After the Texas freeze last February that resulted in loss of electric service to millions of Texans, the Texas Legislature passed laws requiring the Texas Railroad Commission and the Public Utility Commission of Texas to address the issues raised by the systems’ failures. One of those issues was the failure of natural gas supply to electric generators. Senate Bill 3 and House Bill 3648 require the RRC to collaborate with the PUC “to adopt rules to establish a process to designate certain natural gas facilities and entities associated with providing natural gas in this state as critical customers or critical gas suppliers during energy emergencies.” In response, the RRC has proposed a new rule, 16 TAC Section 3.65. The purpose of the new law is to let the PUC know what gas infrastructure is critical to continued delivery of gas to electric utilities during an electric supply crisis so that gas supply won’t be disrupted because gas suppliers don’t have the electricity necessary to operate their systems.

As explained in the RRC’s explanation of its proposed rule, the RRC proposes to designate all gas infrastructure as “critical.” The proposed rule therefor designates as critical gas suppliers and critical customers all wells producing gas and casinghead gas, gas processing plants, gas pipelines and facilities, compressor stations, local distribution company pipelines and facilities, gas storage facilities, natural gas liquids transportation and storage facilities, saltwater disposal facilities and pipelines, and “other facilities under the jurisdiction of the Commission the operation of which is necessary to operate any of the facilities” listed above. In its comments to the proposed rule the RRC explains that all of these facilities are “necessarily critical customers of electric entities during an energy emergency.”

The Commission chooses to include these facility types, located up and down the entire natural gas supply chain, because the statistics from Winter Storm Uri reveal that during the storm, every molecule of natural gas was important. … Each piece of the supply chain included in [the list of critical customers] contributes to the delivery of gas downstream. If one piece of the supply chain cannot operate, then the gas cannot be delivered for electric generation or other important uses. Further, daily gas production alone many not be adequate for peak demand during a weather emergency, which makes gas storage an important source of natural gas. Thus, natural gas storage facilities are included ….

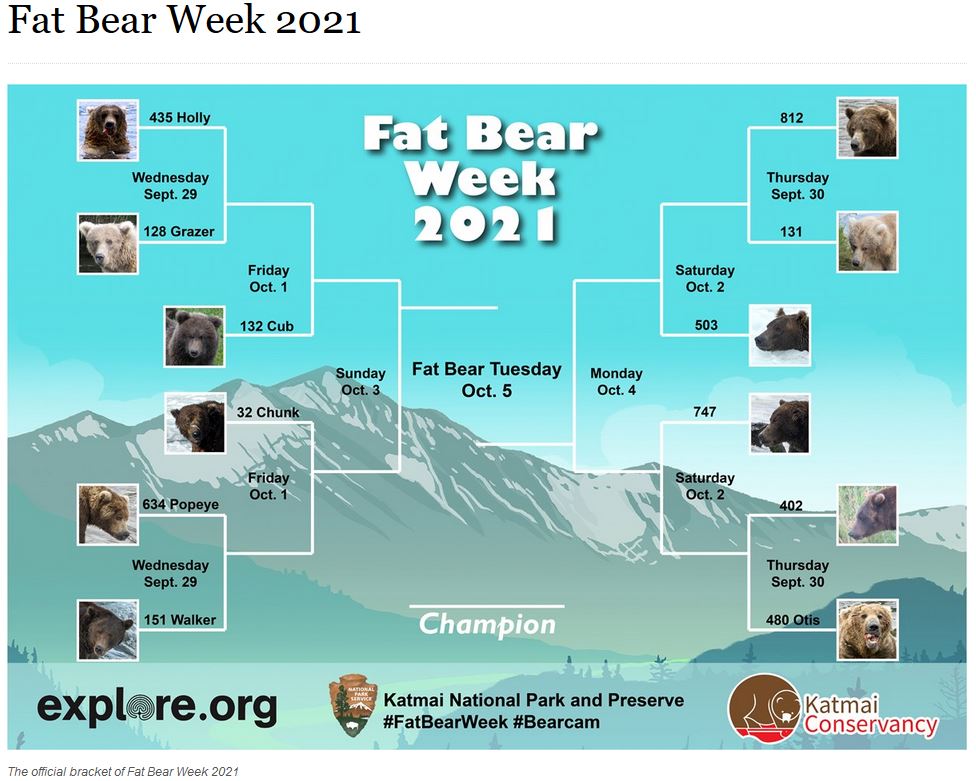

You can see the contestants and vote here: https://explore.org/fat-bear-week. Here is the bracket (click to enlarge):

You can see the contestants and vote here: https://explore.org/fat-bear-week. Here is the bracket (click to enlarge):