The fight between Williams and Exco over whether Exco can continue to flare gas from its wells has moved to District Court in Travis County.

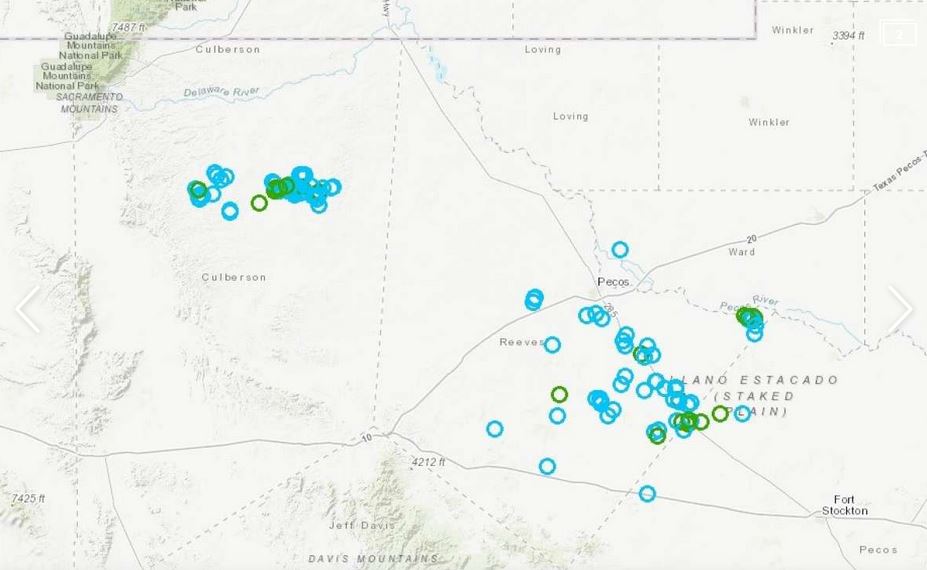

Exco filed an application with the Texas Railroad Commission for permission to flare gas from more than 130 Eagle Ford oil wells on the Briscoe Ranch. Exco bought the wells from Chesapeake. Williams protested Exco’s application. It owns the gathering system, which it purchased from Mockingbird Midstream, at that time an affiliate of Chesapeake. Under RRC Rule 32, a company must obtain a permit to flare gas. After a hearing, the administrative law judge recommended that the permit be granted, and the RRC granted the permit.

Exco’s wells had been connected to the Williams gathering system and dedicated to the gathering contract between Chesapeake and Mockinbird Midstream when the two companies were affiliated. Exco and Williams disputed whether the Exco wells were still under that contract. Exco was in bankruptcy, and that dispute was in the bankruptcy court.