7th Annual GDHM Land & Mineral Owner Seminar – November 18

Our firm is hosting its 7th annual seminar for Texas land and mineral owners on topics of interest in oil, gas, and energy law, including:

- Legislative session forecast

7th Annual GDHM Land & Mineral Owner Seminar – November 18

Our firm is hosting its 7th annual seminar for Texas land and mineral owners on topics of interest in oil, gas, and energy law, including:

Ridgefield Permian v. Diamondback is another case arising out of the same tax foreclosure suit that was addressed in Mitchell v. MAP Resources, decided earlier this year by the Texas Supreme Court. My discussion of Mitchell can be found here. Both Ridgefield and Mitchell were initially decided by the El Paso Court of Appeals. While Mitchell’s appeal to the Supreme Court was pending the El Paso Court handed down its opinion in Ridgefield, 2021 WL 1783260 (May 5, 2021). In Ridgefield, the El Paso Court held that the taxing authorities’ lien attached only to the royalty interest reserved in the lease; once the lease terminated, the purchaser of the royalty interest foreclosed upon owned no interest in the mineral estate. This week, the Texas Supreme Court declined to hear Ridgefield’s appeal of the El Paso Court’s judgment.

Alberta Griffith owned a 1/7th interest in the surface and minerals in a section of land in Reeves County. When she died her interest passed to her two sons, Albert and David, subject to a life estate interest in her surviving husband. In 1975, the husband and sons signed an oil and gas lease to Billings, reserving a 1/8th royalty. A well, the Meriwether No. 1, was completed on the lease.

In 1998, there was a small tax debt owed by Mr. Griffith and Albert on their royalty in the Meriwether lease. That year the taxing districts filed suit to foreclose tax liens against several hundred defendants, including Mr. Griffith and Albert. In the suit their interests were each described as a .005952 decimal interest in the Meriwether lease (each owning a royalty of 1/3 of 1/7 of 1/8 royalty). Judgment was entered foreclosing the lien, the interests were sold at Sheriff’s sale, and the interests came to be owned by Magnolia, LLC.

Last year KUT produced a podcast, “The Disconnect,” chronicling the February 2021 Texas freeze and blackout. KUT has now produced Part 2: “The Disconnect: Power, Politics and the Texas Blackout,” explaining what has happened since–what has been fixed, the cost in electric bills, and the aftermath–hosted by KUT reporter Mose Buchele. An excellent look at what the legislature, regulators, gas producers and generators have and have not done to prevent future system failures.

Yesterday the Texas Railroad Commission approved new regulations requiring well, gas plant and pipeline operators to winterize their facilities. Critics are skeptical they will do the job.

Sometimes lawyers really do have the best responses. The following is just one example.

Rebuilding New Orleans after Katrina often caused residents to be challenged to prove home titles back hundreds of years. That is because of community history stretching back over two centuries during which houses were passed along through generations of family, sometimes making it quite difficult to establish a paper trail of ownership.

A New Orleans lawyer sought a FHA rebuilding loan for a client. He was told the loan would be granted upon submission of satisfactory proof of ownership of the parcel of property as it was being offered as collateral. It took the lawyer 3 months, but he was able to prove title to the property dating back to 1803. After sending the information to the FHA, he received the following reply.

Dr. Scott Tinker will host a 12-episode TV series on energy and climate, on Austin’s PBS station, KLRU, beginning September 4 at 6 pm and streaming on PBS.org. More information can be found here.

From the press release:

Energy and climate are intertwined, two of the most important topics in the world today. Yet very little is known about them. This show aims to change that. ENERGY SWITCH brings together two renowned experts from government, NGOs, academia and industry, with differing perspectives on important energy and climate topics, such as: Could solar and wind power our future? Or could hydrogen be the dominant energy source? Should we have more or less nuclear power? How should we respond to climate change? What policies most effectively reduce emissions? How could we pay for them?

The King Ranch Institute for Ranch Management at Texas A&M University – Kingsville has published a webinar and a white paper on how ranchers should consider whether to enter into agreements to change their ranch practices to increase CO2 in their soil, generating carbon credits. Links to the webinar and white paper can be found here.

In 1860, at the age of 60, Joseph Glidden invented barbed wire. He patented it the next year and sold the patent in 1876 to a company named Washburn and Moen, retaining a royalty that made him one of the richest men in the US.

John Warne Gates was born in Chicago in 1855. After several failed business, Gates became a salesman for Washburn and Moen. They gave him Texas as his sales territory. To show the benefits of barbed wire Gates set up a demonstration at the San Antonio Military Plaza. He built a barbed-wire pen and placed 100 head of cattle in the pen, who were run full speed into the fencing; the fence held. He sold lots of barbed wire for Washburn and Moen, then started his own successful wire business, which he later sold to JP Morgan’s US Steel. So he got in the steel business, forming Republic Steel, and invented a new process to purify iron called the open-hearth process.

John Warne Gates was born in Chicago in 1855. After several failed business, Gates became a salesman for Washburn and Moen. They gave him Texas as his sales territory. To show the benefits of barbed wire Gates set up a demonstration at the San Antonio Military Plaza. He built a barbed-wire pen and placed 100 head of cattle in the pen, who were run full speed into the fencing; the fence held. He sold lots of barbed wire for Washburn and Moen, then started his own successful wire business, which he later sold to JP Morgan’s US Steel. So he got in the steel business, forming Republic Steel, and invented a new process to purify iron called the open-hearth process.

In 1900, Patillo Higgins was drilling a well at a place called Spindletop, near Beaumont. He ran out of money, and Gates  eventually invested $590,000 into the project. On January 10, 1901 the well blew in and spewed 100,000 barrels of oil a day for nine days. The company Gates invested in, the Texas Company, which later became Texaco. Gates became its president.

eventually invested $590,000 into the project. On January 10, 1901 the well blew in and spewed 100,000 barrels of oil a day for nine days. The company Gates invested in, the Texas Company, which later became Texaco. Gates became its president.

Last week the Supreme Court of North Dakota handed down its opinion in Northwest Landowners Association v. State of North Dakota, 2022 ND 150. The court struck down portions of a statute passed by the North Dakota Legislature, Senate Bill 2344, dealing with ownership rights to “pore space.” North Dakota law defines “pore space” as “a cavity or void, whether natural or artificially created, in a subsurface sedimentary stratum.” The purpose of the statute was to facilitate operators’ use of pore space for saltwater disposal and CO2 injection in tertiary recovery operations, and to deny landowners the right to compensation for such uses. But the language of the statute is much broader:

Notwithstanding any other provision of law, a person conducting unit operations for enhanced oil recovery, utilization of carbon dioxide for enhanced recovery of oil, gas, and other minerals, disposal operations, or any other operation authorized by the commission under this chapter may utilize subsurface geologic formations in the state for such operations or any other permissible purpose under this chapter. Any other provision of law may not be construed to entitle the owner of a subsurface geologic formation to prohibit or demand payment for the use of the subsurface geologic formation for unit operations for enhanced oil recovery, utilization of carbon dioxide for enhanced recovery of oil, gas, and other minerals, disposal operations, or any other operation conducted under this chapter. As used in this section, “subsurface geologic formation” means any cavity or void, whether natural or artificially created, in a subsurface sedimentary stratum.

North Dakota (unlike Texas) has a statute, the Damage Compensation Act, requiring that requiring a mineral developer to compensate the surface owner for “lost land value, lost use of and access to the surface owner’s land, and lost value of improvements caused by drilling operations.” N.D.C.C. sec. 38-11.1-04. Senate Bill 2344 amended the Damage Compensation Act to exclude “pore space” from its definition of “land.”

The Inflation Reduction Act, passed by the Senate yesterday and on its way to passage in the House, contains carrots and sticks for reducing methane emissions in the oil and gas sector.

From Inside Climate News:

One of the least discussed, but potentially most significant, climate aspects of the proposed Inflation Reduction Act is a fee it would place on methane emissions from oil and gas operations. The bill would charge companies for methane that they leak or vent into the atmosphere, with the fee starting at $900 per ton in 2024 and increasing to $1500 per ton by 2026.

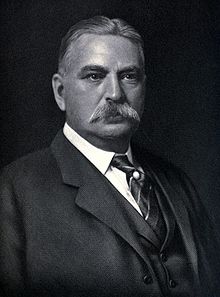

I ran across an article recently in the Journal of the Texas Supreme Court Historical Society about James V Allred, who succeeded the infamous Miriam “Ma” Ferguson as Governor of Texas in 1935. The Article, “Texas Troubles: Governor Allred and His Rangers Defy Jim Crow,” by Jody Edward Ginn, Ph.D. (Executive Director of the Texas Rangers Heritage Center in Fredericksburg), is excerpted from his book East Texas Troubles: The Allred Rangers’ Cleanup of San Augustine. In it he chronicles Allred’s depoliticizing and professionalizing of the Texas Rangers (he fired all but three of Ma Ferguson’s five thousand Rangers) and his clean-up of San Augustine, at that time run by a criminal gang “who built their power exploiting Jim Crow limitations on African American Texans’ access to the courts,” with the help of his new Rangers. In three trials in 1935 and 1936, three all-white juries convicted members of the gang of felony crimes against African American victims, based exclusively on the testimony of black victims and witnesses and the Rangers’ investigations.

Reading about Jimmy Allred sparked a memory about a case our firm handled years ago, which I will relate momentarily. First, a little more about Allred.

James V (no period, that’s his name) Allred was born in Bowie, Texas in 1899, went to Rice, served in the Navy, and graduated from Cumberland University law school in Lebanon, Tennessee, in 1921. He served as Texas’ Attorney General 1931-34 and Governor 1934-39. He was a progressive Democrat in the model of Franklin Roosevelt. After his stint as Governor Allred served on the U.S. District Court for the Southern District of Texas, taking the bench at the age of forty. He resigned his judgeship in 1942 to pursue an unsuccessful run for the U.S. Senate, losing to Pappy Lee O’Daniel. Roosevelt nominated him for the Fifth Circuit Court of Appeals in 1942, but he was not confirmed. He was later again appointed as Judge for the Southern District in 1949, where he served until his death in 1959.