Here is link to an excellent publication by Tiffany Dowell Lashmet, Assistant Professor and Extension Specialist at Texas A&M AgriLife Extension. Print it out and save it.

Sundown Energy v. HJSA No. 3 Limited Partnership: Another Poorly Drafted Retained Acreage Clause

Last week the Texas Supreme Court issued a per curiam opinion, without oral argument, reversing the judgment of the El Paso Court of Appeals in Sundown Energy LP v. HJSA No. 3 Limited Partnership, No. 19-10654. The lease at issue covers 30,450 acres in Ward County. The case is another illustration of how parties fail to clearly express their intent in drafting retained acreage clauses.

The lease provides that, after the end of its six-year primary term, the lessee must release acreage not held by production unless the lessee was engaged in a “continuous drilling program:”

The obligation . . . to reassign tracts not held by production shall be delayed for so long as Lessee is engaged in a continuous drilling program on that part of the Leased Premises outside of the Producing Areas. The first such continuous development well shall be spudded-in on or before the sixth anniversary of the Effective Date, with no more than 120 days to elapse between completion or abandonment of operations on one well and commencement of drilling operations on the next ensuing well.

Warren Buffett group lobbying Texas lawmakers for deal to build $8 billion worth of power plants for emergency use (from Texas Tribune)

The following article appeared today in The Texas Tribune:

Cassandra Pollock

The Texas Tribune Thu, 25 Mar 2021 13:01:53 -0500

BlueStone v. Randle — A Win for Royalty Owners on Post-Production Costs

On March 12 the Texas Supreme Court issued its opinion in BlueStone Natural Resources II, LLC v. Walker Murray Randle, No. 19-0459, affirming most of the judgment of the court below in favor of the royalty owners. The Court’s opinion contains a summary and discussion of its prior cases on post-production costs and attempts to reconcile those prior opinions and clarify its views on the issue. I believe the opinion does provide clarification and substantially reduces the precedential value of its first case addressing post-production costs, Heritage v. Nationsbank. The Court also discusses when royalties must be paid on gas used as fuel. Because I consider this an important case on post-production costs, I will examine the opinion in some detail. Continue reading →

On March 12 the Texas Supreme Court issued its opinion in BlueStone Natural Resources II, LLC v. Walker Murray Randle, No. 19-0459, affirming most of the judgment of the court below in favor of the royalty owners. The Court’s opinion contains a summary and discussion of its prior cases on post-production costs and attempts to reconcile those prior opinions and clarify its views on the issue. I believe the opinion does provide clarification and substantially reduces the precedential value of its first case addressing post-production costs, Heritage v. Nationsbank. The Court also discusses when royalties must be paid on gas used as fuel. Because I consider this an important case on post-production costs, I will examine the opinion in some detail. Continue reading →

Endeavor v. Energen: What does a court do if a lease retained acreage clause is ambiguous?

A colleague recently pointed out to me that I had miss-read the Texas Supreme Court’s recent opinion in Endeavor Energy Resources v. Energen Resources Corporation. In my previous post on the case I said that the Court had concluded that the retained acreage clause being construed was ambiguous and had remanded the case for a trial on the meaning of the clause. Instead, the Court concluded that, because the clause was ambiguous, it should be construed in favor of the lessee, Endeavor.

The retained acreage clause in Endeavor’s lease allowed the lessee to retain all interest in the leased premises if, after the primary term, it drilled a new well every 150 days. The clause also allowed  Endeavor to “accumulate unused days in any 150-day term … in order to extend the next allowed 150-day term between the completion of one well and the drilling of a subsequent well.” If and when the lessee failed to do so, the lease will terminate except as to specified acreage earned by wells then completed and producing. The dispute was over the meaning of the quoted language. Endeavor argued that the language allowed it to carry forward unused days across multiple 150-day terms; or alternatively, Endeavor argued that the language is ambiguous and that “the disputed language may not operate as a special limitation.” The Court concluded that the clause was indeed ambiguous and, because it operates as a “special limitation” on the lessee’s title, it should be construed in favor of the lessee.

Endeavor to “accumulate unused days in any 150-day term … in order to extend the next allowed 150-day term between the completion of one well and the drilling of a subsequent well.” If and when the lessee failed to do so, the lease will terminate except as to specified acreage earned by wells then completed and producing. The dispute was over the meaning of the quoted language. Endeavor argued that the language allowed it to carry forward unused days across multiple 150-day terms; or alternatively, Endeavor argued that the language is ambiguous and that “the disputed language may not operate as a special limitation.” The Court concluded that the clause was indeed ambiguous and, because it operates as a “special limitation” on the lessee’s title, it should be construed in favor of the lessee.

[I]t has long been the rule that contractual language will not be held to automatically terminate the leasehold estate unless that “language … can be given no other reasonable construction than one which works such a result.” Knight, 188 S.W.2d at 566 (citing Decker, 216 S.W. 38). As explained above, the Lease’s description of the drilling schedule required to avoid termination is ambiguous under these circumstances. Courts should not treat an obligation so “lacking in definiteness and certainty as introducing” into a lease a “limitation[] leading to …termination of [a] vested estate[].” W.T. Waggoner Estate, 19 S.W.2d at 31. Because the disputed provision is ambiguous, it cannot operate as a special limitation under these circumstances.

In other words, the tie goes to the lessee. Continue reading →

What Happened to the Texas Electric Grid?

Here is an excellent article in which engineers discuss the crisis that almost shut down Texas’ electric grid: Texas Electricity Crisis: Engineers Explain What Went Wrong.

Due Process and the No-Extrinsic-Evidence Rule: Challenges to Default Judgments When Service Was By Publication

Governmental entities in Texas like school districts, municipalities, hospital districts, and counties rely heavily on property taxes to finance their operations. Mineral interests are real property interests, and when a producing well is drilled the owners of rights to production from the well, both the working interest and the royalty owners, are subject to being levied a property tax on the value of their interests. When those property taxes are not paid, the taxing districts can file suit to foreclose their tax lien securing payment of the tax.

It has become the practice of some taxing districts to hire private law firms to file tax suits to collect taxes. Multiple small delinquent tax accounts are combined into one suit. The attorneys handling the case charge a flat fee per account to handle the matter and are responsible for trying to locate and serve the defendants with the lawsuit. In many cases, the delinquent taxes go back years and the taxing authorities have no current address for the royalty owners. So many named defendants are served by publication notice in a local newspaper or posting notice at the county courthouse. If the defendants do not answer, a default judgment is entered and the sheriff of the county is ordered to sell the royalty interests at a public sale.

Mitchell v. Map Resources, Inc. involves such a delinquent tax sale. In 1998, the Pecos-Barstow-Toyah Independent School District and the Reeves County Hospital District filed suit to foreclose  tax liens against a some 673 defendants for delinquent taxes on royalty interests. One of the named defendants was Elizabeth Mitchell. The taxing authorities’ lawyers filed an affidavit seeking the court’s permission to serve the named defendants by posting, saying that each defendants is “either nonresident(s) of the State of Texas, absent from the state or transient,” and that “the names or residences of the owner or owners of the land or lots involved in said suit … are unknown and cannot be ascertained after diligent inquiry ….” Based on that affidavit, the court authorized service of the suit on the defendants by posting notice of the suit at the Reeves County courthouse. The court appointed an attorney ad litem to represent the defendants served by posting who had not appeared or answered. Continue reading →

tax liens against a some 673 defendants for delinquent taxes on royalty interests. One of the named defendants was Elizabeth Mitchell. The taxing authorities’ lawyers filed an affidavit seeking the court’s permission to serve the named defendants by posting, saying that each defendants is “either nonresident(s) of the State of Texas, absent from the state or transient,” and that “the names or residences of the owner or owners of the land or lots involved in said suit … are unknown and cannot be ascertained after diligent inquiry ….” Based on that affidavit, the court authorized service of the suit on the defendants by posting notice of the suit at the Reeves County courthouse. The court appointed an attorney ad litem to represent the defendants served by posting who had not appeared or answered. Continue reading →

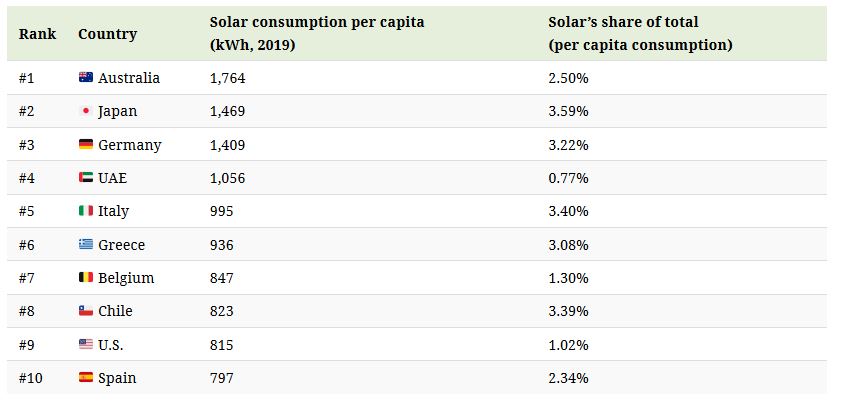

Solar Consumption per Capita by Country

This is from Visual Capitalist (click on image to enlarge):

Toxic substance or water supply? Lawmakers to weigh whether wastewater from oil fields could replenish the state’s aquifers

Article from Texas Tribune, by Erin Douglas, republished with permission:

Deep underneath the ground, fluids travel down and shoot through ancient shale formations, fracturing rock and starting the flow of oil — the essential part of hydraulic fracturing technology that’s transformed America’s oil industry.

But that’s not all that comes up out of the earth.

Salty, contaminated water — held in porous rocks formed hundreds of millions of years ago — is also drawn to the surface during oil production. Before an oil price war and the coronavirus pandemic caused prices to crash in March, Texas wells were producing more than 26 million barrels of the ancient and contaminated water a day, according to an analysis by S&P Global Platts.

In the oil patch, figuring out how to dispose of this water “is something that only gets worse,” said Rene Santos, an energy analyst for S&P Global Platts. “Every time (companies) produce, they have to do something with the water.”

Usually, it’s later injected back underground, into separate wells — a practice that has been linked to increased seismic activity. Sometimes it’s reused in another fracking well. But a new U.S. Environmental Protection Agency decision allowing Texas to regulate the discharge of the water after it’s treated could be a first step toward new uses of the water — at least that’s what some Texas lawmakers and oil and gas producers hope. Continue reading →