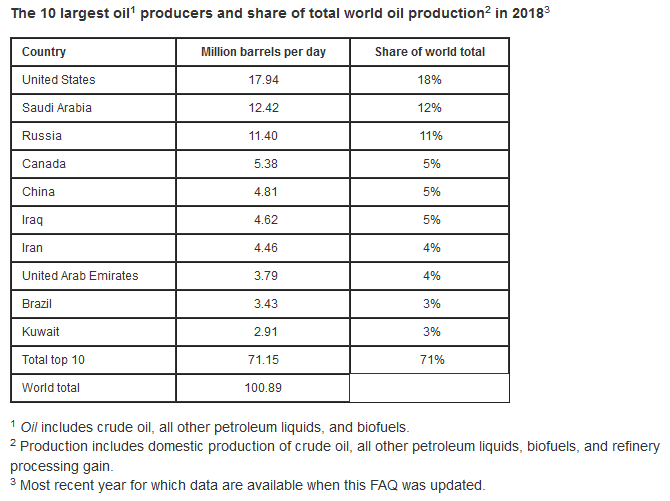

I recently ran across an article on Investing.com, “The Problematic Truth About U.S. Shale Oil Production,” by Dr. Ellen Wald, who hosts a podcast about global energy. Dr. Wald reports on her recent podcast discussion with Art Berman, a geology consultant and frequent speaker and author. It reminded me that I wrote about Mr. Berman several years ago, when the shale gas plays in the Marcellus and Barnett were getting started. He told Dr. Wald that the Permian shale plays have much smaller reserves than others — including the Energy Information Administration — have estimated, as little as 3.8 billion barrels.

In 2010, I wrote about Mr. Berman’s attendance at a conference in Washington sponsored by the Association for the Study of Peak Oil & Gas – USA, of which he is a director. At that time he argued that the gas reserves in the Marcellus were much smaller than were being predicted. A year earlier, Mr. Berman created a stir when he published a gloomy analysis of the Barnett Shale. He was then a contributor to World Oil, a trade publication, and World Oil refused to publish one of his articles, causing him and his editor to resign and creating a stir.

Mr. Berman was on a panel hosted by Texas Monthly in 2013, along with Scott Tinker of the UT Bureau of Economic Geology, and Kenneth Medlock, then an energy fellow at the Baker Institute. He continued to question estimates of shale oil and gas reserves. (Dr. Tinker created a wonderful website for those wanting to know more about world energy, the Switch Energy Project, worth exploring.)

Oil and Gas Lawyer Blog

Oil and Gas Lawyer Blog