https://www.visualcapitalist.com/electricity-sources-by-fuel-in-2022/

Worldwide only 14.4% of electricity comes from renewables – wind, solar, geothermal; if you add in hydroelectric, the number is 29%.

https://www.visualcapitalist.com/electricity-sources-by-fuel-in-2022/

Worldwide only 14.4% of electricity comes from renewables – wind, solar, geothermal; if you add in hydroelectric, the number is 29%.

The federal district court in Pecos, Judge David Counts, issued a memorandum opinion in H.L. Hawkins, Jr., Inc. v. Capitan Energy, Inc., P:22-CV-DC[Hawkins] addressing Hawkins’ claim that Capitan had improperly deducted post-production costs from its royalty. The Court held that the reasoning in the recent Texas Supreme Court case of Devon v. Sheppard was of no help to Hawkins.

Hawkins’ lease reserved a royalty of “one-fourth of the gross proceeds received by Lessee,” and contained a free-royalty provision:

Lessor’s royalty shall not bear or be charged with, directly or indirectly, any cost or expense incurred by Lessee, including without limitation, for exploring, drilling, testing, completing, equipping, storing, separating, dehydrating, transporting, compressing, treating, gathering, or otherwise rendering marketable or marketing products, and no such deduction or reduction shall be made from the royalties payable to Lessor hereunder, provided, however, that Lessor’s interest shall bear its proportionate share of severance taxes and other taxes assessed against its interest or its share of production.

Production of oil and gas is often accompanied by production of water from the same formation. In recent years, water has been injected into wells in the process known as hydraulic fracturing, or “fracking.” Much of the frac water returns with oil and gas during the initial production of the fracked well. Fracking of horizontal wells requires huge quantities of water, and when this water—and water native to the formation—returns to the surface, something must be done with the water.

Historically produced water has been treated as waste—a substance that contains not only water but also salts, chlorides, sodium, carbon dioxide, and heavy metals. Produced water has typically been disposed of by injection into underground formations. Well operators may drill their own disposal wells or may contract with third parties to dispose of produced water for a fee.

Water used in fracking has typically been obtained from formations containing fresh groundwater. The huge quantities of fresh water used for fracking have taxed some aquifers, and the practice has been criticized as wasting a precious resource.

The Amarillo Court of Appeals recently decided PBEX II, LLC, et al. v. Dorchester Minerals, L.P. et al., addressing an interesting issue on adverse possession of a non-operating working interest. One justice dissented.

The Court’s opinion relies on two Texas Supreme Court decisions that were controversial: Natural Gas Pipeline co. of America v. Pool, 124 S.W.3d 188 (Tex. 2003) and BP America Production Co. v. Marshall, 342 S.W.3d 59 (Tex. 2010) Pool held, to everyone’s surprise, that an operator could adversely possess or revive an oil and gas lease that had expired by continuing to operate and pay royalties on production. Marshall held that an operator’s continued payment of royalty on an expired lease “establish[ed] as a matter of law that [the mineral owner] was on notice that [the operator] claimed to own the leasehold ….”

In Dorchester, Torch was the owner of a 25% interest in an oil and gas lease covering a section of land in Midland County. Torch was party to an operating agreement under which it was a non-operating working interest owner. In 1990 Torch signed an assignment to Dorchester’s predecessors which Torch later claimed erroneously included its working interest in the lease. But from 1990 to 2016 Dorchester and its predecessors participated as working interest owners in the lease, paying their share of costs and receiving their share of revenues, in effect claiming to own Torch’s working interest.

Tiffany Dowell Lashmet and Karli Kaase, with Texas AgriLife Extension, have put together a great resource for landowners considering carbon contracts. It can be found here. Tiffany has regular blog posts providing great information for landowners.

From Visual Capitalist (click on image to enlarge):

Maybe you’ve heard of “green hydrogen.” There’s been a lot of press lately about projects to produce hydrogen to use as an alternative fuel, and the Inflation Adjustment Act provides tax credits for production of “green hydrogen.” But did you know that there are other hydrogen “colors”? An excellent article from MartenLaw.com provides a summary of the methods and tax credits and regulations being developed for green hydrogen programs. Here is its description of colors of hydrogen:

Types of Hydrogen

Hydrogen can be created through a variety of techniques. To distinguish between the different processes, the industry has developed an informal color-based categorization system:

Since passage by Congress of the Inflation Reduction Act (IRA) in 2022, significant activities and developments have taken place in Texas regarding carbon capture and underground storage (CCUS) projects. The IRA provides tax credits for injection and underground storage of carbon dioxide. As a result, major companies have begun developing CCUS projects in Texas and other states. Landowners are signing agreements with these developers allowing use of their land for injection and storage.

Tax Credits for CCUS Projects

The economic benefits to developers of CCUS projects derive solely from the federal income tax credits granted for underground storage of CO2. The credits are granted based on tons of CO2 injected. The amount of the credit varies depending on the type of project.

Governor Abbot has signed House Bill 456, passed by the Legislature, granting certain charities an exemption from ad valorem taxes on their oil and gas royalties, effective January 1, 2024. The bill amends Tax Code Section 11.18(a), which provides ad valorem tax exemptions for charitable organizations, including churches and educational institutions. The bill amends the statute to provide an ad valorem tax exemption for mineral and royalty interests, but only for some charitable organizations.

The exemption applies to the following types of charitable organizations who provide services without regard to ability to pay, but only if the mineral or royalty interest (i) is not severed from the surface estate (i.e., is under land owned by the charity), or (ii) was donated to the charity:

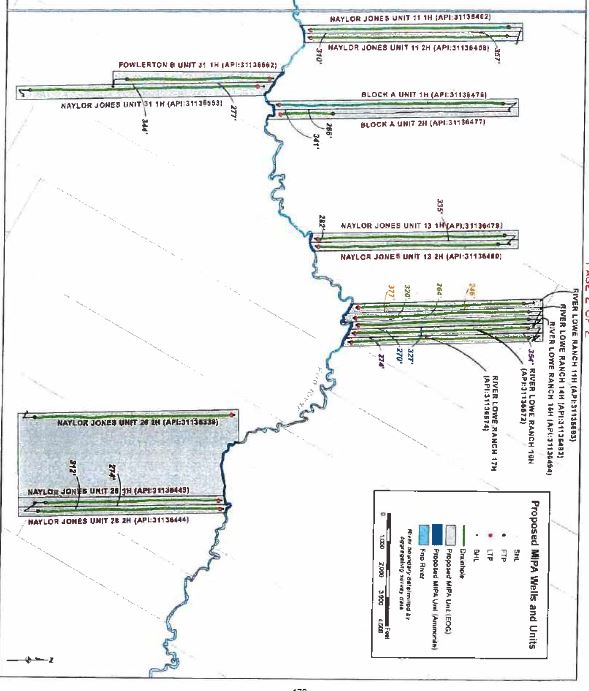

Today the Texas Supreme Court agreed to hear Ammonite Oil & Gas Corp. v. Railroad Commission of Texas and EOG Resources, an appeal from the Commission’s denial of sixteen applications by Ammonite under the Mineral Interest Pooling Act.

I wrote about this case when it was decided against Ammonite by the Austin Court of Appeals. Ammonite has oil and gas leases from the State on the bed of the Frio River. Operators, including EOG, have drilled horizontal wells whose last take points extend to 100 feet from the edge of the river. Ammonite applied to the Commission to include portions of the riverbed in the units for the EOG wells. The Commission denied the applications.

Ammonite holds more than 50 state riverbed leases and has filed MIPA cases against EOG, Apache, Chesapeake and ConocoPhillips, all of which have resisted Ammonite’s efforts to include riverbed acreage in their units, leaving the minerals under the riverbed stranded. Royalties from riverbed leases are paid into the Texas Permanent School Fund for the benefit of Texas schools, managed by the Texas General Land Office.