If you’d like to know when there has been a new post on this blog but you don’t want to keep going back to see if there have been any updates, you can subscribe to my blog. There is a link to the right, “how to subscribe to RSS feeds.” Click on that and it will tell you how. Also, I always post on LinkedIn and Twitter when I post a new blog, you can follow me there.

Can a Gathering Agreement Survive the Bankruptcy of the Producer?

The oil and gas industry is at the beginning of a significant downturn. Oil and gas prices are down, supply is up, demand is flat. Another in the never-ending cycle of a boom-and-bust industry, now exacerbated by appearance of a potential coronavirus world epidemic and a sharp reduction in demand for hydrocarbons in China.

As in the past, a downturn in the industry results in a rise in bankruptcies, and this downturn is no exception. Two recent bankruptcy cases illustrate a new wrinkle in disputes arising from failed companies: Monarch Midstream, LLC v. Badlands Production Co., 608 B.R. 854 (Bkrtcy.D.Colo. 2019), and Alta Mesa Holdings, LP v. Kingfisher Midstream, LLC, 2019 WL 7580122 (Bkrtcy.S.D.Tex. Dec. 20, 2019). Continue reading →

ConocoPhillips v. Ramirez – Devise of “all right, title and interest in and to Ranch ‘Las Piedras” did not include decedent’s mineral estate

The Texas Supreme Court issued its opinion in ConocoPhillips Co. v. Ramirez, No. 17-0822, a family dispute over ownership of minerals in 10,058 acres in Zapata County, and ConocoPhillips’ claim to an oil and gas lease covering those minerals.

In 1995, ConocoPhillips bought oil and gas leases from EOG covering 1,058 acres, the Las Piedras Ranch, in Zapata County. At the time there was one producing well on the leases. The minerals belonged to the Ramirez family. One member of that family was Leonor, who died in 1990, owning all of the surface estate and a 1/4 mineral interest in the Ranch. Her will devised to her son Leon Oscar Sr. “all of my right, title and interest in and to Ranch Las Piedras … during term of his natural life,” and on his death “to his children then living in equal shares.” Leon Oscar Sr. signed an oil and gas lease on the Ranch, which was acquired by ConocoPhillips. Continue reading →

Bluestone v. Randle – Another Case to Watch – Post-Production Costs

Last April the Fort Worth Court of Appeals issued its opinion in Bluestone Natural Resources II, LLC v. Randle, No. 02-18-00271-CV, 2019 WL 1716415. The Court decided that, under Randle’s lease, Bluestone could not deduct post-production costs and owed royalty on plant fuel and compressor fuel. Bluestone has petitioned the Supreme Court for review and the Court has asked for briefs on the merits.

Randle’s lease was a printed form with an exhibit. The printed form provided that royalties on gas would be “the market value at the well of one-eighth of the gas so sold or used …” Exhibit A provided that “the language on this Exhibit A supersedes any provisions to the contrary in the printed lease hereof.” One provision in Exhibit A dealt with post-production costs:

Lessee agrees that all royalties accruing under this Lease (including those paid in kind) shall be without deduction, directly or indirectly, for the cost of producing, gathering, storing, separating, treating, dehydrating, compressing, processing, transporting, and otherwise making the oil, gas and other products hereunder ready for sale or use. Lessee agrees to compute and pay royalties on the gross value received, including any reimbursements for severance taxes and production related costs.

Significant Oil & Gas Cases in 2019, and Pending Cases to Watch in 2020

Significant cases on oil and gas issues in 2019:

In Texas Outfitters v. Nicholson, the Texas Supreme Court again addressed the duty of the older of executive rights to minerals owned by another.

In Trial v. Dragon, the Supreme Court delved into the arcane theories of the Duhig rule and estoppel by deed.

End of a Decade: Rise of the Permian

Happy New Year.

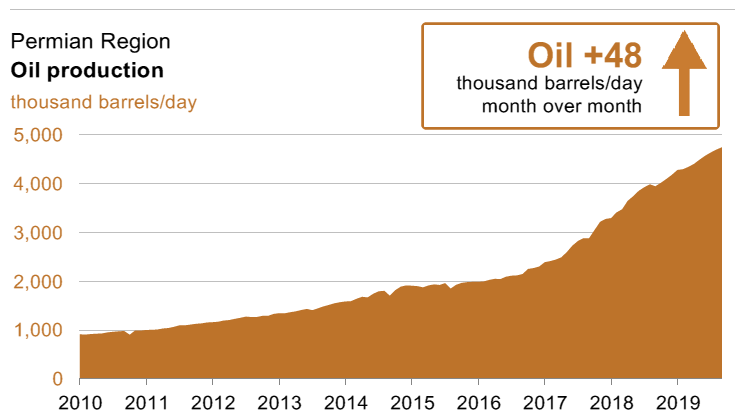

The decade now ending was the decade of the Permian Basin. Its rise in production changed the US to a net oil exporter.

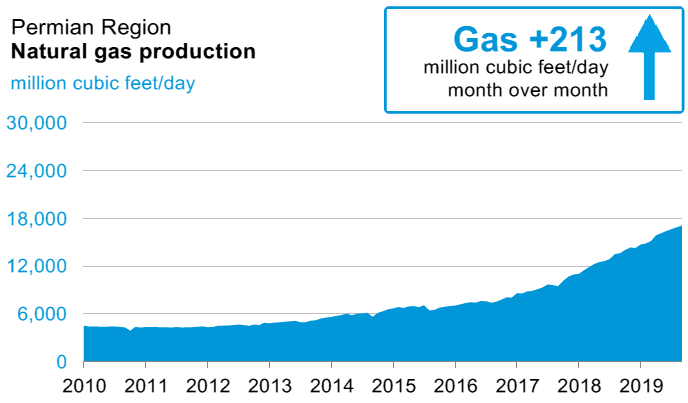

Permian gas production, a byproduct of the search for oil, drove down gas prices and resulted in a frenzied effort to build pipelines to move the gas to the coast.

More Focus on Environmental Consequences of Methane Emissions

The Cynthia and George Mitchell Foundation has funded research resulting in a report, “Emissions in the Stream: Estimating the Greenhouse Gas Impacts of an Oil and Gas Boom,” by to professors at UT Austin. The report focuses on downstream sources of methane emissions, and will be followed by a report examining policy and technology solutions to reduce emissions.

Here’s the abstract of the report:

The Shale Revolution has stimulated a large and rapid buildout of oil and gas infrastructure in the Gulf and Southwest regions of the United States (US), expected to unfold over decades. Therefore, it is critical to develop a clearer understanding of the scale and composition of the likely greenhouse gas (GHG) emissions associated with this activity. We compile a detailed inventory of projected upstream oil and gas production expansions as well as recently and soon-to-be built midstream and downstream facilities within the region. Using data from emissions permits, emissions factors, and facility capacities, we estimate expected GHG emissions at the facility level for facilities that have recently been constructed or are soon to be constructed. Our central estimate suggests that the total annual emissions impact of the regional oil and gas infrastructure buildout may reach 541 million tons of CO2 equivalent (CO2e) by 2030, which is more than 8% of total US GHG emissions in 2017 and roughly equivalent to the emissions of 131 coal-fired power plants. A substantial fraction of the projected emissions come from petrochemical facilities (38%) and liquefied natural gas (LNG) terminals (19%). Researchers have largely focused on upstream emissions such as fugitive methane (CH4) associated with new US production; our findings reveal the potentially greater prominence of midstream and downstream sources in the studied region.

The full report can be found here.

Lyle v. Midway Solar – Solar Farm Meets Accommodation Doctrine

Plaintiffs Kenneth Lyle and Linda Morrison have appealed the dismissal of their suit against Midway Solar to the El Paso Court of Appeals, No. 08-19-00216-CV. Lyle and Morrison own the minerals under 315 acres in Pecos County. Midway Solar has constructed a solar farm on 215 of those acres.

Typically, a solar developer will obtain surface-use waivers from mineral owners before building a facility. Midway did not do that. Instead, it set aside portions of the 315 acres, on the north and south ends of the property, to allow for development of the minerals by directional drilling.

Typically, a solar developer will obtain surface-use waivers from mineral owners before building a facility. Midway did not do that. Instead, it set aside portions of the 315 acres, on the north and south ends of the property, to allow for development of the minerals by directional drilling.

Lyle and Morrison contend their minerals are not susceptible to development by directional or horizontal drilling, because of the subsurface geology. They say 70% of their tract cannot be developed for minerals. Their minerals are not now leased and there are no plans to drill wells. There has been production from wells in the vicinity.

Record Settlement in Citizens’ Suit against Formosa Plastics for Contamination in Texas Waters

The Texas Tribune has published an article describing a remarkable settlement in San Antonio Bay Estuarine Waterkeeper and S. Diane Wilson v. Formosa Plastics Corp, a suit claiming environmental damages for Formosa’s plastics pollution discharges into Lavaca Bay. The judge in the US District Court for the Southern District of Texas, Kenneth Hoyt, approved a $50 million settlement – the largest ever for a citizen’s suit against an industrial polluter under the Clean Air Act and Clean Water Act.

Formosa argued that the $121,875 fine imposed by the Texas Commission on Environmental Quality made the suit moot. In an earlier ruling, Judge Hoyt disagreed, calling the company a “serial offender” and saying that “the TCEQ’s findings and assessment merely shows the difficulty or inability of the TCEQ to bring Formosa into compliance with its permit restrictions.” I cited this case in an earlier post about the inadequacy of Texas agencies’ enforcement of environmental laws and the complexities of administrative enforcement actions.

Diane Wilson, a retired shrimper and environmental activist, was represented by Texas Rio Grande Legal Aid and others. Congratulations to Ms. Wilson.

The Economics of Flaring

Rice University’s Baker Institute for Public Policy recently published an Issue Brief, “Reducing Oilfield Methane Emissions Can Create New US Gas Export Opportunities,” written by Gabriel Collins, Baker Botts Fellow in Energy & Environmental Regulatory Affairs at the Institute. Collins argues that instead of flaring gas, it should be liquefied and sold in the international market.

Actions that improve environmental well-being are most effective and sustainable when the yield a bona fide economic benefit. This certainly would be the case with policies to reduce flaring and venting of natural gas in the US, as doing so would free up gas molecules for export to customers worldwide seeking cleaner, more secure gas supplies.

Some statistics from Collins’ brief: Continue reading →