As evidenced by the fight between Williams MLP Operating and EXCO Operating over EXCO’s flaring of Eagle Ford wells on the Briscoe Ranch, now pending on appeal in the 345th District Court of Travis County, flaring continues to be an issue in Texas. I thought a little history might enlighten the subject.

Controversy over gas flaring is not new. In the 1940’s flaring of gas was also an issue in Texas, and the Texas Railroad Commission successfully fought to reduce flaring as a waste of Texas’ valuable resource.

In the early days of oil exploration and production there was very little market for natural gas. It could not be stored and had to be transported by pipeline. In 1930 oil sold for about a dollar a barrel, and gas sold for 3.6 cents per mcf. Six mcf of methane gas produces the same heat as one barrel of oil. So based on heat equivalency, oil was five times more valuable than gas.

The giant Panhandle Gas Field was discovered in 1918 with the completion of the Masterson No. 1. Three additional wells soon followed, and those four wells were tested in March 1920 at 160 million cubic feet per day. Initially no one could be found to buy the gas. The City of Amarillo spent $60,000 advertising the resource but found no buyers. The city offered free gas for five years to any industry that would move to Amarillo. No takers.

But, by 1929 several gas pipelines were laid to move the gas to distant markets and fifty-three gasoline plants and twenty-four carbon black plants had been constructed. The value of gas had been realized. Continue reading →

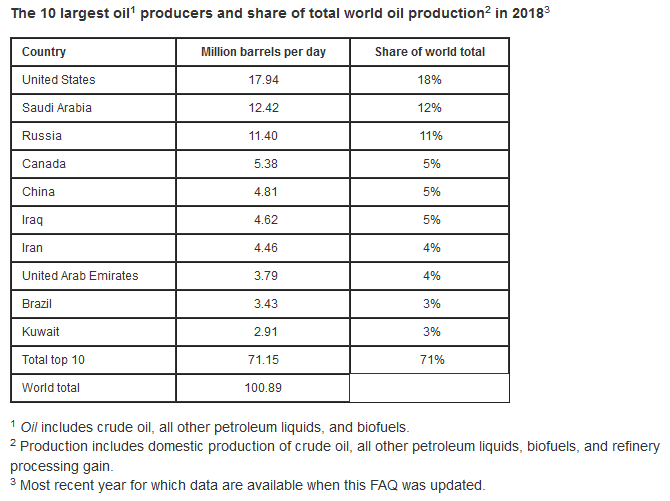

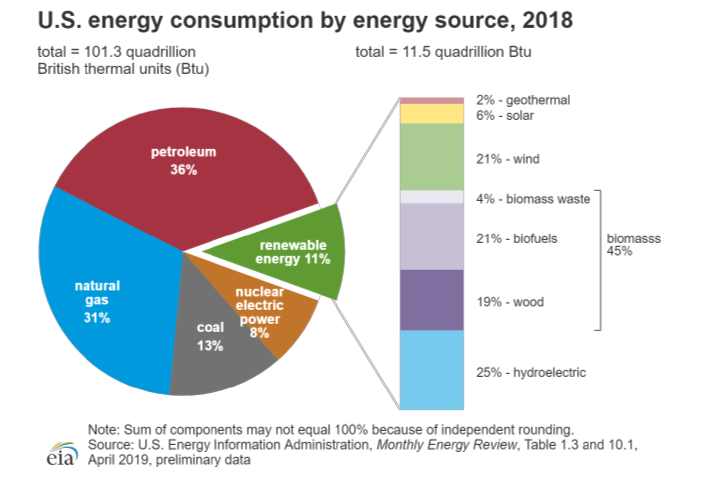

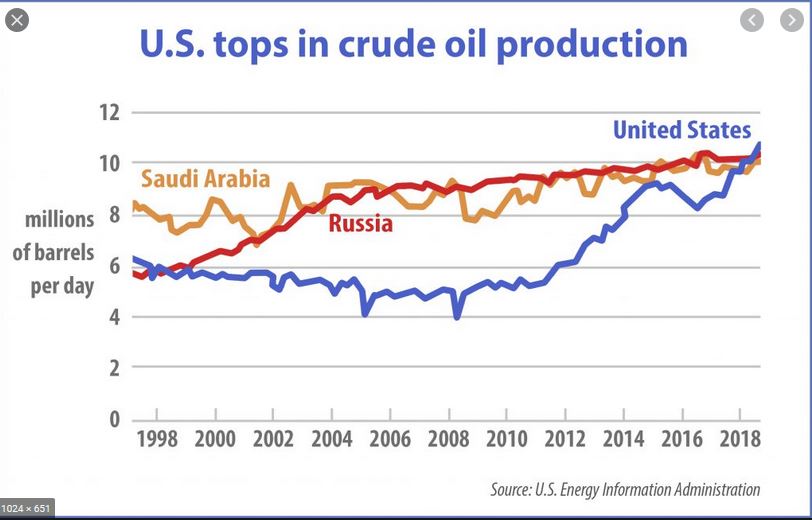

US producers have relied on OPEC to regulate the world oil price, while ramping up their production. Maybe US producers should take some responsibility as well.

US producers have relied on OPEC to regulate the world oil price, while ramping up their production. Maybe US producers should take some responsibility as well.