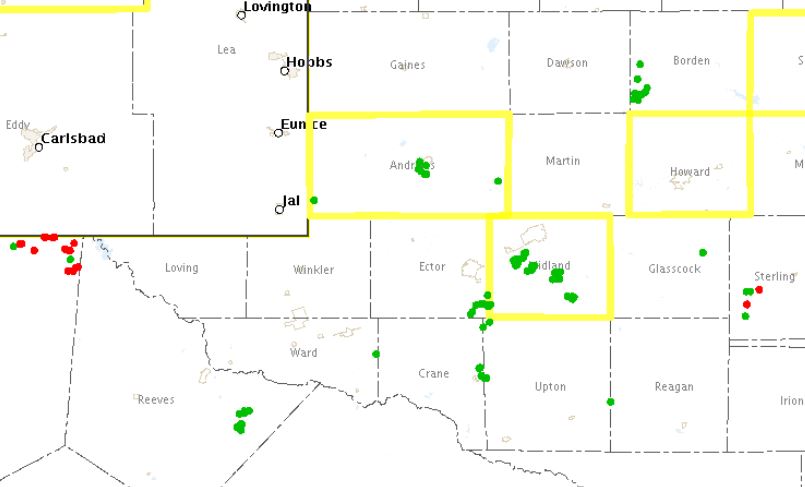

The Delaware Mountain Group is a group of formations including the Bell Canyon, Cherry Canyon and Brushy Canyon formations, deposits in ancient canyons filled in over the ages, and are productive of oil and gas. These formations lie above parts of the Wolfcamp formation in the Permian Basin. Disposal of produced water in the Permian has become a big problem, and the Texas Railroad Commission has granted permits for disposal wells that inject produce water into depths within the Delaware Mountain Group. These disposal wells have caused water to migrate to producing wells in the Delaware Mountain Group, killing those wells. The disposed water from these wells has also migrated to long-abandoned wells causing gushers of produced waters from the abandoned wells.

In Basic Energy Services v. PPC Energy, No. 08-23-00218-CV in the El Paso Court of Appeals, PPC Energy operated several marginal wells producing from the Delaware Mountain Group. It sued several disposal well operators in the vicinity for killing nine of PPC’s producing wells, resulting in a total loss of their remaining reserves. PPC settled with all disposal well operators except Basic. (Basic’s well was 6,300 feet from PC’s nearest well.) At trial, the jury found that Basic’s disposal well was responsible for 60% of PPC’s losses, and the trial court entered a judgment for PPC of $13 million, including interest. Basic appealed.

Basic complained that the charge to the jury was erroneous. The jury was asked:

Oil and Gas Lawyer Blog

Oil and Gas Lawyer Blog