Once the largest landowner in Texas with 3.5 million acres of land, Texas Pacific Land Trust now owns 888,333 acres of land in West Texas. The Trust is owned by holders of “shares of proprietary interest” traded on the New York Stock Exchange. TPLT’s story is a window into the history of Texas and railroads in the 19th century.

Once the largest landowner in Texas with 3.5 million acres of land, Texas Pacific Land Trust now owns 888,333 acres of land in West Texas. The Trust is owned by holders of “shares of proprietary interest” traded on the New York Stock Exchange. TPLT’s story is a window into the history of Texas and railroads in the 19th century.

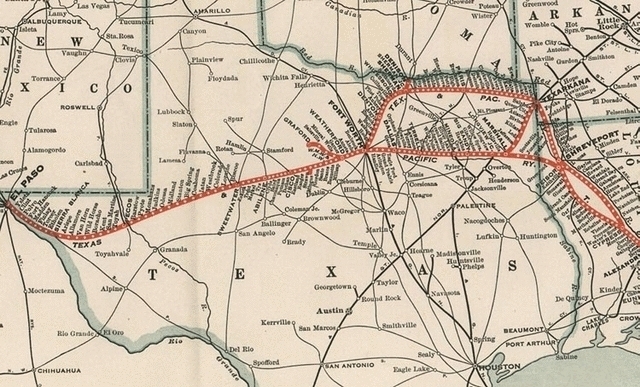

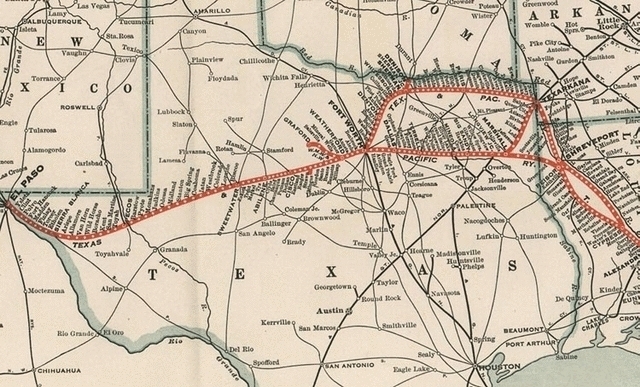

Texas and Pacific Railway was created by federal charter in 1871. Its charter was to build a southern transcontinental railroad between Marshall, Texas and San Diego, California. Railroad companies were given land grants in exchange for building rail line, and the U.S. Congress granted T&P twenty sections of land per mile in California and forty sections per mile through the territory that is now Arizona and New Mexico. The State of Texas (where there were no federal lands) agreed to grant T&P twenty sections per mile for the portion of the line crossing Texas. The panic of 1873 caused financial difficulties, and by 1876 only 444 miles had been built. In 1879, Jay Gould bought the company and began laying track west. Gould merged T&P with Southern Pacific Railway, and by 1881 it had built a total of 972 miles of track, entitling it to 12.4 million acres of land. But because it had not built all of the line within the time required by its charter, T&P was awarded only 5,173,120 acres, later reduced to 4,917,074 acres – 3.5 million of that in Texas.

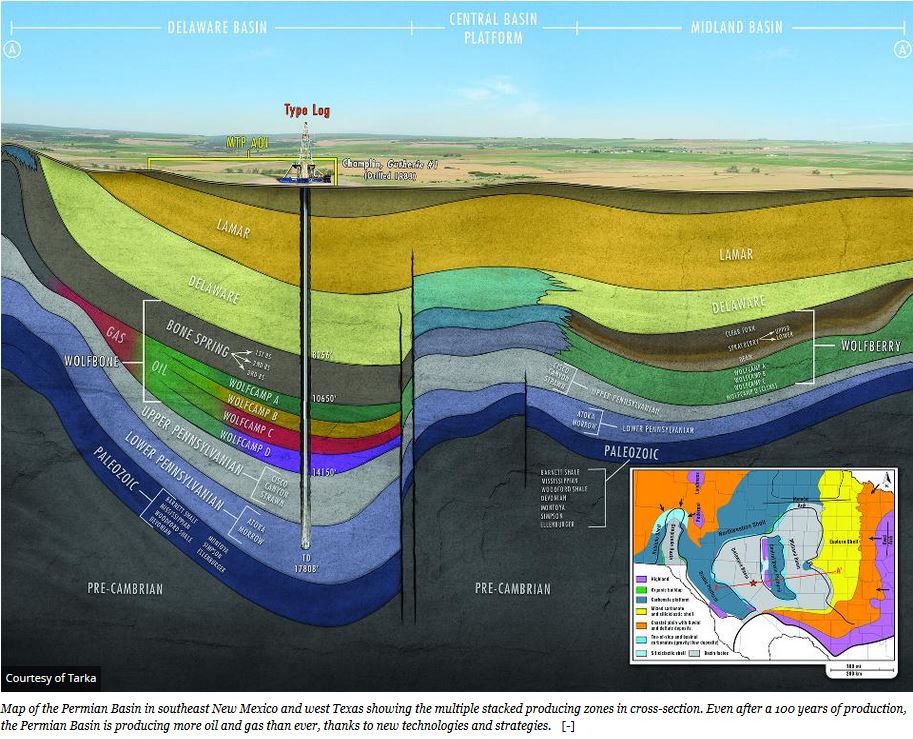

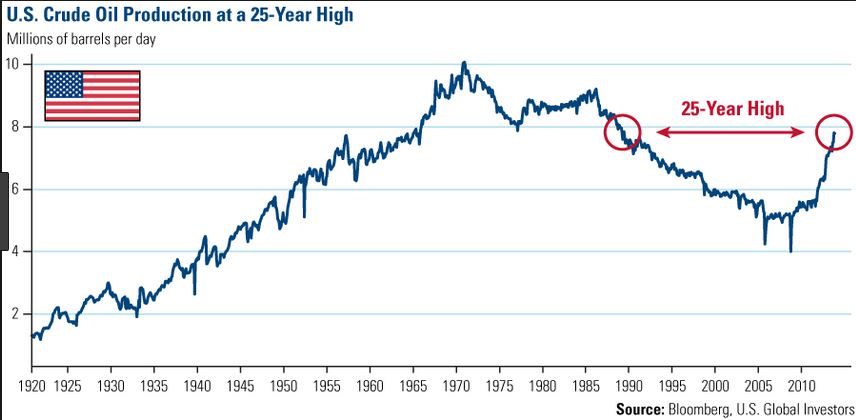

In 1888, the T&P went through bankruptcy and receivership, and the bondholders who financed the railroad were awarded the land in Texas that had been granted to T&P. The bondholders created a trust, Texas Pacific Land Trust, to liquidate those lands for the benefit of the bondholders, receiving 3.5 million acres of land. The certificates of trust issued to the bondholders were later listed on the New York Stock Exchange. The mineral estate under the land was spun off into a separate entity and later sold to Texaco, now Chevron. TPLT owns a royalty interest in almost 500,000 acres of its land.

Oil and Gas Lawyer Blog

Oil and Gas Lawyer Blog