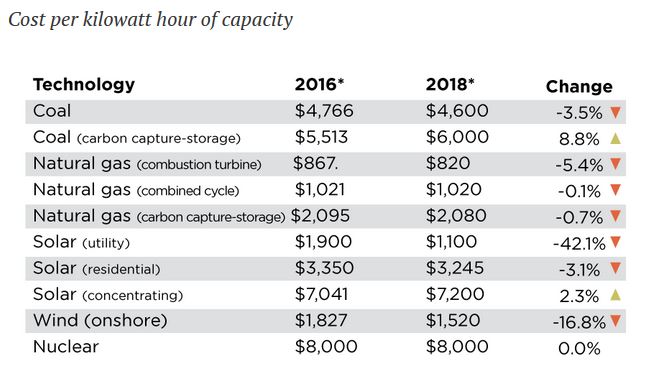

A Tsunami of Crude Exports?

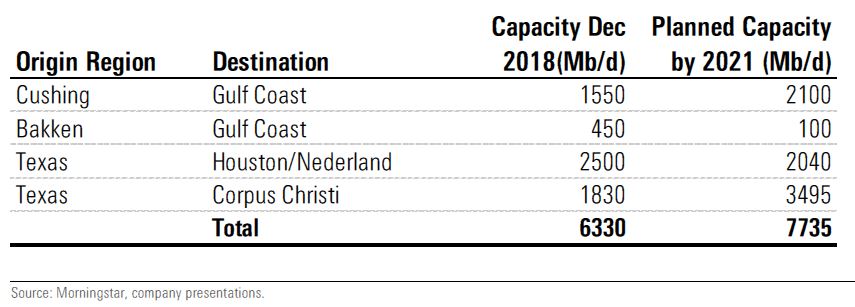

Morningstar has published a report analyzing oil pipeline and refining capacities along the Texas Gulf Coast – “Pipeline Plans Suggest Tsunami of Crude Exports – Midstream companies looking to double Gulf Coast shipments.” pipeline-plans-suggest-tsunami-of-crude-exports-FINAL If all planned pipelines are built and run to capacity, new lines “would carry as much as 7.7 mmb/d of new crude to the Gulf Coast, the majority of which would be light shale crude looking for a home in the export market.”

The result: a fourfold increase in crude exports to more than 8 mmb/d after 2021. Morningstar concludes:

The result: a fourfold increase in crude exports to more than 8 mmb/d after 2021. Morningstar concludes:

Fortunately, current production forecasts don’t match the volume of pipeline projects, and crude growth over the next three years is likely to be closer to 3 mmb/d. The mismatch suggests an infrastructure overbuild is underway in the short term, and we expect consolidation of many of these projects before they’re built. Yet the history of shale expansion has taught us that the most optimistic forecasts frequently appear in the rearview mirror.

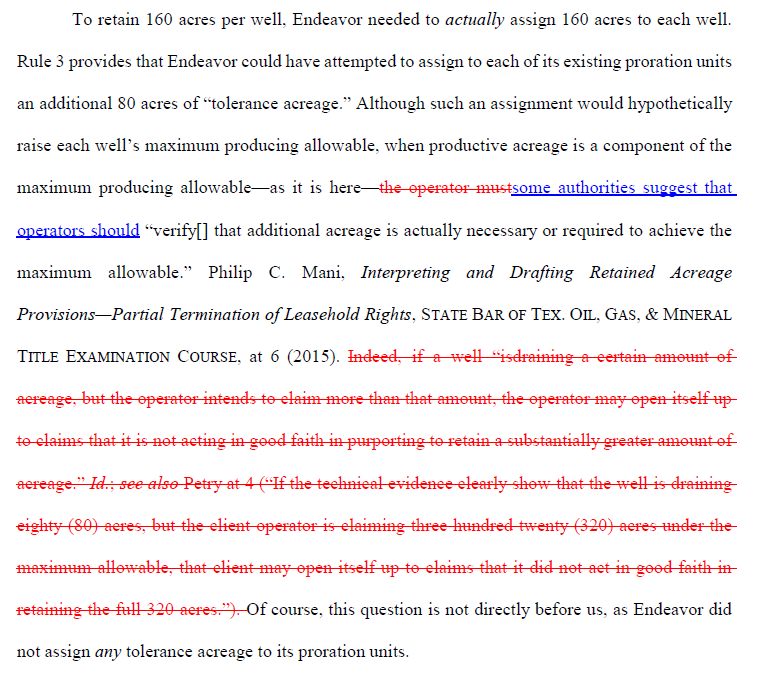

Endeavor v. Discovery Operating on rehearing

Last April the Texas Supreme Court issued its opinion in Endeavor Energy Resources, L.P. et al. v. Discovery Operating, Inc., et al., No. 16-0155, construing a retained acreage clause in an oil and gas lease. I commented that the opinion commented in dicta that, even if a lease allows the lessee to retain “tolerance acreage” as allowed by applicable field rules, the operator must “verify that additional acreage is actually necessary or required to achieve the maximum allowable,” quoting from a 2015 CLE paper by Phillip C. Mani. On rehearing, the Court revised the language I quoted, so that it now reads as follows (click to enlarge):

So the court watered down its language somewhat. The issue nevertheless remains an open one.

So the court watered down its language somewhat. The issue nevertheless remains an open one.

Takeaway Capacity in the Permian and Reflections on Judicial Elections in light of Murphy v. Adams

Wade Caldwell, San Antonio attorney and President of NARO-Texas, published the article below in the recent NARO newsletter. He has kindly allowed me to republish it here.

And Happy New Year.

The Take Away

9th Circuit Court of Appeals holds that dinosaur fossils are “minerals” under Montana law

In Murray v. BEJ Minerals, LLC, No. 1:14-cv-00106-SPW, a panel of the US 9th Circuit Court of Appeals ruled on a fight over fossils of two “dueling dinosaurs”, a 22-foot-long theropod and a 28-foot-long ceratopsian, “engaged in mortal combat” when “entombed under a pile of sandstone.”

The surface owner and mineral owners then became involved in a fight over the ownership of these fossils, as well as several other fossils (including a nearly intact Tyrannosaurus Rex skeleton) found on the property. Pointing out that “oil, gas and coal all derive from the remains of plants and animals,” the mineral owner argued that the fossils are “minerals.” The court agreed with the mineral owner, citing a Montana Supreme Court case, Farley v. Booth Brothers Land & Livestock Co.,, 890 P. 2d 377, 379 (Mont. 1995), which in turn adopted a definition from a Texas Supreme Court Case, Heinatz v. Allen, 217 S.W.2d 994 (Tex. 1949):

[S]ubstances such as sand, gravel and limestone are not minerals within the ordinary and natural meaning of the word unless they are rare and exceptional in character or possess a peculiar property giving them special value, as for example sand that is valuable for making glass and limestone of such quality that it may be profitably manufactured into cement. Such substances, when they are useful only for building and road-making purposes, are not regarded as minerals in the ordinary and generally accepted meaning of the word.

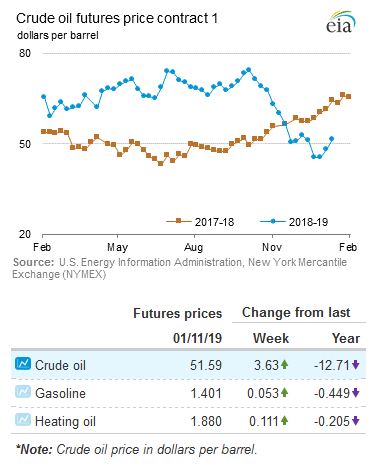

The cost of electricity

From an article in the Dallas Morning News, “Texas power costs: What’s the cheapest way to generate electricity?”

Miller on Negotiating Oil and Gas Leases

My partner Nicholas Miller recently appeared on Tiffany Dowell’s podcast “Ag Law in the Field,” one of the programs offered by Texas A&M Agrilife Extension Service. A great discussion on how to approach negotiating an oil and gas lease. You can listen to it here.

Check out Tiffany’s other podcasts here.

Murphy v. Adams – What is an “offset well”?

The Texas Supreme Court denied the landowners’ motion for rehearing last Friday in Murphy v. Adams, rejecting their claim that Murphy Exploration had breached their oil and gas lease by failing to drill an offset well or pay liquidated damages. The Court was divided 5-4 on the issue when it issued its original opinion, and the court remained divided 5-4 on rehearing, but both the majority and the dissent issued corrected opinions.

Our firm represented the landowners in the case, so I must admit that it is difficult for me to be objective in reporting on this case. I wrote about the case when the Court of Appeals ruled in favor of the landowners, reversing a summary judgment in Murphy’s favor issued by the trial court.

The landowners’ lease contains the following provision:

It is hereby specifically agreed and stipulated that in the event a well is completed as a producer of oil and/or gas on land adjacent and contiguous to the leased premises, and within 467 feet of the premises covered by this lease, that Lessee herein is hereby obligated to, within 120 days after the completion date of the well or wells on the adjacent acreage, as follows:

(1) to commence drilling operations on the leased acreage and thereafter continue the drilling of such off-set well or wells with due diligence to a depth adequate to test the same formation from which the well or wells are producing from on the adjacent acreage; or

(2) pay the Lessor royalties as provided for in this lease as if an equivalent amount of production of oil and/or gas were being obtained from the off-set location on these leased premises as that which is being produced from the adjacent well or wells; or

(3) release an amount of acreage sufficient to constitute a spacing unit equivalent in size to the spacing unit that would be allocated under the lease to such well or wells on the adjacent lands, as to the zones or strata producing in such adjacent well.

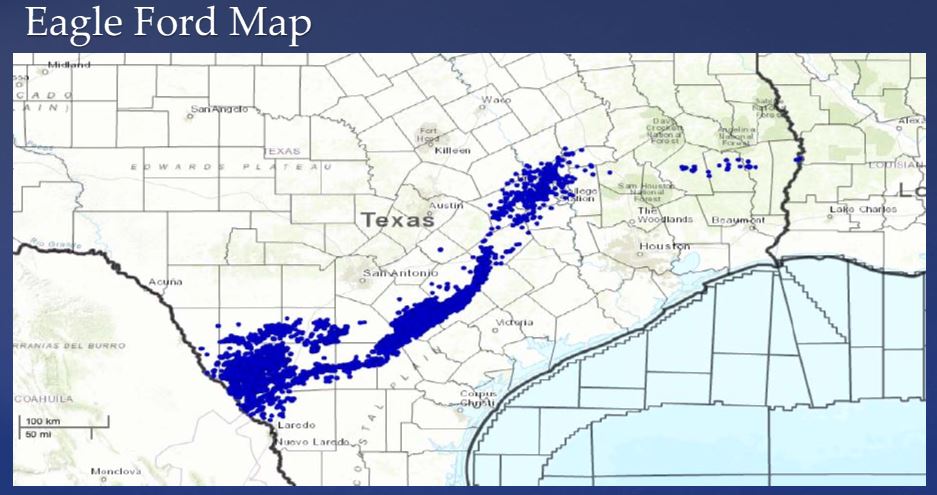

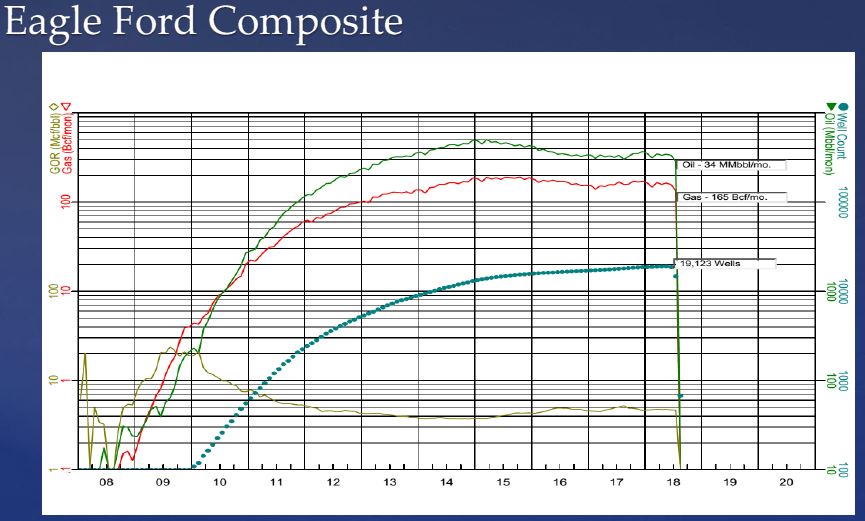

Huddleston on Shale Plays in Texas

Peter Huddleston, President of Huddleston & Co. and a prominent petroleum engineer and a friend, agreed to report on the status of shale plays in Texas at our firm’s land and mineral owner seminar on November 9. He kindly agreed to let me use some of his slides. You can click on all images below to enlarge.

Peter’s presentation concentrated on developments in the Eagle Ford and the Permian Basin, by far the sources of most drilling in Texas today.

The map below shows the extent of the Eagle Ford formation.

Below graph shows cumulative Eagle Ford production to date, and number of wells producing.

Vote for Me!

My blog has been nominated in The Expert Institute’s 2018 Best Legal Blog Contest! I’m in the category “Niche & Specialty.” And I have one vote already! So vote early and often.