Winter Storm Uri

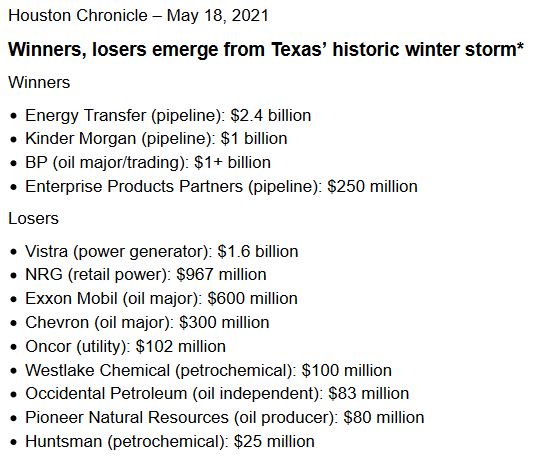

The fallout from the Texas Freeze in February 2021 continues. A year later, UT’s Austin Energy Institute concluded that multiple failures of power plants, gas processing plants, gas storage and distribution facilities, and gas production all contributed to the system failures. ERCOT management was fired; natural gas prices spiked to more than $400/MMBtu; politicians blamed wind and solar generation; the legislature passed legislation requiring the Public Utility Commission and the Railroad Commission to strengthen weatherization requirements for production, processing and generation facilities and has since criticized those agencies for failing to fix the problem. ERCOT drastically raised electricity prices during the storm, resulting in multiple bankruptcies. The legislature provided for securitization of about $7 billion in private losses caused by the storm, so those losses are spread over the next twenty years in customer rate increases. Expect new legislation in the upcoming session.

Mitchell v. Map Resources, 649 S.W.3d 180 (Tex. 2022)

Oil and Gas Lawyer Blog

Oil and Gas Lawyer Blog