I ran across a blog post by Andy Nold, a surveyor, about his research into a large subdivision of land in Reeves County. It provides great incite into the challenges faced by surveyors in West Texas. Here is his post, with permission:

Today’s surveying challenge is the garden spot of northern Reeves County, Texas. Mont Clair is a dusty little burg miles from civilization and services that makes Orla look like a major metropolitan destination. Mont Clair was platted in 1911 over several sections of Blocks 57 and 58 of Township 1 of the T&P Railway Company Survey, bisected by the Pecos River Railroad (later the Panhandle and Santa Fe). Speculation on a great land rush brought by the development of canals and cheap farmland, Mont Clair joined many other now defunct towns along the railroad like Arno, Angeles, Dixieland, Riverton, and Patrole. Unfortunately, the sales of Pecos River water rights far exceeded the actual quantity of water that the river could provide especially with the development of dams and lakes in New Mexico that reduced the flow.

The subdivision plat was signed by J.L. Walker, president of the Pecos Valley Interstate Livestock Company whose principle place of business was Groesbeck, Limestone County, Texas. The partnership included L.B. Cobb, Jr., W.W. Brown, R.L. Reese, R.M. Cralle, L.L. Brown and F.F. Brown. The plat purports to be based on a survey made by L.B. Cobb. It is a very large map and has no recording information. The plat is kept in a big folder at the courthouse and all the deeds referencing it just cite “Lot #, Block # in the Town of Mont Clair, Reeves County, Texas as shown by the map or plat of said town of record in the Deed Records of Reeves County, Texas.”

The town is aligned to the railroad, occupying most of Section 18 and portions of Sections 13 and 19. The north town limits are annotated N 70°20’ E. The east line of Section 18, Block 57, Twp. 1 is annotated NS and the Pecos River Railroad slices through the east third of town on a 50-foot right-of-way. There is no call for any monumentation and no ties to the section corners. The blocks are 250’x250’ with 20-foot alleys and 60-foot street rights-of-way.

Several other sections adjoining the town lots and in the vicinity are also platted into farm lots, 80 equal sized lots on the typical section ringed with an apparent right-of-way of unknown dimension. It is my belief that the sections were presumed to be 640 acres oriented to the cardinal directions.

A Reeves County history says that a Post Office was organized for Mont Clair in 1911. I do not know if any buildings or residences were constructed at all. I have found nothing indicating a railroad depot was ever here, although several of the other ghost towns listed did have a depot at one point. Lot and farm sales must have been good because in 1952, G. E. Ramsey and G. E. Ramsey, Jr., sued over 1,000 property owners and won a judgment in a Trespass to Try Title suit.

http://law.justia.com/cases/texas/supreme-court/1961/a-7892-0.html

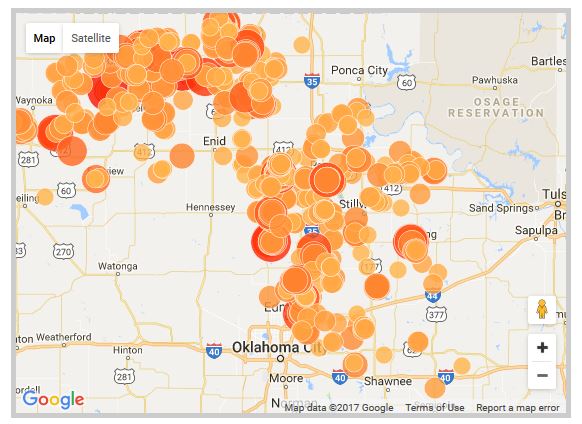

While the Ramseys did gain title to close to 6000 acres of land, some landowners successfully defended their title. Other landowners successfully sued for the return of their property a few years later. My company has been hired to locate 2 of the town lots and 2 of the farm tracts. You may wonder why anyone would be concerned about a few acres of scrub desert land that can barely support cattle or farming in the middle of nowhere. You might be surprised to learn that the commuter adjusted daytime population of the ghost town of Mont Clair is much greater than zero as various people pursue their daily occupations. The town sits atop the Delaware Basin oil shale formation which has some of the most active oilfields in Texas. I’m sure the landowners who sued to reclaim their property were more concerned about maintaining their mineral interests than the surface use.

In talking to one of the Reeves County officials, the plat has never been vacated. No field work has been scheduled yet but I am not optimistic about finding any evidence. We have previously tied the railroad right-of-way through this section and there are several different opinions about where the section corners are supposed to be as evidenced by multiple monuments at each corner. Continue reading →