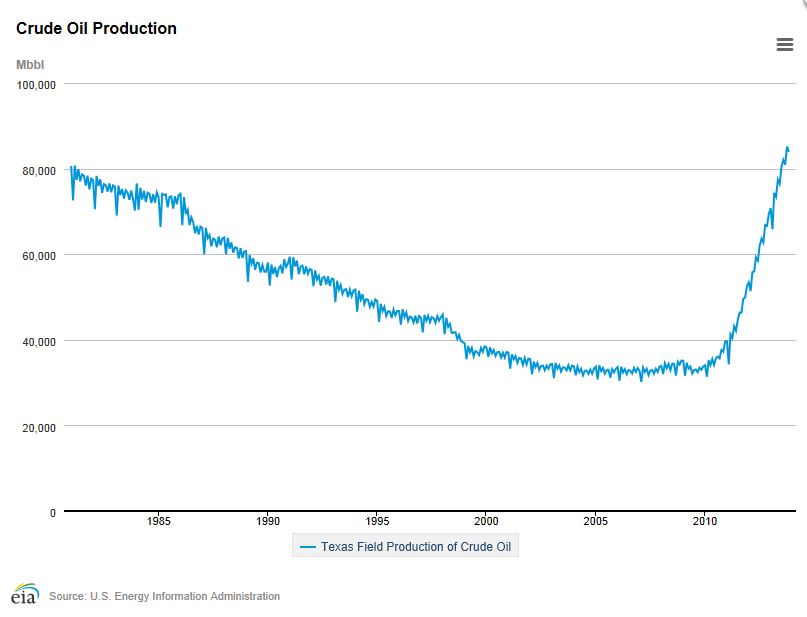

Texas pumped 2.575 million barrels of oil per day in June, exceeding Iran’s production of 2.56 million barrels/day. Texas now ranks ahead of seven members of OPEC in oil production.

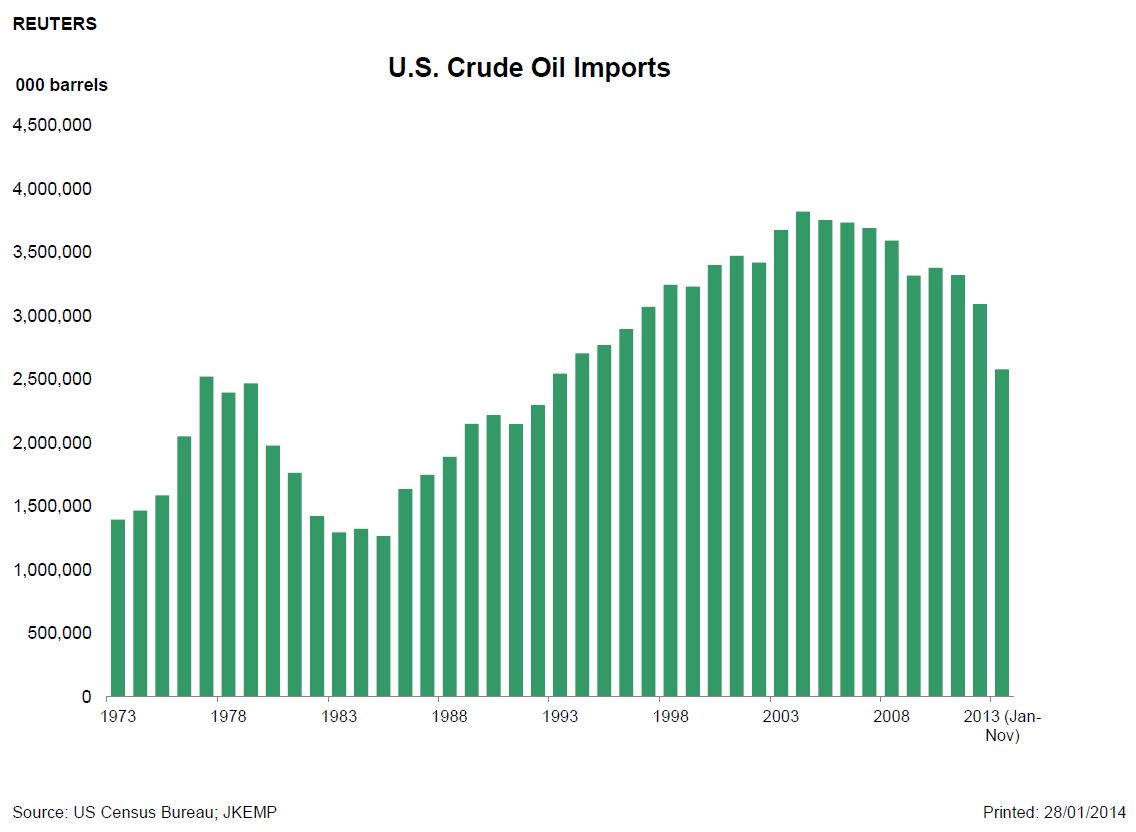

The U.S. is now the world’s largest exporter of refined fuels, including gasoline and diesel. The U.S. met 87 percent of its energy needs in the first five months of 2013. This is expected to be the highest annual rate since 1986. Net imports of oil and petroleum products will fall to 5.4 million barrels a day by 2014, down from 12.5 million in 2005, according to the Energy Information Administration. It is expected that the U.S. will pump 7.75 million barrels/day by the end of the year. West Texas Intermediate’s price is now above $107/bbl.

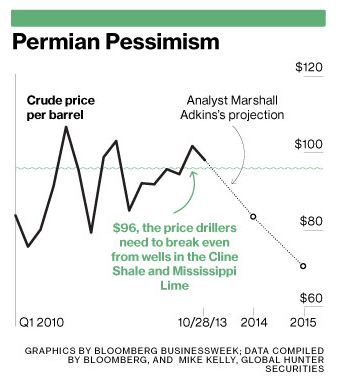

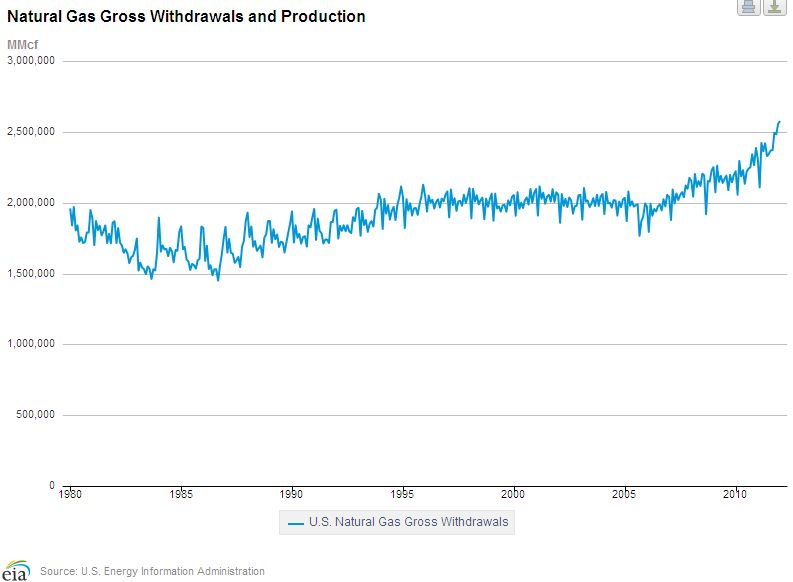

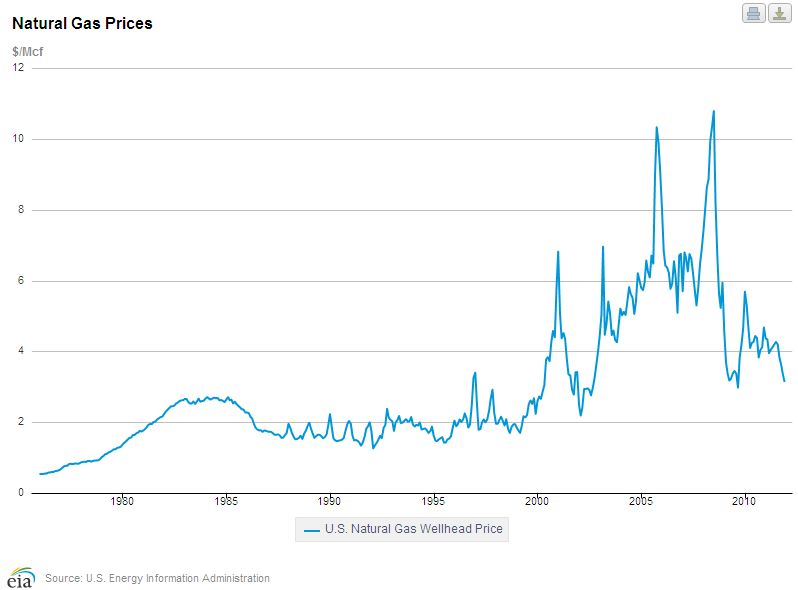

Meanwhile, the Houston Chronicle reported that a “growing number of experts” are now saying that the increased production of oil will result in a significant decline in prices. Amy Myers Jaffe, executive director for energy and sustainability at the University of California at Davis, recently wrote that “The most likely scenario – absent war – is for oil prices to decline significantly.” She sees a repeat of the decline in oil prices from the 1980s. If you superimpose a curve of oil prices from the 1980s over today’s price curve, “we’re already on the other side of the hump,” said Jaffe. The decline will be a result of rising supplies and falling fuel demand, exacerbated by higher fuel prices, less driving, less demand from emerging nations like China, the rising dollar, replacement of oil with cheaper natural gas, and OPEC’s inability to cut production enough to prop up prices. “Don’t lose sight of the fact that [oil prices are] a cycle. We get in this mania that whatever the price is it’s going to be that forever.”

Oil and Gas Lawyer Blog

Oil and Gas Lawyer Blog