Articles Posted in Oil Price

Oil Prices, Rig Count and Production Rates

Here’s a great interactive graphic from Bloomberg, “Watch Five Years of Oil Drilling Collapse in Seconds,” that illustrates the relationship between oil price, rig count and U.S. oil production. The U.S. rig count has dropped from a high of 1930 in late 2014 to 502 last month. U.S. crude production continued to climb until mid-2015. Since then, it has dropped from 9.6 mmb/day to 9.2 mmb/day.

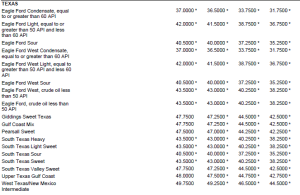

RigData provides another way to look at the market, in Texas (click to enlarge):

It may come as a surprise to some that the average daily oil production per well in Texas is only 16 barrels. There are a lot of wells in Texas that produce a barrel a day or less. The change in average daily oil production per well is a way to gauge the health of the industry. In Mary 2015, Texas average production per well reached a height of 19.6 bbl/day. Between October 2014 and October 2015, Texas oil production declined by 343,00 bbl/day, from 3.3 million to 2.9 million – a decline of 2.2 bbl/day/well.

OPEC and Oil Prices

Oil prices are much in the news, especially in Texas. As oil prices continue to decline, the effect on Texas’ economy is settling in. And with all the talk of oil prices, OPEC is again the focus of much news coverage. What will OPEC do? How much does OPEC really control oil prices? What effect are the low prices having in the OPEC countries themselves?

Here are some interesting websites about OPEC:

OPEC’s own website. It publishes a monthly report, available online, in English.

More Interesting Data from EIA

States’ Reliance on Severance Tax and Oil Price Decline

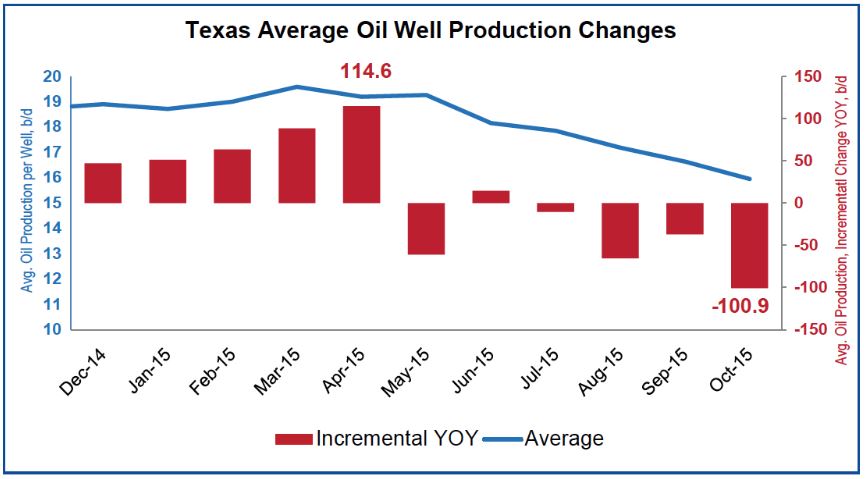

Last week, the US Energy Information Administration provided a summary of states’ severance tax revenue (click on image below to enlarge):

With the precipitous decline in oil prices, Alaska, North Dakota and Wyoming will be hurting.

According to EIA, Texas

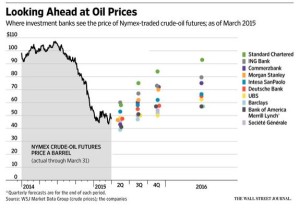

Major Banks’ Oil Price Predictions

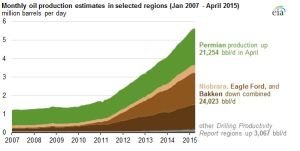

Bakken and Eagle Ford Production Declining

The Energy Information Administration shows oil production from the Niobrara, Eagle Ford and Bakken fields dropping for the first time, by 24,023 bbl/d — much sooner than some predicted. Production from the Permian Basin is still rising. Operators may be delaying completion of wells already drilled, in effect storing their reserves in the ground. (Click image below to enlarge.)

Oil and Gas Lawyer Blog

Oil and Gas Lawyer Blog