Articles Posted in Energy markets

OPEC and Crude

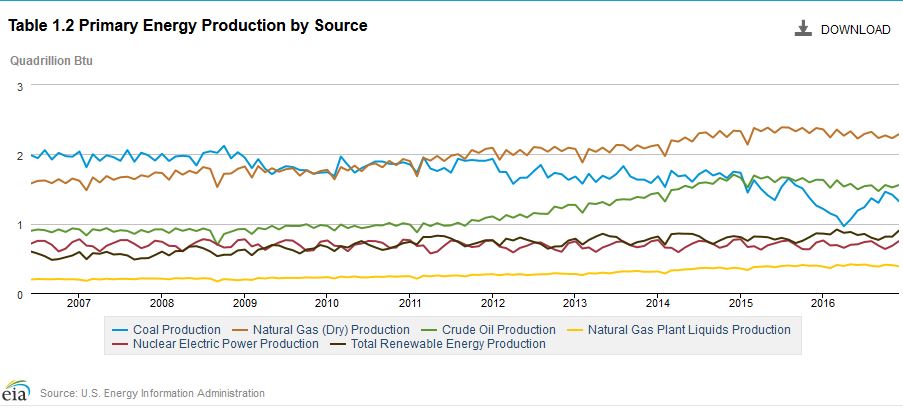

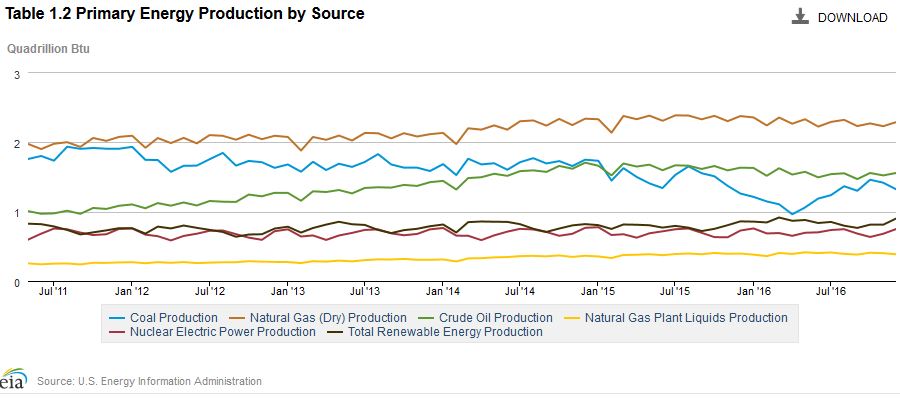

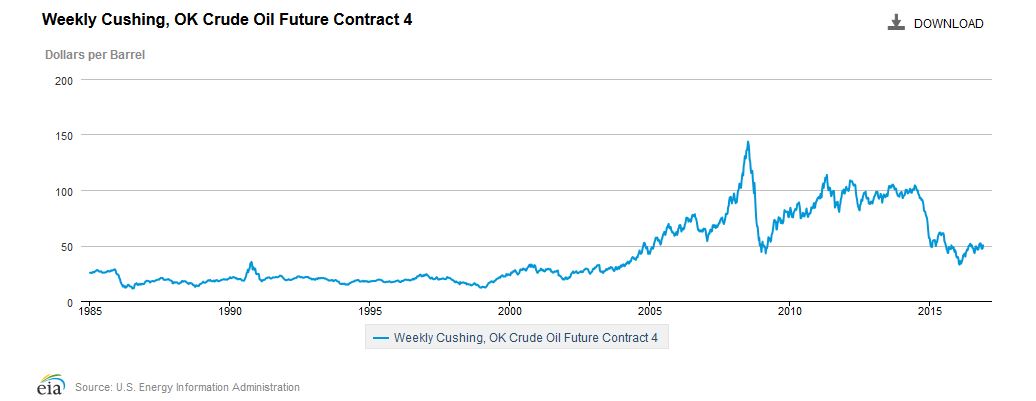

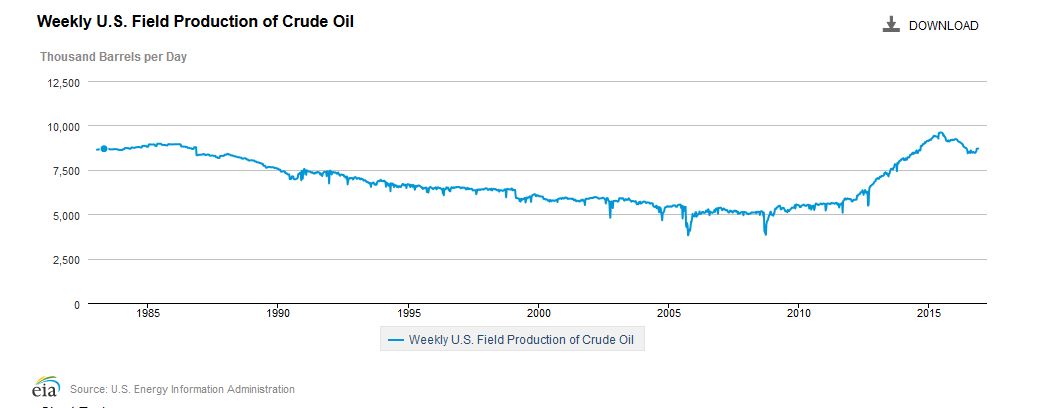

With OPEC’s announced reduction in crude production, it might be good to take the long view. Below is chart of crude prices since 1985. The period between 2005 and today has seen a revival of the US oil industry. Companies have now bet that they can make money at $50/bbl, at least in the Permian. While significant, OPEC’s announced reduction (1) has not yet been realized and (2) is a small percentage of total world oil production. If drilling rigs return to the field in the numbers present in 2008-2014, Opec’s reduction can easily be made up by increased production from US fields. (click on charts to enlarge)

Energynet – a Dotcom Success in the Oil and Gas Sector

One of the speakers at our firm’s recent oil and gas seminar for land and mineral owners was Chris Atherton, President of EnergyNet, Inc. EnergyNet is an online auction site for oil and gas assets- mineral and leasehold interests. It now controls 75% of the online auction business for oil and gas assets in the U.S.; so far in 2016, it has sold 354 asset packages for $155 million. It makes its money by taking a commission on each sale. Properties are sold both in online auctions and in sealed-bid sales.

Recently, the Texas General Land Office began using EnergyNet for its auctions of oil and gas leases on state lands. It also auctions leases for Colorado, North Dakota, Utah and Wyoming, and it has recently signed up the Bureau of Land Management to conduct lease sales. An example of an EnergyNet offer for lease of a state tract in Loving County, Texas can be viewed here.

One of EnergyNet’s first big deals was sale of a package of 220,000 net mineral acres owned by Chevron in 2003, in dozens of counties in multiple estates. Chevron wanted at least $80 million. By breaking the assets down into smaller parcels, EnergyNet sold them for $120 million.

Oil Prices, Rig Count and Production Rates

Here’s a great interactive graphic from Bloomberg, “Watch Five Years of Oil Drilling Collapse in Seconds,” that illustrates the relationship between oil price, rig count and U.S. oil production. The U.S. rig count has dropped from a high of 1930 in late 2014 to 502 last month. U.S. crude production continued to climb until mid-2015. Since then, it has dropped from 9.6 mmb/day to 9.2 mmb/day.

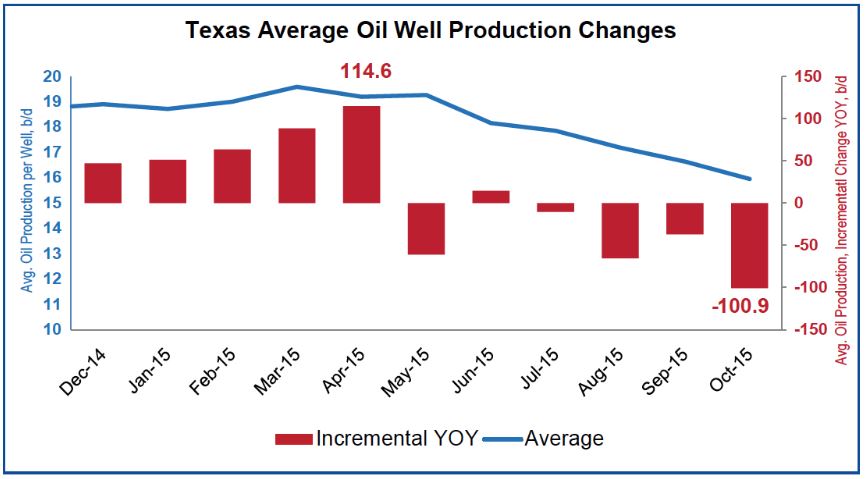

RigData provides another way to look at the market, in Texas (click to enlarge):

It may come as a surprise to some that the average daily oil production per well in Texas is only 16 barrels. There are a lot of wells in Texas that produce a barrel a day or less. The change in average daily oil production per well is a way to gauge the health of the industry. In Mary 2015, Texas average production per well reached a height of 19.6 bbl/day. Between October 2014 and October 2015, Texas oil production declined by 343,00 bbl/day, from 3.3 million to 2.9 million – a decline of 2.2 bbl/day/well.

Oil at $1.50 a Barrel?

Flint Hills Resources, LLC, a refiner owned by Charles and David Koch, offered to pay $1.50/bbl for North Dakota Sour crude, from the Bakken shale. Flint Hills originally posted a price of -$0.50/bbl (that’s right, minus fifty cents) for the sour crude, but later said that was a mistake and corrected the posting to $1.50. There is a lack of pipeline capacity for this ultra-low quality crude.

Plains All American, another oil buyer, offered $13.25/bbl for South Texas Sour and $13.50 for Oklahoma Sour.

West Texas Intermediate futures traded as low as $28.36/bbl in New York, and Brent Crude futures settled at $28.55/bbl in London.

EIA Financial Review of 97 Global E&P Companies

EIA issued its 2nd quarter financial review of the E&P industry, found here. Highlights:

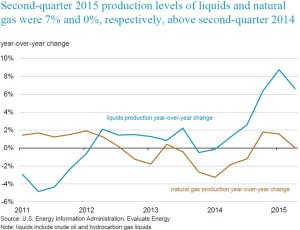

Production is declining for the first time since the beginning of 2014 (click to enlarge).

States’ Reliance on Severance Tax and Oil Price Decline

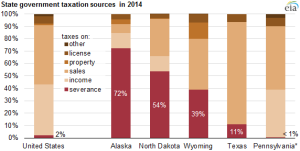

Last week, the US Energy Information Administration provided a summary of states’ severance tax revenue (click on image below to enlarge):

With the precipitous decline in oil prices, Alaska, North Dakota and Wyoming will be hurting.

According to EIA, Texas

Backlog of Drilled but Uncompleted Wells Skyrockets

This graphic from Bloomberg article, US Fracklog Triples as Drillers Keep Oil from Market (click to enlarge):

Bloomberg says that these uncompleted wells, if completed (that is, hydraulically fractured), would produce 322,000 bbls/day, equivalent to the current production of Libya. Total drilled but uncompleted wells, according to Bloomberg: 4,731.

The Economist – “Let There Be Light”

In a special section of the January 17 edition of The Economist, Edward Lucas gives a broad overview of the world energy outlook and the future for renewable energy. His is an optimistic forecast for cleaner, cheaper and more plentiful energy. His article can be found online here.

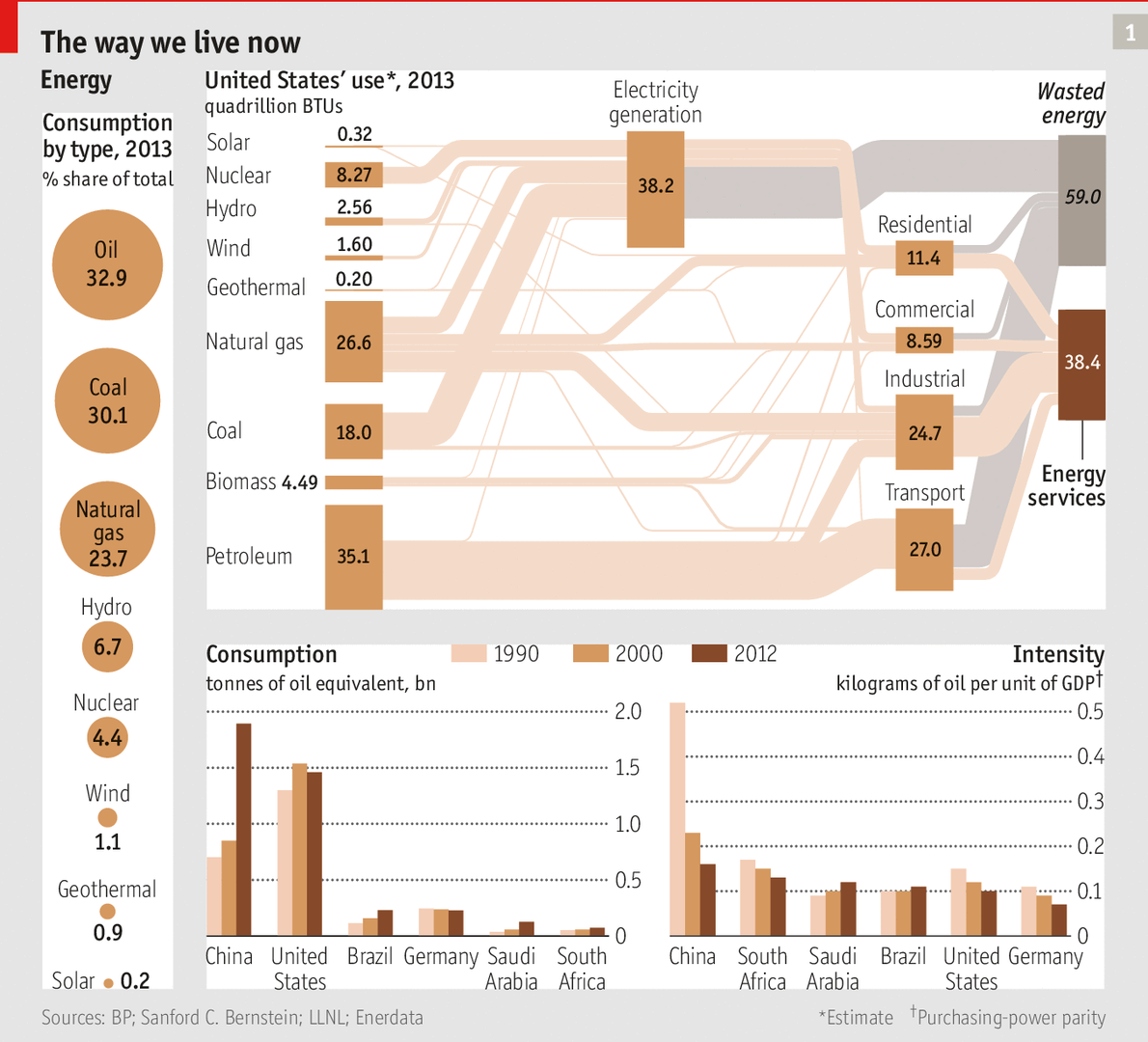

First, the article provides this view of current world energy production and consumption:

This picture doesn’t present a very optimistic view. Almost 60% of energy production is “wasted energy.” Oil still provides 33% of all energy consumed, while wind supplies only 1.1%, and solar only 0.2%. And the EIA projects that global demand for energy will increase by 37% in the next 25 years.

This picture doesn’t present a very optimistic view. Almost 60% of energy production is “wasted energy.” Oil still provides 33% of all energy consumed, while wind supplies only 1.1%, and solar only 0.2%. And the EIA projects that global demand for energy will increase by 37% in the next 25 years.

The Fall in Oil Prices

The news is filled with stories predicting the effect of falling oil prices on US production. Good news for the economy, bad news for the Texas oil and gas industry. Will the rig count fall? Will companies go into bankruptcy? Only time will tell.

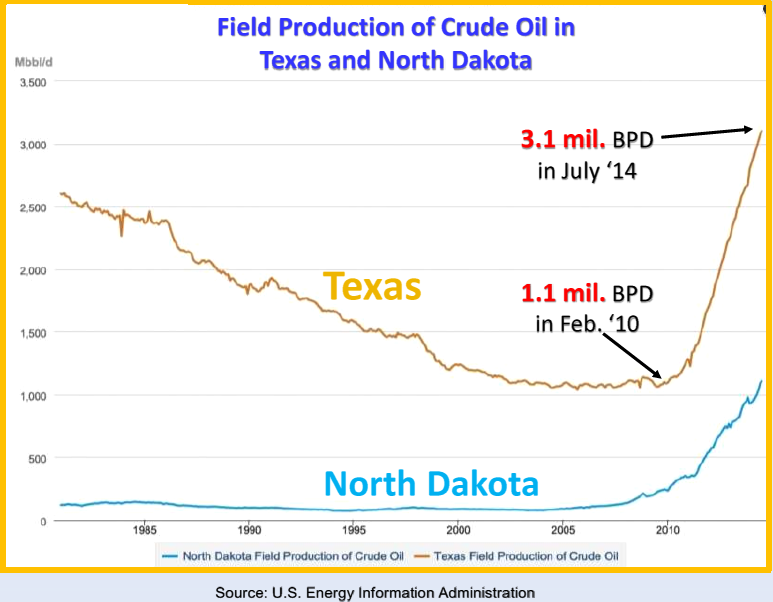

The answer may depend on OPEC. OPEC countries produce about one-third of the world’s total oil each month. OPEC countries have about 80 percent of the world’s oil reserves. Predictions of OPEC’s demise are greatly exaggerated. But US production has increased to almost 9 million barrels a day, close to Saudi Arabia’s production. Texas is responsible for a big part of that increase:

Clearly the increased US production, combined with the predictable decline in demand and the slowdown of China’s and Europe’s economies, is affecting the world oil price. OPEC convenes on November 27, and pundits are guessing what it will do. On October 29, OPEC’s Secretary-General Abdalla El-Badri, cautioned calm, after a conference in London: “We don’t see really fundamental changes in the supply side or the demand side. Unfortunately everyone is panicking. The press is panicking, consumers are panicking. We really should think and see how this will develop.”

Oil and Gas Lawyer Blog

Oil and Gas Lawyer Blog