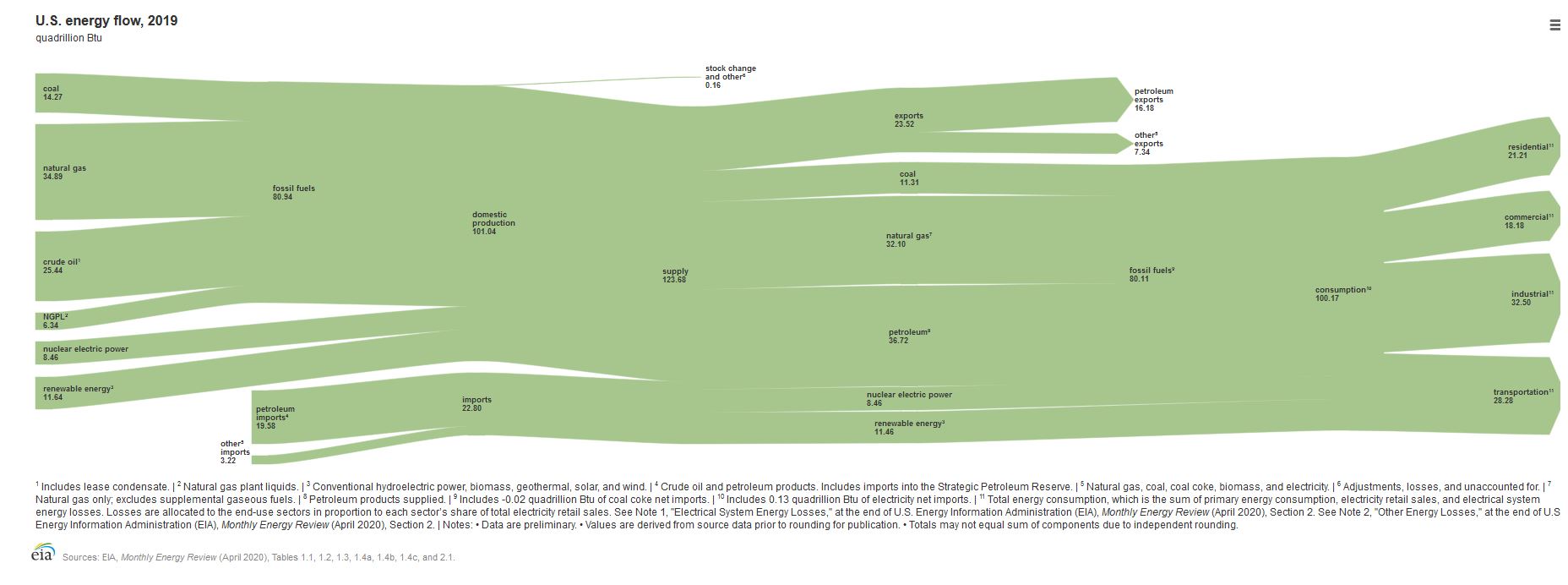

Another great chart from the US Energy Information Administration, showing sources and uses of energy in the US last year. Click on image below to enlarge. You can also view it on the EIA website. Hydrocarbons continue as by far the largest sources of energy consumed by the US.

Articles Posted in Energy markets

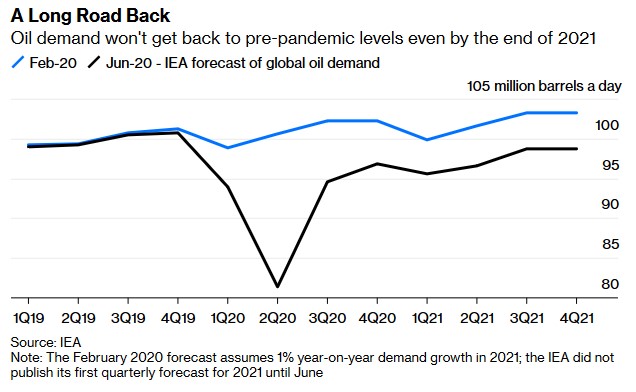

Recovery of the Oil Market

From Bloomberg Opinion:

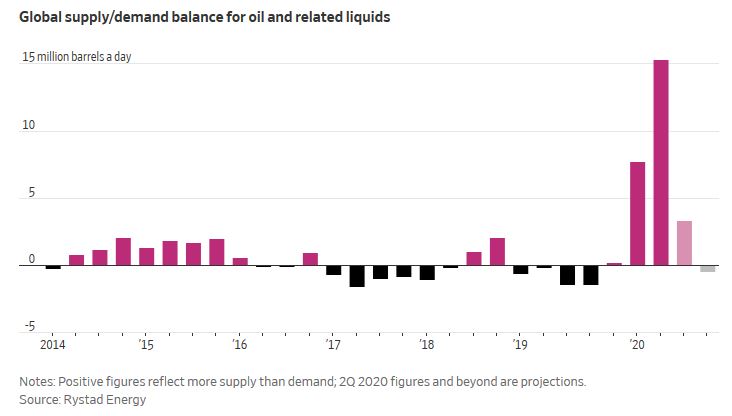

“The International Energy Agency … doesn’t think demand will have fully recovered by [the end of 2021]. In the final quarter of next year it predicts global oil demand will still be running about 2 million barrels a day below pre-pandemic levels, and more than 4% below where it might reasonably have been expected to be in the absence of the crisis.”

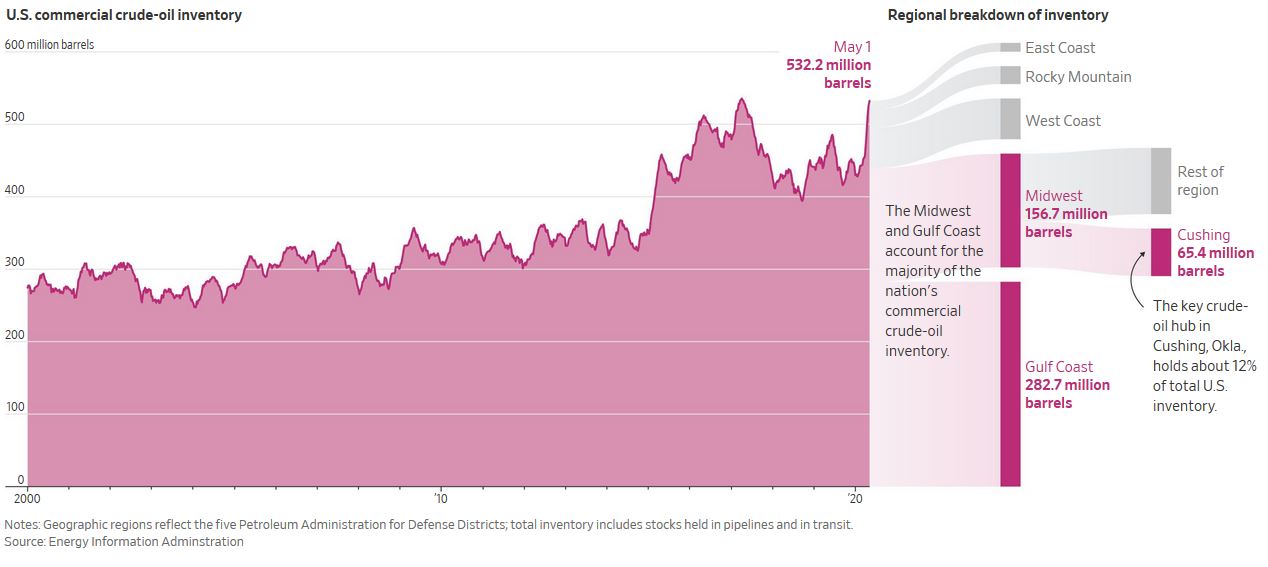

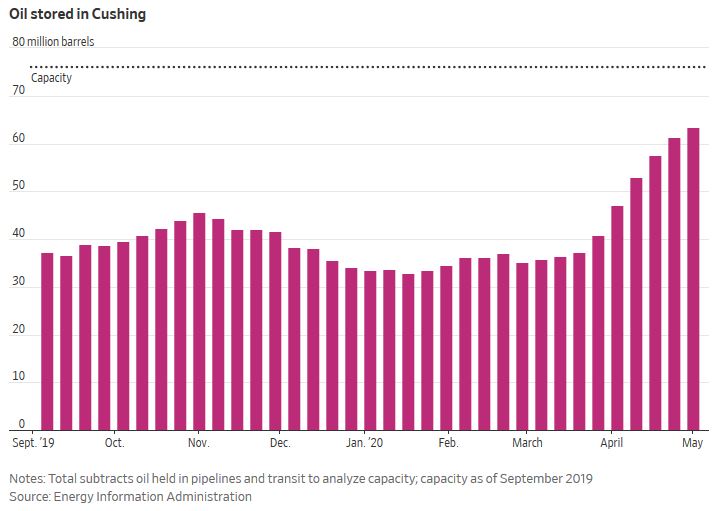

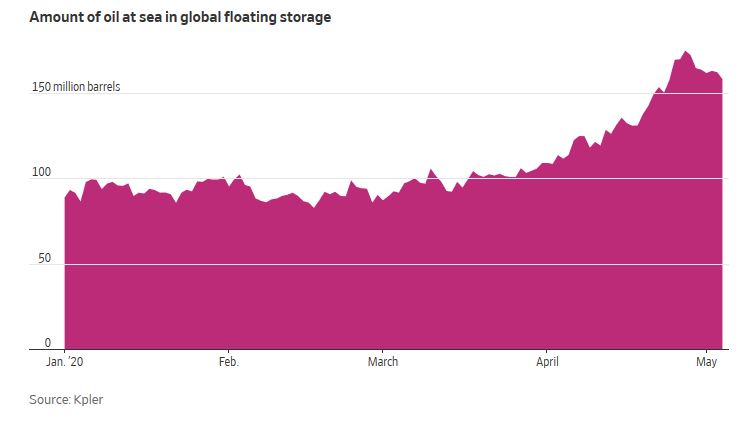

“The amount of stored oil that needs to be burnt through before there is room for producers to pump more is huge. Enough of the black stuff has gone into storage tanks, caverns and ships over the past six months to drive every heavy truck in the U.S. around the world five times–if it could all be turned into diesel fuel.”

“The amount of stored oil that needs to be burnt through before there is room for producers to pump more is huge. Enough of the black stuff has gone into storage tanks, caverns and ships over the past six months to drive every heavy truck in the U.S. around the world five times–if it could all be turned into diesel fuel.”

Solar, Wind, Oil and Coal

US oil production fell by 300,000 bbls/day last week to 11.6 million bbls/day. US oil production peaked earlier this year at 13.1 million bbls/day–decline from that peak is more than 11%. Expect more decline to come.

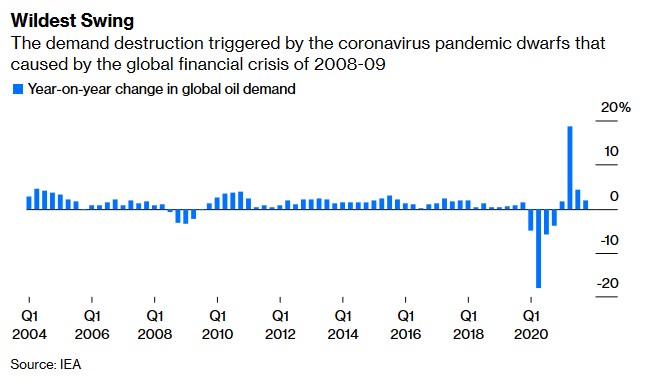

Crude stockpiles declined last week by 700,000 bbls. Gasoline inventories fell by 3.5 million bbls. The Energy Information Administration estimates that global petroleum and liquid fuels consumption declined by 5.8 million bbls/day in the first quarter from the same period in 2019.

EIA projects that renewable power sources will generate more electricity this year than coal for the first time on record. It estimates that generation from coal will decline by 25% this year.

Texas’ “Competitive” Retail Electricity Market

Great story in Houston Chronicle. Power companies were deregulated by the Legislature to create a competitive market for retail electricity, except for some municipally owned utilities like those in Austin and San Antonio. Turns out consumers in Austin and San Antonio have the better deal. Power companies do their best to confuse consumers into signing up for higher-cost plans, and they don’t want anyone to mess with their system–and the Public Utility Commission has declined to get involved.

Reporter L.M. Sixel writes:

The maddening experience of shopping for electricity has spawned a group of concierge websites that say they find the lowest-price plans and move their customers when better deals appear.

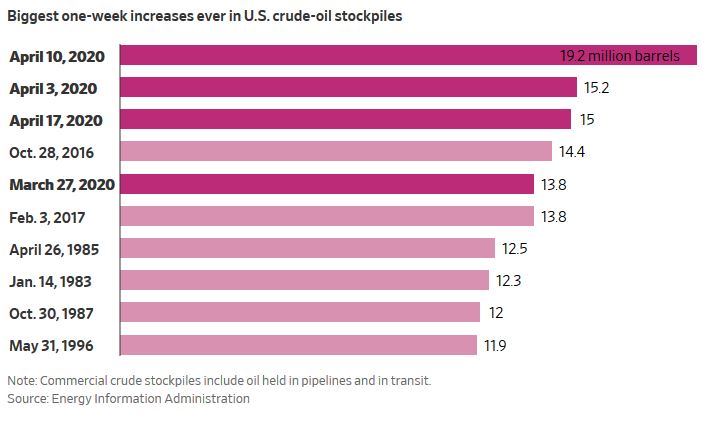

The State of Crude Oil Inventory

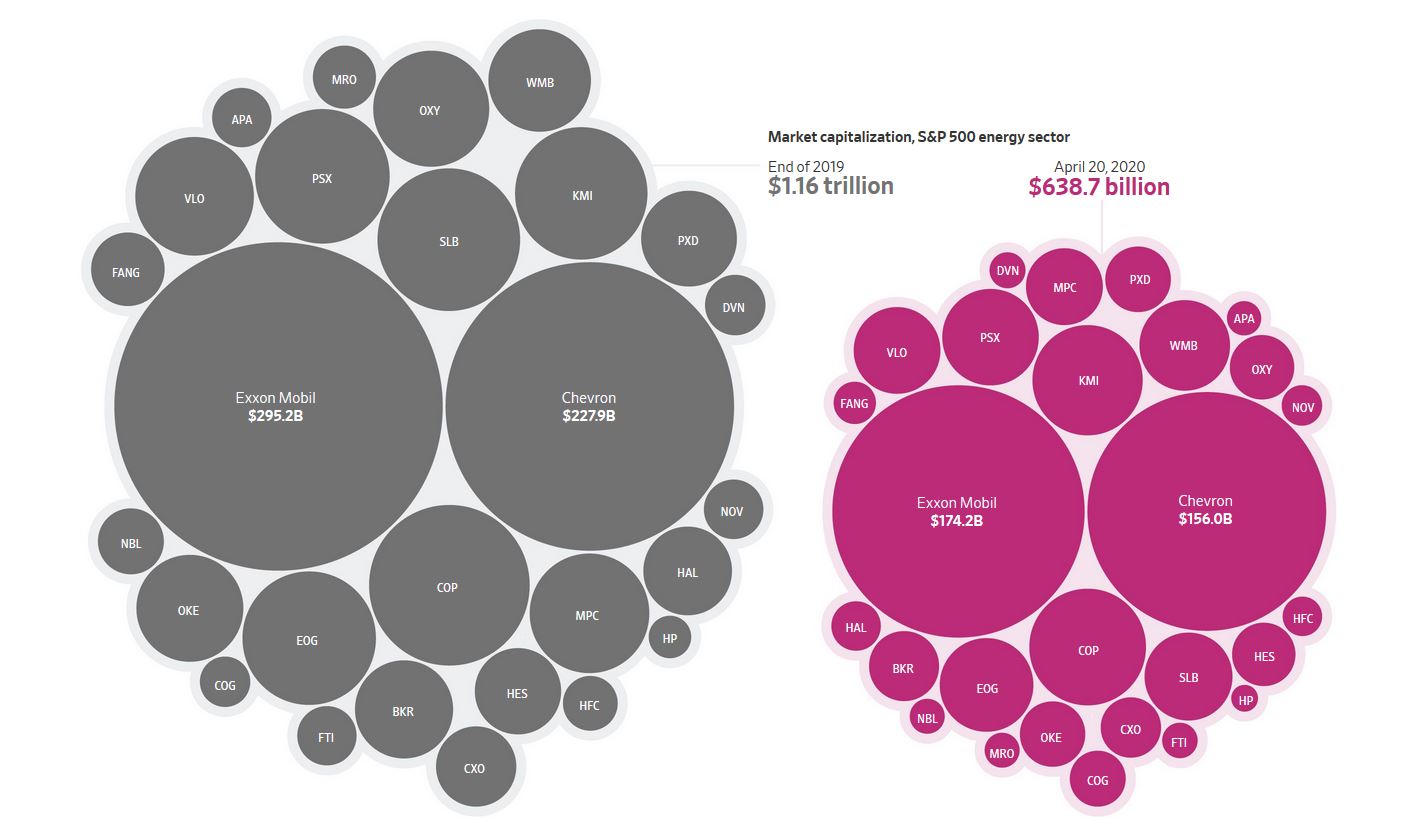

The Wall Street Journal today published some excellent graphs illustrating the glut in world and US oil inventories. Click on images to enlarge. Article is here.

Texas Railroad Commission: Commissioner Sitton’s proposed proration order to be considered May 5; Commissioner Christian opposed

Commissioner Ryan Sitton has published his proposed conditional order imposing proration on oil production in Texas, to be considered at the Commission’s hearing on May 5.

Commissioner Wayne Christian, in an op ed in the Houston Chronicle, has come out against the proposal.

Sitton’s proposed order is attached to the Commission’s May 5 hearing agenda. His proposal follows the recommendation he described at the Commission’s prior open meeting on April 14. The Commission received 888 comments prior to that meeting, and more than 50 individuals presented live comments during the meeting.

Proration at the Railroad Commission: Sitton’s motion to conditionally order Texas operators to reduce their oil production by 20% is tabled.

The Texas Railroad Commission at open meeting today considered Pioneer and Parsley’s petition asking the Commission to institute oil proration. Commissioner Sitton moved to institute proration, conditioned on other states and countries committing to a total of 4 mm bbls/day additional reduction in oil production by June 1. Sitton’s motion provided that each Texas operator would be required to reduce its production by 20% effective June 1, amounting to 1 mm bbls/day of Texas production, but exempting operators producing less than 1,000 bbls/day. Sitton got no second on the motion.

Commissioner Christian announced he has appointed a blue-ribbon panel to study the issue. He named only associations – TxOGA, TIPRO, Panhandle PRA,O and Permian Basin PA, and Pipeline Association — and not individuals, to be on that panel.

Commissioner Craddick said she wanted staff to present “all options” for how to institute proration and wanted guidance from the Texas Attorney General as to what was legal before taking any action, commenting that any action by the Commission is bound to end up in litigation.

To Prorate or Not to Prorate?

The Texas Railroad Commission heard comments yesterday in a virtual open meeting on the proposal from Pioneer and Parsley that the Commission re-institute proration of Texas oil wells in response to the drastic reduction of world oil demand. Unsurprisingly, those providing comments did not agree.

In general, the division was between majors and independents – though not totally.

Marathon, Ovintiv, and Diamondback opposed proration, as did TxOGA, Texas Alliance of Energy Producers, the American Petroleum Institute, Texas Pipeline Association, Plains All American Pipeline, and Enterprise Products Partners. Parsley and Pioneer testified in favor of proration, as did Latigo Petroleum, Discovery Operating, Elevation Resources, and former Railroad Commissioner and Congressman Kent Hance. Surprisingly, Quantum Energy, a major independent, testified in favor. In addition, the following provided written comments in favor of proration: Continental Resources, CrownQuest, Hibernia Resources, Texas American Resources, the Panhandle Producers and Royalty Owners Association, and Permian Basin Petroleum Association. Those submitting written comments opposing proration included Chevron, Cimarex, Concho, ConocoPhillips, EOG, Occidental, TXO, and former Commissioner Michael Williams. Written comments can be viewed on the Commission website, here.

Arguments against proration included: Continue reading →

Who Is Responsible for the Oil Glut?

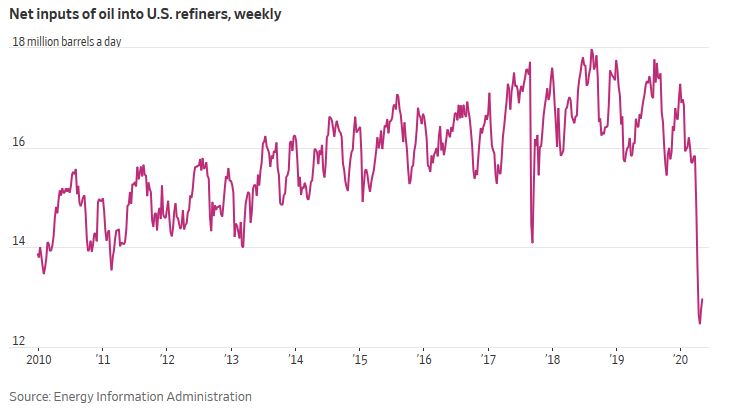

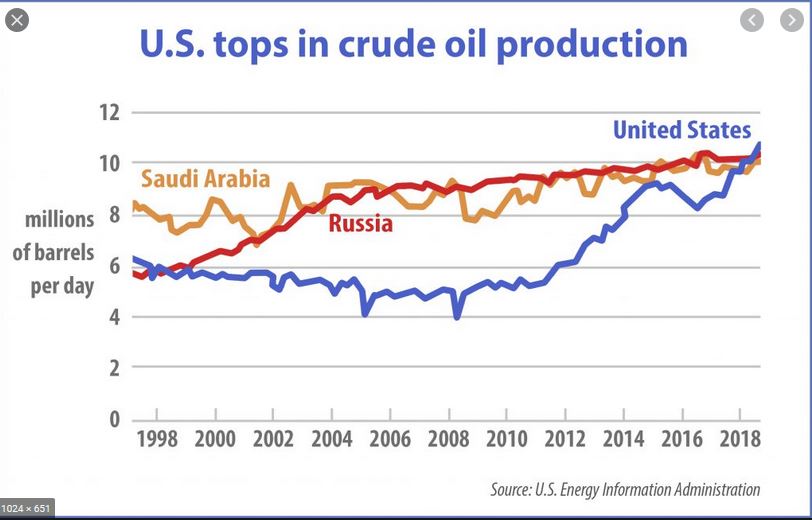

The failure of Saudi Arabia and Russia to agree on reductions in oil production, combined with the crash in demand caused by COVID-19, are blamed for the rapid decline in oil prices and the glut in supply. But looking back, it can be argued that another cause is the rapid rise in US oil production since 2010.

US producers have relied on OPEC to regulate the world oil price, while ramping up their production. Maybe US producers should take some responsibility as well.

US producers have relied on OPEC to regulate the world oil price, while ramping up their production. Maybe US producers should take some responsibility as well.

Texas accounts for 41% of US oil production, and increased production from the Permian is the principal driver of increased oil production in the US.

Oil in the Time of Pandemic

| From POLITICO:

OIL IN THE TIME OF PANDEMIC: The global oil market is in an unprecedented situation, one that will hasten companies falling out of the sector, IHS Markit vice chairman and long-time energy industry doyen Daniel Yergin said Thursday. Yergin, in D.C. for an Energy Department board meeting, would normally have been in Houston to preside over the mammoth CERAWeek energy conference this week if the spread of the coronavirus hadn’t forced its cancellation for the first time in its nearly 40-year history. The economic distress, coupled with the flood of oil coming from Saudi Arabia and Russia, has put the overall industry in a situation it has never faced before and one that the federal government would be hard-pressed to fix, he said. “I mean, there’s just so much weakness,” Yergin told reporters after the meeting. “There’s so much oil out there flooding into the market. It’s a problem of an oil price war in the middle of a constricting market and the walls are closing in. Normally, demand would solve the problem in a way. But not in this case, because of the freezing up of economic activity. Low gasoline prices and low oil prices don’t do much when schools are closed, when people are canceling all their trips and people are working from home. There have been many cases of an oil market collapse and competition for market share, but I can’t think of any one that was in the context of a larger global epidemic.” Some of the possible solutions being bandied about probably wouldn’t work , Yergin said. Government purchases of oil to put into the Strategic Petroleum Reserve? “You’d have to write some very big checks, and I don’t know if they could deal with the amount of oil coming into the market,” Yergin said. Anti-dumping complaints of the sort Continental Resources CEO Harold Hamm said he’s pursuing? “I don’t think it would solve things overnight,” Yergin said, and it would be tough to prove Saudi Arabia is selling its oil below cost. “I think this is certain to accelerate consolidation” in the industry, Yergin said of the current market. “But it’s still early days.” |

Here’s one idea: Railroad Commission should (1) order all flaring in the Permian to cease, requiring those wells flaring gas to shut in the wells or sell the gas, and (2) re-institute proration of production in the Permian, reducing economic waste.

Oil and Gas Lawyer Blog

Oil and Gas Lawyer Blog