Articles Posted in Uncategorized

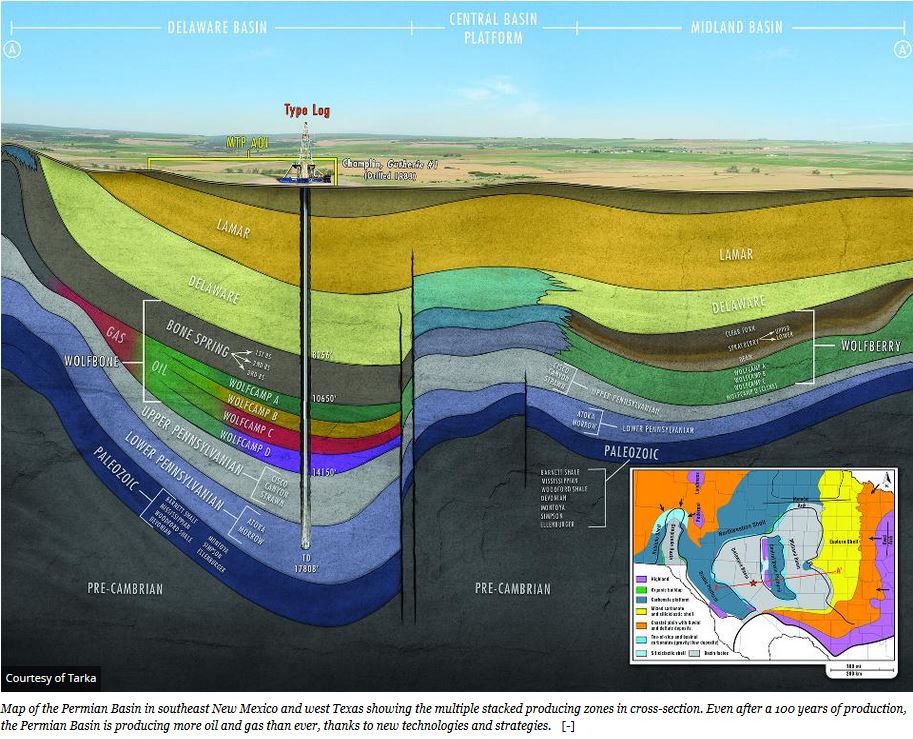

Great Permian Graphic

Lightning Oil v. Anadarko Set for Oral Argument in Supreme Court

Lightning Oil v. Anadarko will be argued before the Texas Supreme Court on March 21. I wrote about the court of appeals’ opinion here. The issue: whether the owner of a mineral estate has a cause of action for trespass if a horizontal well is drilled through the tract to produce from an adjacent tract. The parties’ briefs may be found here.

TAMU Energy Law Symposium

Texas A&M has asked that I post notice of its 2017 Energy Law Symposium on “The Future of Energy”. The symposium, scheduled for March 23–24, 2017, will convene industry experts, academic commentators and public officials to discuss a wide range of issues bearing on anticipated needs, policy challenges and proposed reforms in the U.S. and global energy markets. Panel, debate and keynote sessions will address legislative and regulatory priorities, power generation, allocation wells, trans-boundary resource management, environmental considerations, bankruptcy and much more. $50 Registration / $150 Registration + CLE (12.75 CLE credit hours pending approval). The agenda for the symposium can be viewed here: energy-symposium-agenda-2feb17(4)

Another Chesapeake Royalty Suit: Addax Minerals Fund v. Chesapeake, No. DC-16-07867, Dallas County

Yet another suit alleging underpayment of royalties has been filed against Chesapeake in the Barnett Shale. The petition can be viewed here: Addax v. Chesapeake Among the long list of plaintiffs is Kimbell Art Foundation. The petition alleges that plaintiffs are lessors under more than 8,000 leases in 280 pooled units with more than 725 producing gas wells. Defendants are Chesapeake and its working interest partner in the Barnett, Total E&P USA, Inc. Plaintiffs’ counsel is Burns Charest LLP.

The suit focuses on two complaints against the defendants. The first is based on the gathering agreement between Chesapeake and Access Midstream. The second is based on how Chesapeake has calculated the plaintiffs’ royalty interests in the pooled units. Continue reading →

Debate over Allocation Wells Continues

Three recent articles have intensified the debate over whether allocation wells are authorized by a typical oil and gas lease. Two of the articles appear in the most recent edition of the Section Report of the Oil, Gas & Energy Resources Law Section of the State Bar. The first, written by Ernest E. Smith, makes clear in its title the position of the author: Applying Familiar Concepts to New Technology: Under the Traditional Oil and Gas Lease, a Lessee Does not Need Pooling Authority to Drill a Horizontal Well that Crosses Lease Lines. View here: Applying Familiar Concepts A later version of his article will be published in the Texas Journal of Oil, Gas and Energy Law at the University of Texas School of Law. The second article is by Ronald D. Nickum, an oil and gas attorney in Amarillo, titled Non Consent Allocation – Will it Survive Judicial Scrutiny. View here: Non Consent Allocation Mr. Nickum’s article is more skeptical about the legality of allocation wells.

Professor Smith’s article is written in rebuttal to an article to be published in the Baylor Law Review written by Professor Bret Wells, Allocation Wells, Unauthorized Pooling, and the Lessor’s Remedies, which can be viewed here. Professor Wells argues that allocation wells are a form of pooling not authorized by a typical oil and gas lease and give rise to claims for trespass and punitive damages.

The Texas Railroad Commission ruled in the Klotzman case that it had the authority to issue permits to drill horizontal wells that cross multiple lease lines without pooling those leases together. Although the Commission has never adopted a rule defining or authorizing permits for such wells, an “allocation well” has generally come to be understood as a well that crosses one or more lease lines and that produces from more than one lease without pooling those leases and without any agreement with the royalty owners as to how production will be allocated among the leases crossed by the well. Because of the uncertainty as to the legality of allocation wells, exploration companies sought legislation in the last legislative session expressly authorizing such wells. That bill, HB 1552, died in committee. It is expected that similar legislation will be filed in the upcoming session.

GDHM 3rd Annual Landowners’ Seminar – Register Today!

Our firm’s third annual seminar for land and mineral owners is May 6th at the Stephen F Austin Intercontinental Hotel from 9am to 6pm.

As a reader of my blog, if you use the coupon code BLOG, you will save $5 off the registration fee.

Topics covered throughout the day will include:

$4.2 MM Verdict Against Cabot in Dimock, PA

The township of Dimock, Pennsylvania has been the focus of controversy over the environmental impact of hydraulic fracturing. Residents of Dimock rely on groundwater, and in 2009 they were forced to obtain alternate sources because of contamination of their groundwater that they blamed on wells drilled by Cabot. Cabot had drilled and fracked 62 wells in an nine-square-mile area around Dimock. Cabot denied, and has continued to deny, that its wells were responsible for the contamination. Dimock featured prominently in the anti-fracking “documentary” Gasland.

Last month, a case filed by Dimock residents against Cabot, Ely v. Cabot Oil & Gas Corporation, filed in 2009, finally went to trial. A large number of residents originally joined the suit, but most settled with Dimock in 2012. Cabot, represented by Norton Fulbright, vigorously fought the case with pretrial motions. The plaintiffs originally had claims for negligence, gross negligence, private nuisance, strict liability, breach of contract, fraudulent misrepresentation, and claims under the Pennsylvania Hazardous Sites Cleanup Act. By the time of trial, Cabot had convinced the judge to dismiss all of plaintiffs’ claims except negligence and private nuisance. Two families remained as plaintiffs, the Elys and the Huberts. They still live in Dimock and still truck their drinking water to their homes. The Elys and Huberts, represented by two local attorneys, Leslie Lewis and Elisabeth Radow. Their case was financed by crowd-funding and the Energy Justice Network.

During trial, the judge dismissed the plaintiffs’ negligence claim and held that potential damages in the sole remaining claim for private nuisance should be limited to “inconvenience and discomfort” cause by the nuisance, excluding any claim for mental and emotional discomfort or the cost of replacing the water. The judge also ruled that plaintiffs could not discuss before the jury consent decrees between Cabot and the Pennsylvania Department of Environmental Protection relating to the Dimock groundwater contamination.

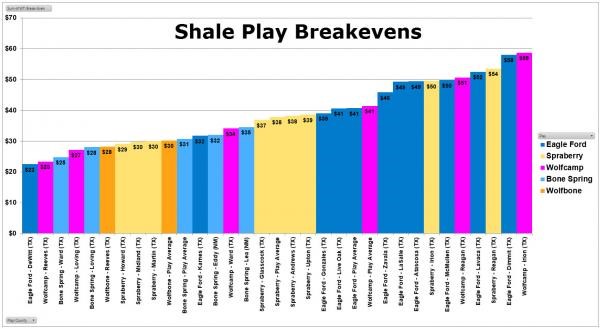

Bloomberg Estimates of Breakeven Prices in Shale Plays

Bloomberg’s estimates of the oil price necessary to recover drilling, completion and operating costs in various shale plays (click to enlarge):

The winners: DeWitt County in the Eagle Ford Shale, $23/bbl, the Wolfcamp in Reeves County, $24/bbl, and the Bone Spring in Ward County, $25/bbl. Except for DeWitt County, all breakeven prices below $30/bbl are in the Permian Basin.

Texas Railroad Commission Candidates

The filing deadline is now past, and eight Republicans, three Democrats and a Libertarian have said they will run for a seat on the Texas Railroad Commission to replace David Porter, who unexpectedly decided not to run for re-election. Here’s the lineup:

- Gary Gates, Republican. Gates is a wealthy real estate developer and rancher from Rosenberg and a social conservative. He spent more than $1 million of his own money in an unsuccessful effort to take Comptroller Glenn Hegar’s former senate seat, losing to Lois Kolkhors in a special election – the fourth time he failed to win an election for the Texas legislature.

- John Greytok, Republican. He’s a lawyer and registered lobbyist and an early supporter of Ted Cruz. He wants the RRC to lead the charge against the Obama administration’s environmental policies.

Oil and Gas Lawyer Blog

Oil and Gas Lawyer Blog