Pending before the Texas Supreme Court is the petition for review of Ammonite Oil & Gas Corporation challenging the decision of the San Antonio Court of Appeals in Ammonite Oil and Gas Corp v. Railroad Comm’n of Texas, 2021 WL 4976324 (Oct. 27, 2021). The Court of Appeals upheld the RRC’s decision to deny Ammonite’s sixteen applications to force-pool portions of the Frio River into pooled units created by EOG for its horizontal wells in the Eagleville (Eagle Ford-1) Field in McMullen County. The application presents several interesting issues regarding the scope and interpretation of the MIPA.

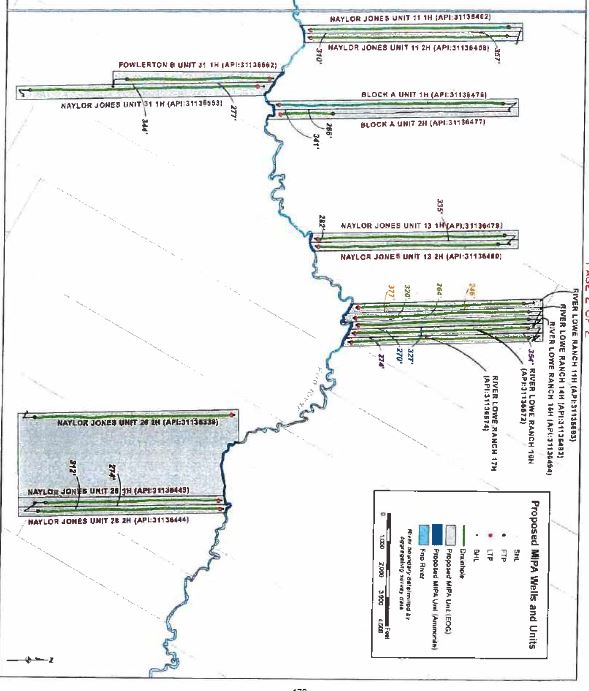

The State of Texas owns the land within Texas riverbeds. Ammonite leased the oil and gas in the Frio River from the Texas General Land Office. Ammonite then made an offer to EOG to pool adjacent portions of the riverbed into sixteen existing EOG units along the river. (click on image to enlarge) Ammonite offered to sign an operating agreement with EOG providing for Ammonite to pay its share of costs related to wells in the pooled unit, based on its share of the acreage in the unit. It also offered a 10% “risk penalty.” Ammonite would agree that EOG could recover 110% of its already-incurred costs for wells on the unit before Ammonite would receive its share of revenues from the wells.

Ammonite offered to sign an operating agreement with EOG providing for Ammonite to pay its share of costs related to wells in the pooled unit, based on its share of the acreage in the unit. It also offered a 10% “risk penalty.” Ammonite would agree that EOG could recover 110% of its already-incurred costs for wells on the unit before Ammonite would receive its share of revenues from the wells.

EOG rejected Ammonite’s offers and did not make any counteroffer.