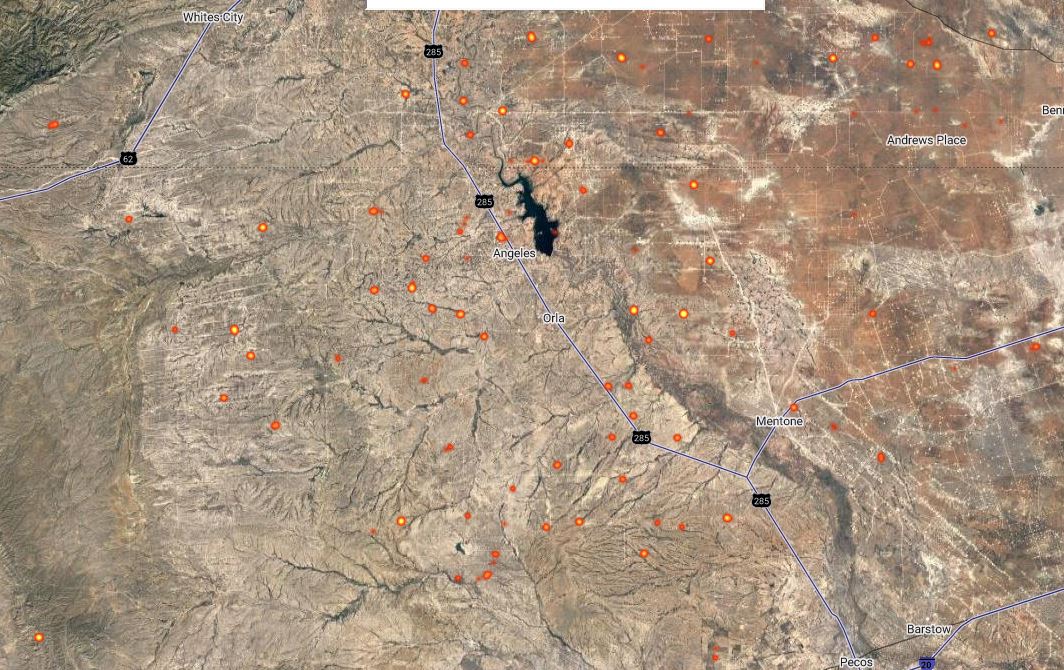

Last March the El Paso Court of Appeals decided Cimarex Energy v. Anadarko Petroleum, No. 08-16-00353-CV. The facts are these:

Cimarex leased a 1/6th interest in 440 acres in Ward County. Anadarko leased the remaining 5/6ths. Cimarex asked Anadarko to let Cimarex participate in wells on the leases under a joint operating agreement, but Anadarko refused. Anadarko drilled two wells, carrying Cimarex as a non-consenting co-tenant. Cimarex sued for an accounting. The parties settled, Anadarko agreeing to an accounting and to pay Cimarex its share of net profits from the wells. Cimarex paid its royalty owner for its share of production “according to the terms of its lease, dating back to the date of first production.”

But at the end of the primary term of the Cimarex lease – December 21, 2014 – Anadarko stopped paying Cimarex, claiming its lease had expired. Anadarko took a new lease from Cimarex’s lessor. Cimarex sued Anadarko for breach of the settlement agreement. The trial court held that Cimarex’s lease had expired and dismissed its suit. On appeal, the Court of Appeals affirmed. Cimarex has now filed a petition for review in the Supreme Court.