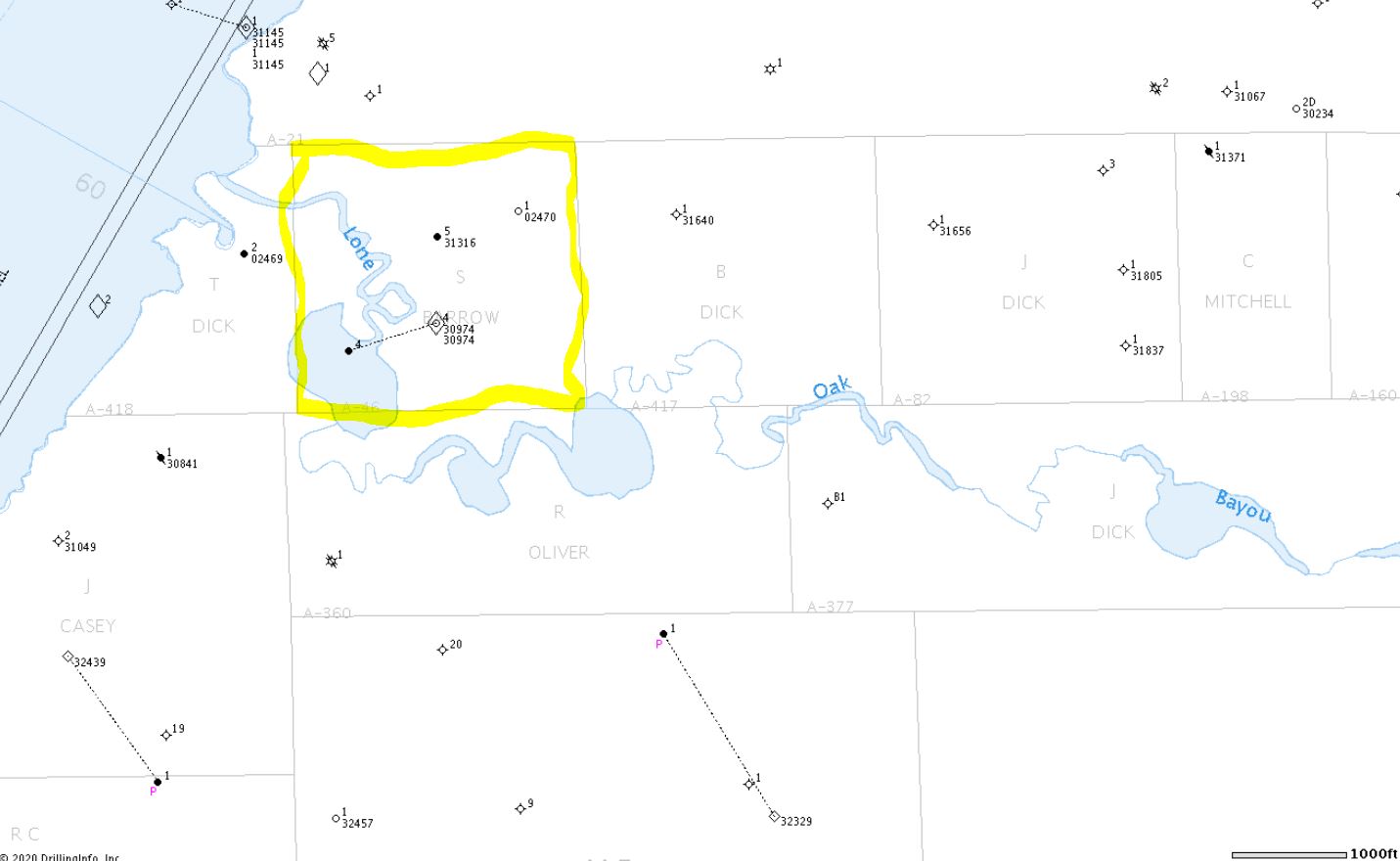

Lone Oak Club, a hunting and fishing club, owns a tract of land in Galveston County near Galveston Bay, through which runs Lone Oak Bayou:

Members of the public boat up into Lone Oak Bayou and sometimes wade and fish or hunt in its shallow waters. Lone Oak complained about this activity and asserted that it owns the bed of Lone Oak Bayou and that members are trespassing when they set foot on the bayou’s bed. The Club agrees that the public has the right to boat on the public waters of the bayou, but when the fisherman or hunter steps out of his boat, they claimed trespass. The Texas General Land Office disagreed. It said the State owns the bed of Lone Oak Bayou adjacent to the Club’s land because the bayou is influenced by tides from the bay and is below the line of mean high tide, and the State owns all submerged lands within tidewater limits. So the Club sued George P. Bush, Commissioner of the Land Office, to establish its title to the bed of the bayou within the boundaries of its 160 acres.

Members of the public boat up into Lone Oak Bayou and sometimes wade and fish or hunt in its shallow waters. Lone Oak complained about this activity and asserted that it owns the bed of Lone Oak Bayou and that members are trespassing when they set foot on the bayou’s bed. The Club agrees that the public has the right to boat on the public waters of the bayou, but when the fisherman or hunter steps out of his boat, they claimed trespass. The Texas General Land Office disagreed. It said the State owns the bed of Lone Oak Bayou adjacent to the Club’s land because the bayou is influenced by tides from the bay and is below the line of mean high tide, and the State owns all submerged lands within tidewater limits. So the Club sued George P. Bush, Commissioner of the Land Office, to establish its title to the bed of the bayou within the boundaries of its 160 acres.

Nature sometimes does not cooperate with the laws created by humans to establish the boundary between the land and water. In Texas especially these laws, mostly created by courts, can sometimes be confusing and complex. Water boundaries shift with the rise and fall of tides, erosion and evulsion, and changes in watercourses. I learned this when I was asked, in my first year of law practice many years ago, to summarize Texas laws regarding land boundaries and rights of public access for a client who owned land along the coast. Continue reading →