Anna Kuchment does an excellent job of summarizing the different regulatory reactions to increased earthquake activity across the country triggered by huge increases in wastewater injection, in “Drilling for Earthquakes.”

Abbott Names Members of Seismic Advisory Panel

Last year the Texas legislature passed House Bill 2, including a supplemental appropriation of $4.5 million to fund a study of the causes of earthquakes in the Dallas-Fort Worth area. The funds are being used to purchase and run seismic monitoring equipment and analysis of data to test the connection between oil and gas activity in the area and recent seismic activity. The legislation also required the governor to name a technical advisory committee to advise on the project, which is led by the University of Texas Bureau of Economic Geology. Yesterday, the governor named the members of the advisory committee:

Ruling on Remand in Hooks v. Samson

In January of last year the Texas Supreme Court decided Hooks v. Samson, a suit by royalty owners against Samson Lone Star Limited Partnership. I wrote a post on the Supreme Court’s decision, found here. The Hooks obtained a $21 million fraud judgment against Samson, but the First District Court of Appeals reversed and rendered judgment that the Hooks should take nothing. The Hooks appealed to the Texas Supreme Court. The focus of the Supreme Court’s opinion was whether the Hooks’ claim was barred by limitations — whether the Hooks should have discovered Samson’s conduct more than four years before it sued Samson. The court of appeals had held that, under prior Supreme Court cases, it was bound to rule that the Hooks’ case was barred by limitations and should be dismissed. But the Supreme Court distinguished its prior opinions and held that, when the fraudulent documents Samson gave to Hooks were filed by Samson in the Railroad Commission, the Hooks could rely on them, even if the documents are contradicted by other public records.

The Passing of Aubrey McClendon

Aubrey McClendon, the founder of Chesapeake Energy, died in a car crash last Wednesday, a day after he was indicted on federal charges of conspiring to rig the price of oil and gas leases. Numerous articles have reviewed his life and legacy. Russell Gold, senior energy writer for the Wall Street Journal and an energy journalism fellow at UT Austin, wrote in the Wall Street Journal that “Aubrey McClendon will be remembered … for helping to usher in an era of abundant natural gas, a weakened OPEC and a grievously wounded American coal industry. We are all living in the energy world that he envisioned a decade ago. ” McClendon was 56 years old.

In some respects, McClendon follows the tradition of wildcatters like Roy Cullen, H.L. Hunt, and Clint Murchison – taking big risks, re-inventing the industry. In other respects, he was the 21st century energy entrepreneur. He was single-handedly responsible for reviving the natural gas industry in the U.S. and, as reported by Gold, “grievously wounding” the U.S. coal industry. He did not invent hydraulic fracturing, but he used it to reinvigorate the oil and gas industry in the U.S.

McClendon was forced out of Chesapeake in 2012, after growing the company into the second largest natural gas producer in the U.S. He started his new company, American Energy Partners, and was recently working on a deal to exploit a shale play in Argentina.

Oil Prices, Rig Count and Production Rates

Here’s a great interactive graphic from Bloomberg, “Watch Five Years of Oil Drilling Collapse in Seconds,” that illustrates the relationship between oil price, rig count and U.S. oil production. The U.S. rig count has dropped from a high of 1930 in late 2014 to 502 last month. U.S. crude production continued to climb until mid-2015. Since then, it has dropped from 9.6 mmb/day to 9.2 mmb/day.

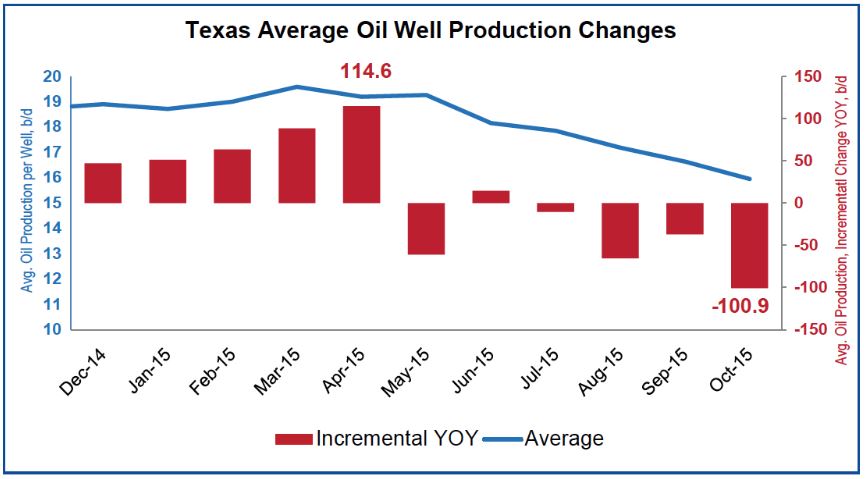

RigData provides another way to look at the market, in Texas (click to enlarge):

It may come as a surprise to some that the average daily oil production per well in Texas is only 16 barrels. There are a lot of wells in Texas that produce a barrel a day or less. The change in average daily oil production per well is a way to gauge the health of the industry. In Mary 2015, Texas average production per well reached a height of 19.6 bbl/day. Between October 2014 and October 2015, Texas oil production declined by 343,00 bbl/day, from 3.3 million to 2.9 million – a decline of 2.2 bbl/day/well.

Division Orders- How Do I Know My Decimal Interest is Right?

So you have received a division order, and it says that ABC Oil Company will pay you for a .015625 royalty interest in the Barn Burner Unit #1 Well. How do you know whether the .015625 interest is correct?

I’ve written previously about the purpose and legal effect of division orders, and you can read that post here. The purpose of a division order is to protect the company paying the royalty (“payor”) from double liability. If you sign a division order and it turns out that you should have been paid a larger interest than shown on the division order, the company is protected as long as it paid according to the division order. If you sign a division order and it turns out that your interest is less than the interest shown on the division order, you are legally obligated to pay back the money that you weren’t entitled to. A payor is legally entitled to require that you sign a division order correctly setting forth your interest as a condition to payment.

To understand division orders, it is helpful to understand how exploration companies handle royalty payments. When a company decides it wants to drill a well in a particular area, it first hires landmen who investigate the mineral title to the tracts in the area where the well will be drilled and identify the mineral owners of those tracts. The company or its landmen then contact those mineral owners and negotiate oil and gas leases covering their interests. Depending on the complexity of the mineral title, there may be dozens or even hundreds of mineral owners from whom oil and gas leases must be obtained. The company may want to acquire leases in a large area around its proposed drillsite, in order to lock up the minerals in that general area so that additional wells can be drilled if the exploratory well is successful. Continue reading →

Denbury Case Returns to Texas Supreme Court

Texas Rice Land Partners v. Denbury is back before the Texas Supreme Court. The case that caused such controversy when originally decided by that court in 2012, involves when a pipeline company can exercise the right of eminent domain to condemn pipeline easements.

Denbury decided to build a pipeline to carry carbon dioxide from Mississippi to the Hastings Field in South Texas, to inject in the field for tertiary recovery. Denbury sought an easement across land owned by Texas Rice Land Partners, but Texas Rice refused. Denbury sought to condemn an easement across the property, but Texas Rice claimed that Denbury did not have authority to condemn an easement. In its first decision in the case, 363 S.W.3d 192 (Tex. 2012), the Texas Supreme Court held that Texas Rice had raised a fact issue as to whether Denbury had authority to condemn, and it remanded the case to the trial court for further proceedings.

Prior to the Denbury decision, pipeline companies routinely asserted the right to condemn by filing a form with the Texas Railroad Commission, form T-4, checking a box to say that the owner of the pipeline to be constructed elected to be a “common carrier” pipeline. A “common carrier” is a pipeline that holds itself out to transport oil, gas, or in Denbury’s case CO2, for others for hire. In the Denbury decision, the Court said that filing this form was not enough to grant condemnation powers:

Oklahoma Shakin’

On Saturday, Oklahoma experienced the third-largest earthquake on record in the state, a 5.1-magnitude quake in northwest Oklahoma. It was felt across Arkansas, Iowa, Kansas, Missouri, Nebraska, New Mexico and Texas, and was followed by 10 smaller quakes ranging from 2.5 to 3.9. In response, the Oklahoma Corporation Commission announced that it would implement a regional plan to address earthquakes in the state, which are linked to the large increase in disposal of produced water. A spokesman for the Commission said that “the plan will involve a large-scale regional reduction in oil and gas wastewater disposal for an approximately 5,000 square mile area in western Oklahoma.” The plan is to be released today. A big loser in the Commission’s plan will likely be Sandridge Energy, a company that has invested heavily in production activities that require disposal of huge volumes of produced water in Oklahoma.

Earthquakes have also been linked to wastewater disposal operations in North Texas, and the Texas legislature last year funded a study now being conducted under the supervision of the University of Texas Bureau of Economic Geology to investigate the causal link between increased seismic activity and wastewater disposal in North Texas. Although the Texas Railroad Commission hired its own seismologist last year, the RRC has so far refused to admit any connection between quakes and disposal operations in Texas. After a study led by scientists at Southern Methodist University linked quakes near Azle, Texas to two disposal wells nearby, the RRC called two “show cause” hearings to require the companies operating those wells to show cause why their disposal operations should not be halted or curtailed; after those hearings, the RRC held that the companies had proven that there was no causal link between the disposal wells and the earthquakes, despite the SMU study.

At a recent forum of Republican candidates for the open RRC seat, no candidate was willing to admit any causal link between recent quakes in the DFW region and increased wastewater disposal activities in that area.

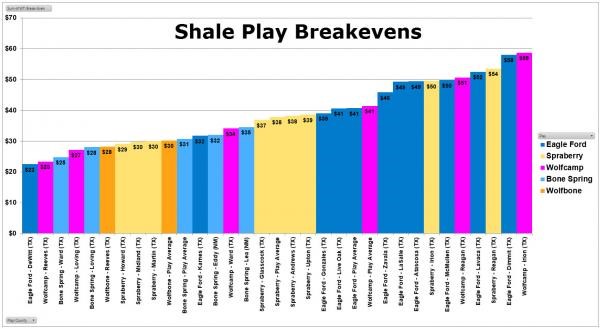

Bloomberg Estimates of Breakeven Prices in Shale Plays

Bloomberg’s estimates of the oil price necessary to recover drilling, completion and operating costs in various shale plays (click to enlarge):

The winners: DeWitt County in the Eagle Ford Shale, $23/bbl, the Wolfcamp in Reeves County, $24/bbl, and the Bone Spring in Ward County, $25/bbl. Except for DeWitt County, all breakeven prices below $30/bbl are in the Permian Basin.

Republican RRC Candidates Forum at Texas Tribune

Republican candidates for the open seat on the Texas Railroad Commission were interviewed by Evan Smith of the Texas Tribune in an open forum yesterday. They were asked about global warming, earthquakes, the EPA, House Bill 40 and municipal regulation of drilling, Sunset Commission review of the Commission in the upcoming legislative session, and the role of the Commission in both regulating and promoting oil and gas development in the state. You can watch the forum here. The Tribune has apparently decided not to hold a similar forum for the Democratic candidates running for the same seat.

My take:

- With two exceptions, the candidates refused to admit that human activity contributes to global warming, although they did appear to admit that global warming is occurring.