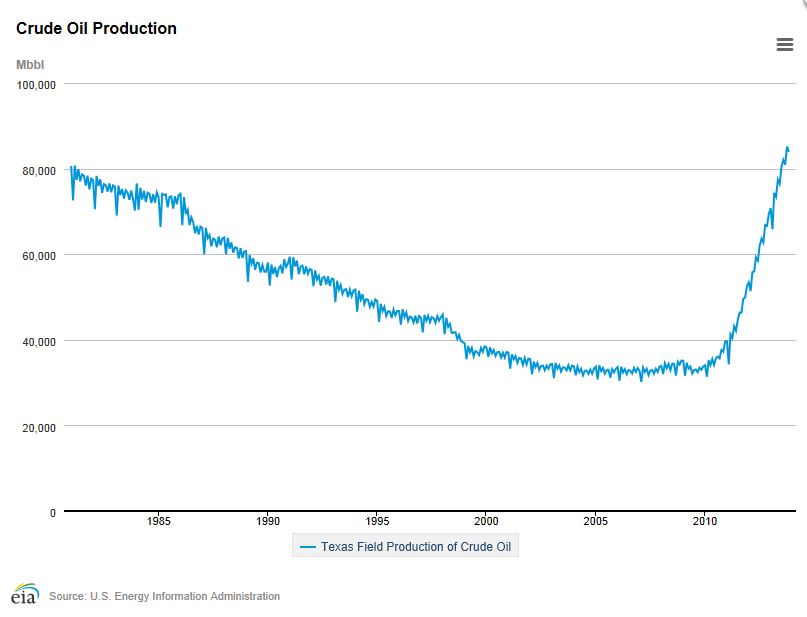

Here is a graph from the Energy Information Administration showing the Texas crude miracle:

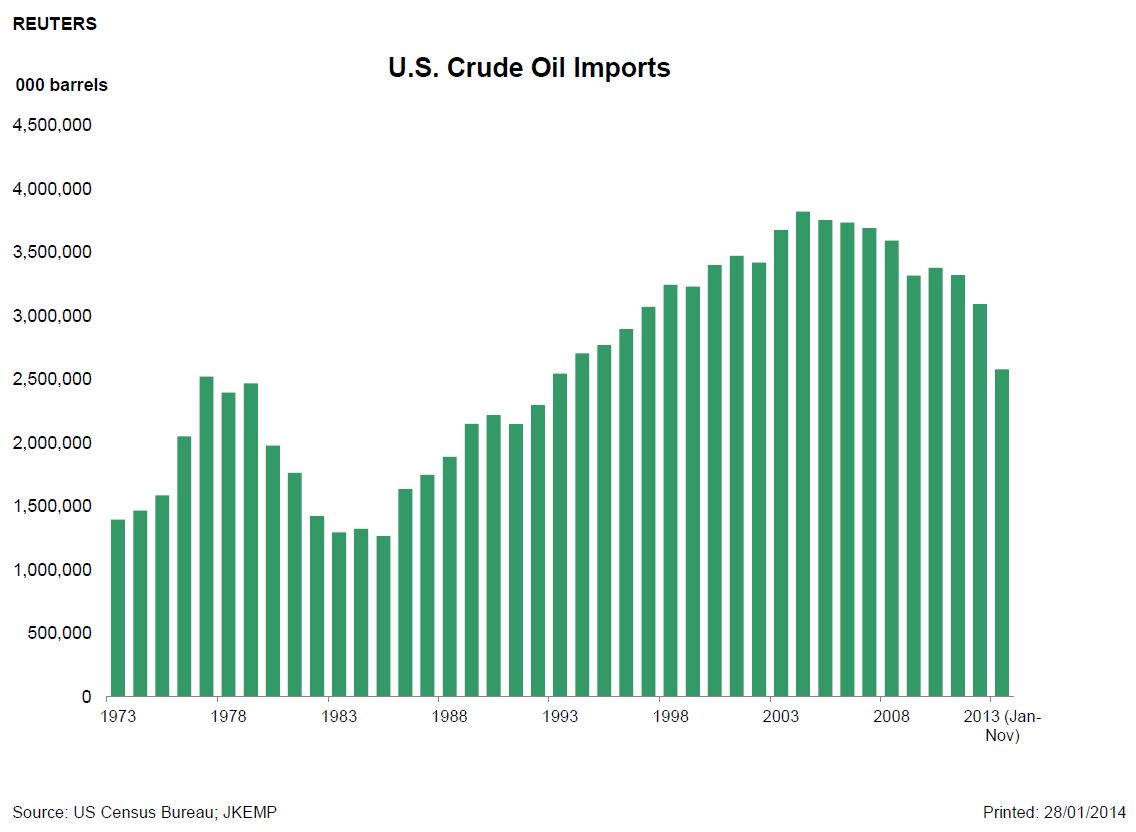

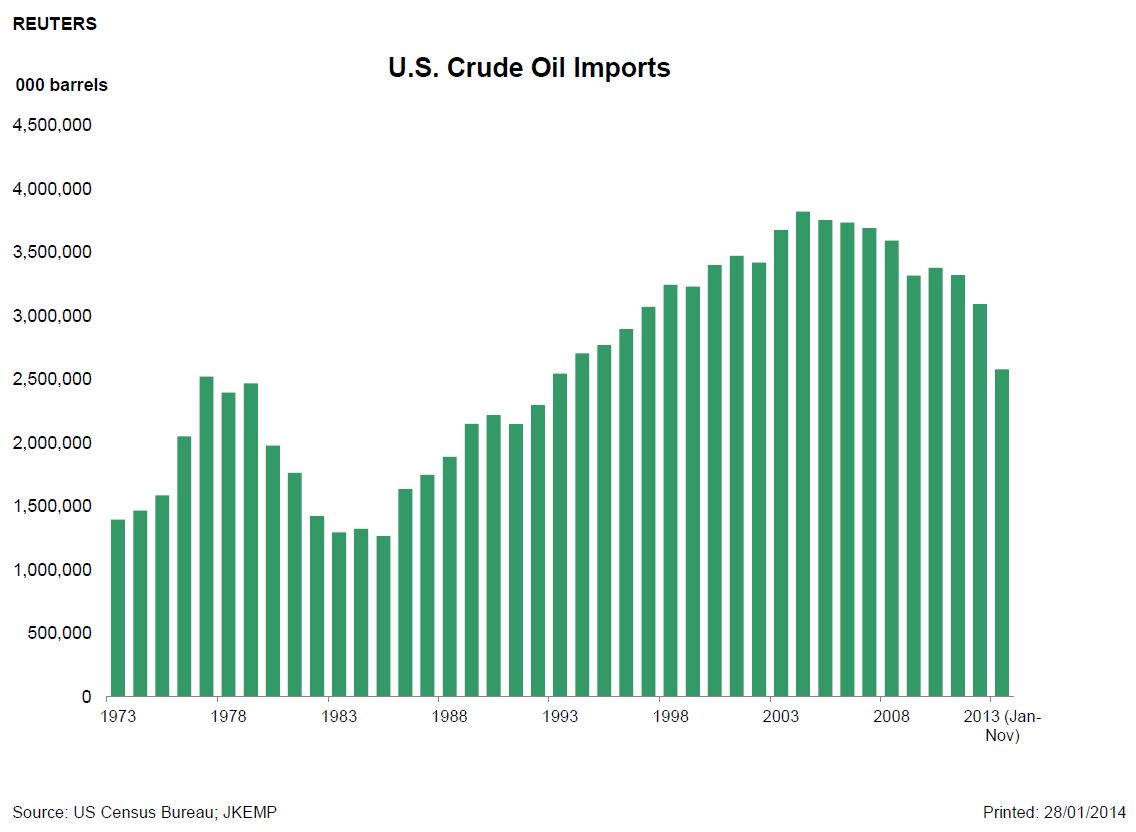

Texas now produces 36% of US oil production. The graph below is from a Reuters article, showing the resultant drop in US crude imports:

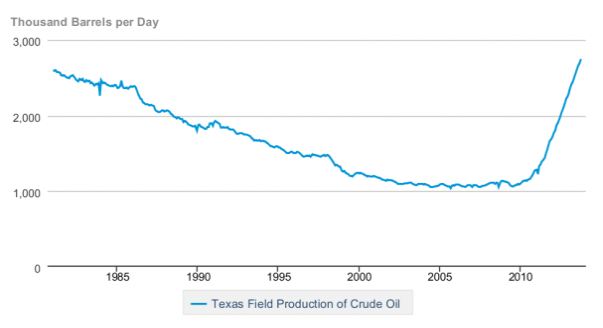

Here is a graph from the Energy Information Administration showing the Texas crude miracle:

Texas now produces 36% of US oil production. The graph below is from a Reuters article, showing the resultant drop in US crude imports:

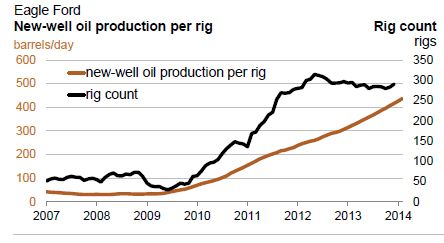

The New York Times reported recently that the number of mobile or “walking” drilling rigs in operation now exceeds the number of conventional rigs, by 650 to 500. “Pad drilling” — the drilling of multiple wells from a single pad site — has now become the norm in unconventional plays, and these walking rigs make drilling from a single pad site more economical and efficient. Moving a rig to a new location now takes a matter of hours instead of days. The new rigs cost up to $20 million. The increased effeciency of these rigs has actually reduced the rig count while increasing the number of wells drilled, and has caused the Energy Information Administration to develop a new rig-efficiency measure. The combination of walking rigs and multi-well drillsites results in significant reductions in drilling costs. Continental Resources, the largest player in the Bakken, says it now can drill 14 wells from a single pad.

EIA’s new Drilling Productivity Report shows how the new technology has affected production in the major shale plays. Here is its graph for the Eagle Ford:

Here is an annual comparison for several shale plays:

From Northern Oil and Gas:

Recent news relating to oil and gas exploration and development in Texas:

Dune Sagebrush Lizard — Good article on efforts of industry and State regulators to avoid problems raised by possible listing of the Dune Sagebrush Lizard under the Endangered Species Act. Here is a map of the lizard’s habitat – right in the middle of the Permian Basin.

Earthquakes in the Oil Patch — Earthquakes in and around Azle, in the Barnett Shale, have caused quite a stir. Here’s a good article from the San Antonio News. Everyone seems to agree that the quakes are caused by injection wells, except the Texas Railroad Commission, which until recently called the connection “hypothetical”. After one of the Commissioners, David Porter, faced angry homeowners at a town hall meeting in Azle, he called for the RRC to hire its own seismologist. Azle residents are planning a bus trip to Austin to attend the next RRC conference in protest.

The Klotzman mineral owners have appealed the Texas Railroad Commission’s order granting EOG a permit to drill an “allocation well” on their land. A copy of the petition can be viewed here: Klotzman Petition.pdf. Our firm represents the Klotzmans. For my previous posts about allocation wells and the Klotzman case, search for “allocation well” in the site’s search engine.

The San Antonio Court of Appeals recently decided a case illustrating the new kinds of issues that can arise from the drilling of horizontal wells.

In Springer Ranch v. Jones, Alice Burkholder owned a ranch, 8,545 acres in La Salle and Webb Counties. She signed a single oil and gas lease on the ranch in 1956 that has been maintained by produciton. When she died, Alice left the ranch to her husband for life, and thereafter in three separate tracts to her three children. In effect, by her will she partitioned the ranch, surface and minerals, into three tracts, subject to the oil and gas lease. Alice’s husband died in 1990, and thereafter the three children signed a contract agreeing on how royalties on production from the lease should be divided among them. The contract provided that all royalties under the lease “shall be paid to the owner of the surface estate on which such well or wells are situated, without reference to any production unit on which such well or wells are located.”

The lessee drilled a horizontal well located partly on one of the ranch tracts, now owned by Springer Ranch, and partly under a different tract now owned by Rosalie Sullivan. The surface location of the well was on the Springer Ranch tract. Springer Ranch argued that, because the surface location was “situated on” its property, it should receive all royalties from the well. Rosalie Sullivan argued that royalties from the well should be allocated between the two tracts based on each tract’s part of the productive lateral of the well. The trial court agreed with Ms. Sullivan, and the court of appeals affirmed. It construed the parties’ agreement to to allocate royalties on the basis of the percentage of the productive interval of the wellbore on each party’s tract, not on the basis of the well’s surface location.

Data from the Energy Information Administration shows that Texas’ oil production is now the highest it’s been in thirty years. Texas crude production is now approaching 3 million barrels/day, a rate not seen since the 1960’s.

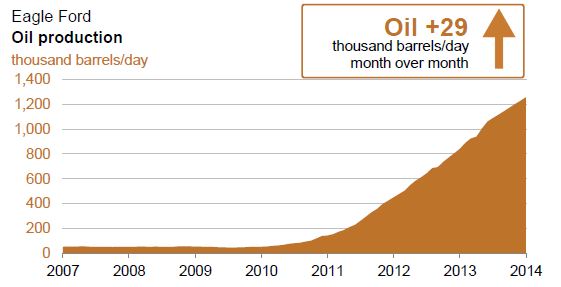

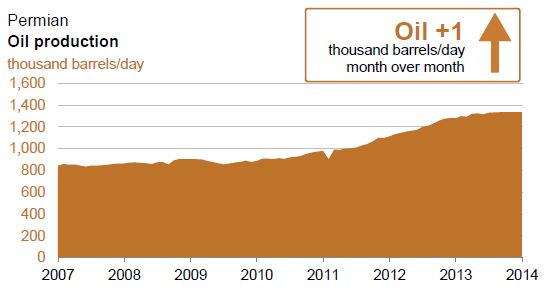

Below are EIA graphs showing production of oil from the Eagle Ford and the Permian Basin. It appears that Eagle Ford production rates will soon surpass production from the Permian.

EIA also calculates changes in the initial productivity of new wells in each field, a measure of the improved efficiency of rigs in the field. The graphs below show that new wells in the Eagle Ford are improving substantially; not so in the Permian. IP rates of Eagle Ford wells are now substantially higher than in the Permian.

On December 20, the Office of Inspector General of the Environmental Protection Agency issued its “Response to Congressional Inquiry Regarding the EPA’s Emergency Order to the Range Resources Gas Drilling Company.” The report was requested by Congress as a result of an emergency order issued by the Dallas regional office of the EPA against Range Resources on December 7, 2010. That order required Range to take certain actions based on EPA’s finding that Range’s wells in the Barnett Shale were the likely source of contamination of water wells in Parker County.

I have written about Range’s saga before. EPA sued Range to enforce its emergency order. Range disputed and fought the EPA order, suing in the U.S. Court of Appeals to get the order revoked. Range called a hearing before the Texas Railroad Commission (in which EPA did not participate), after which the RRC found that Range’s wells were not the source of the gas in the water wells. One of the well owners, the Lipskys, sued Range in state court for damages; Range countersued, contending that the Lipskys had falsified evidence and defamed the company. The district court found that Lipsky had created a “deceptive video” that was “calculated to alarm the public into believing the water was burning.” The Lispkys have appealed to the Texas Supreme Court, where their case remainds pending.

The Energy Information Administration has created a nifty website presenting energy information by state, with a great map interface. Here is the link to the Texas map: http://www.eia.gov/state/?sid=TX Click on “full screen,” then play with the different layers for the map. Under “layers/legend,” click on “views” and explore the different layers on the map. You can also see how Texas ranks among states in crude oil, natural gas, electricity and total energy production (#1), and in per capita energy consumption (#6). Texas also ranks #1 in carbon dioxide emissions.

In November, Texas Monthly hosted a panel discussion at Rice University’s Baker Institute for public policy about the boom in shale oil development in the US. The panel members: Arthur E. Berman, a Sugar Land-based geologist; Scott W. Tinker, the director of the Bureau of Economic Geology at the University of Texas at Austin; and Kenneth Medlock III, an energy fellow at the Baker Institute. You can watch the panel discussion on Texas Monthly’s website, here. It’s worth an hour of your time.

These guys know a lot about energy in general and oil and gas in particular. I have previously written about Arthur Berman, a “shale skeptic,” who has never believed that the shale boom would last. Scott Tinker is the narrator of the documentary “Switch,” an examination of the modern world’s thirst for and sources of energy. In addition to the film, Dr. Tinker has created a website, http://www.switchenergyproject.com/, that provides additional short videos and other resources to further explore questions surrounding energy, including carbon capture, global warming, hydraulic fracturing, and alternative energy technologies. He interviews many world experts on global energy issues. He is to my mind one of the most even-handed and level-headed thinkers and explainers of the complex issues surrounding energy issues.